- China

- /

- Electronic Equipment and Components

- /

- SHSE:688025

High Growth Tech Stocks To Watch In February 2025

Reviewed by Simply Wall St

Amid ongoing geopolitical tensions and concerns about consumer spending, global markets have experienced volatility, with major U.S. indexes like the S&P 500 seeing sharp fluctuations despite reaching record highs earlier in the week. As economic indicators such as the U.S. Services PMI enter contraction territory and inflation expectations rise, investors are closely monitoring high-growth tech stocks that demonstrate resilience through innovation and adaptability to navigate these challenging market conditions effectively.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.86% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 24.94% | 24.24% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.67% | 58.73% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1187 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

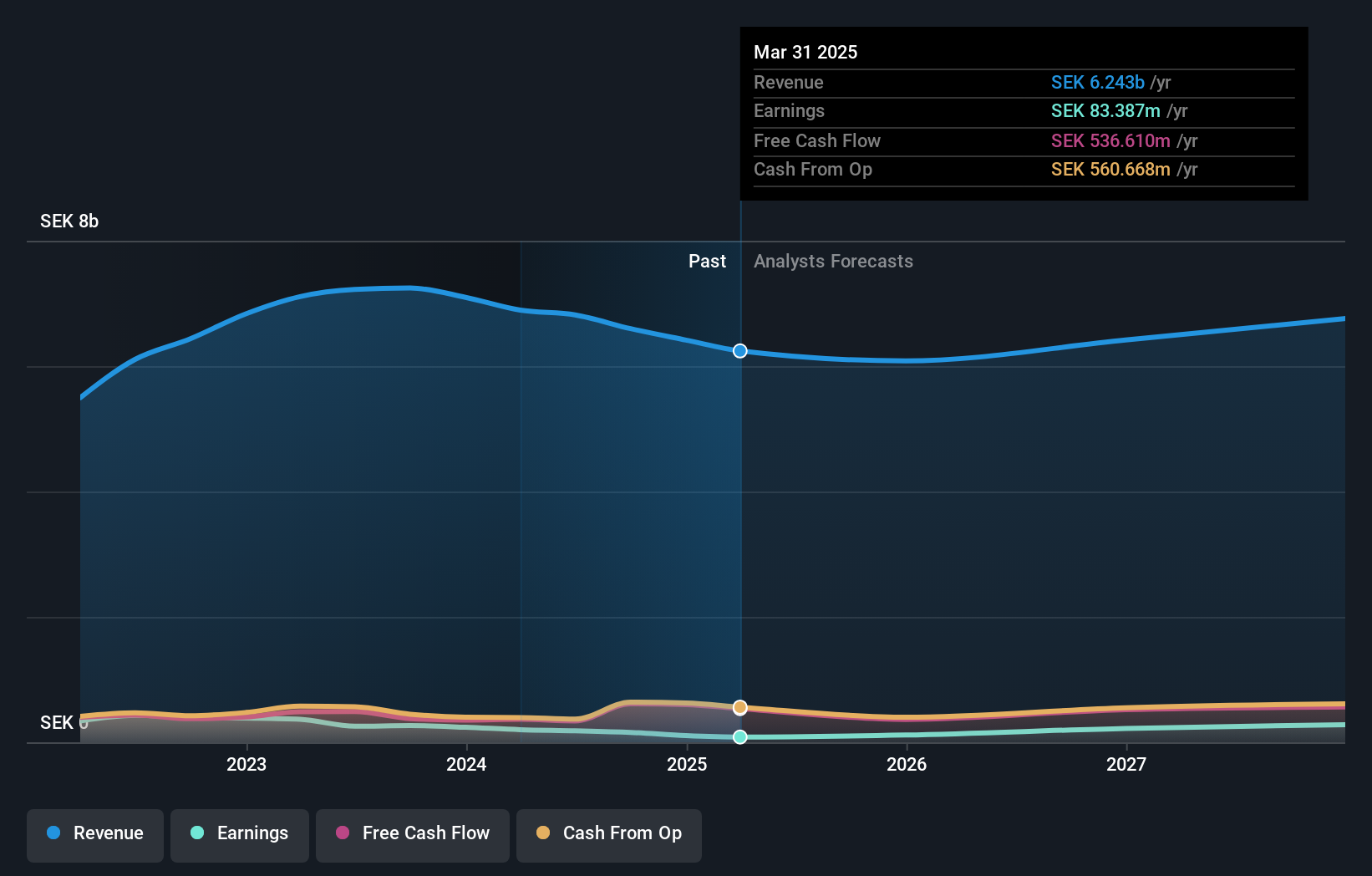

Knowit (OM:KNOW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Knowit AB (publ) is a consultancy company that specializes in developing digital transformation solutions, with a market capitalization of approximately SEK4.03 billion.

Operations: The consultancy firm focuses on digital transformation solutions, generating revenue primarily from its Solutions segment (SEK3.59 billion) and Experience segment (SEK1.18 billion).

Despite recent setbacks, Knowit shows potential for rebound with expected significant earnings growth of 33% annually, outpacing the Swedish market's 9.6%. This optimism is tempered by a challenging past year where earnings fell by 55.7%, more severe than the industry's decline of 9.1%. However, Knowit's commitment to innovation is evident in its R&D investments, crucial for staying competitive in the tech sector. With revenue growth also projected to exceed local market trends at 3.4% annually compared to Sweden's 0.9%, Knowit could leverage its developmental focus to regain and possibly exceed its previous financial performance levels.

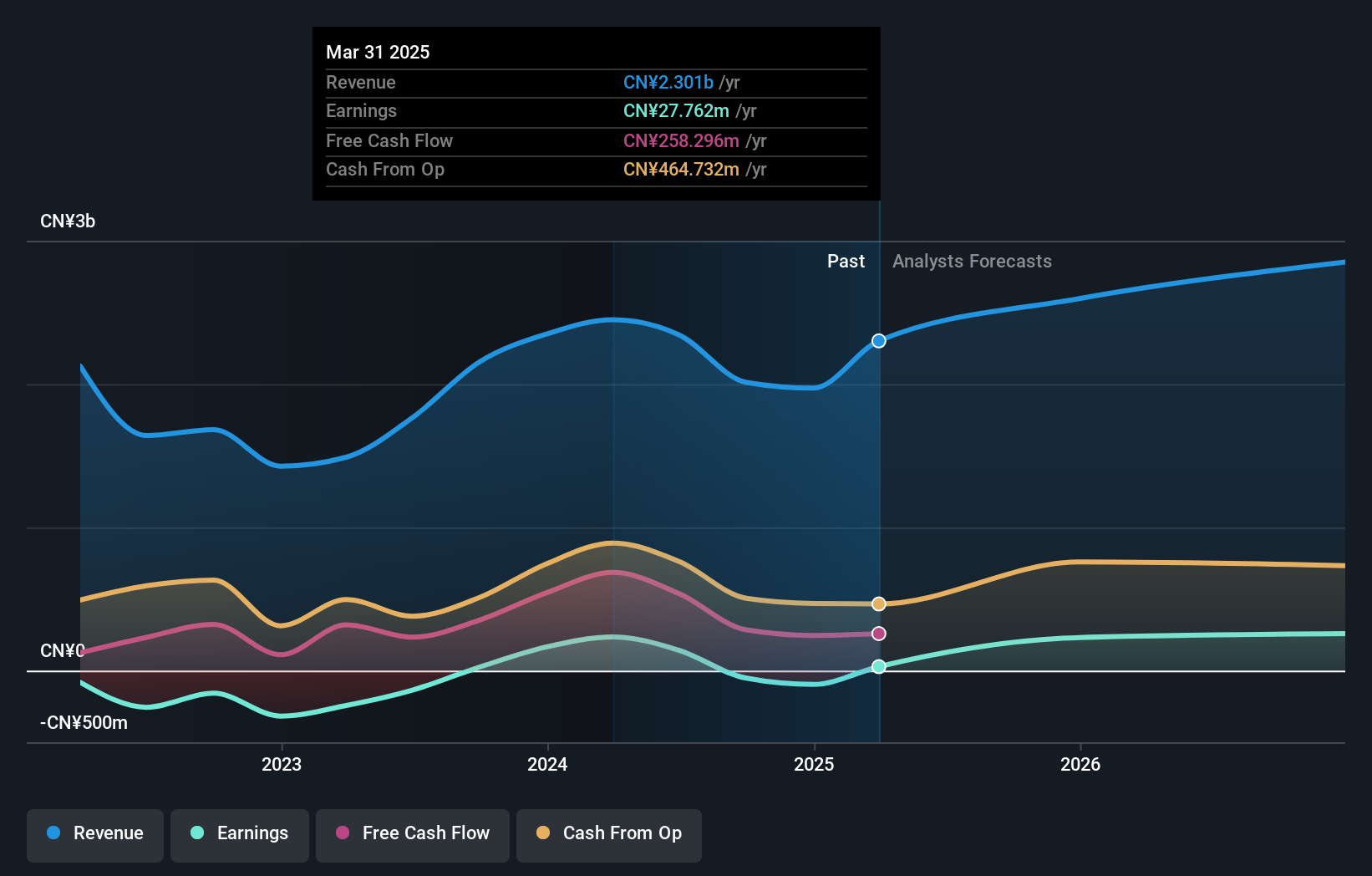

Hengdian EntertainmentLTD (SHSE:603103)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hengdian Entertainment Co., LTD operates theaters in China and has a market cap of CN¥9.02 billion.

Operations: The company generates revenue primarily through its theater operations across China. It focuses on providing entertainment services, which contribute to its financial performance.

Hengdian EntertainmentLTD, amidst a volatile market, stands out with an impressive annual revenue growth rate of 18.1%, surpassing China's average of 13.4%. This growth is underpinned by robust R&D investments, crucial for maintaining its competitive edge in the entertainment sector. The company's earnings are also expected to surge by 124.85% annually, reflecting strong operational efficiencies and market demand. Moreover, with positive free cash flow and a move towards profitability within three years, Hengdian is strategically positioned to capitalize on industry trends and expand its market share further.

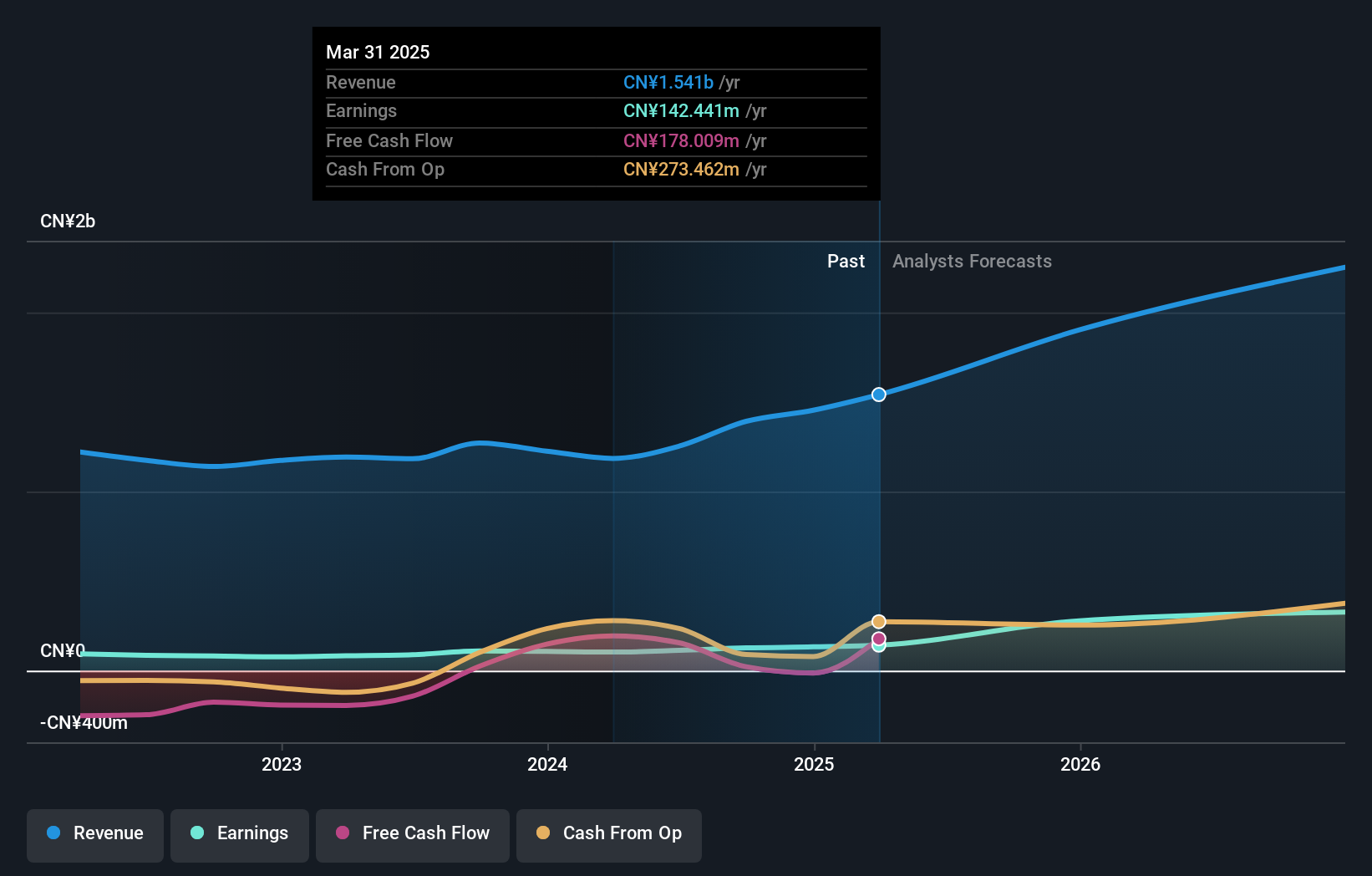

Shenzhen JPT Opto-Electronics (SHSE:688025)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen JPT Opto-Electronics Co., Ltd. focuses on the R&D, production, sale, and technical services of laser, intelligent equipment, and optical devices with a market cap of approximately CN¥4.99 billion.

Operations: JPT Opto-Electronics generates revenue primarily from the computer communications and other electronic equipment segment, contributing CN¥1.39 billion. The company is involved in the R&D, production, sales, and technical services of its products.

Shenzhen JPT Opto-Electronics has demonstrated a robust trajectory in the tech sector, with a notable annual revenue growth of 20.5%, significantly outpacing the broader Chinese market's growth of 13.4%. This performance is bolstered by an aggressive R&D strategy, where investments have surged to support innovation in opto-electronic solutions, crucial for maintaining its competitive edge. Despite recently being dropped from the S&P Global BMI Index, the company's earnings are projected to grow at an impressive rate of 36% annually. These figures underscore JPT's potential to leverage its technological advancements and market position to drive future growth, despite current index valuation challenges.

Taking Advantage

- Take a closer look at our High Growth Tech and AI Stocks list of 1187 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688025

Shenzhen JPT Opto-Electronics

Engages in the research and development, production, sale, and technical services of laser, intelligent equipment, and optical devices.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives