- Sweden

- /

- Capital Markets

- /

- OM:EQT

Top Swedish Growth Companies With High Insider Ownership For September 2024

Reviewed by Simply Wall St

The Swedish stock market has been buoyant recently, benefiting from the broader European trend of interest rate cuts and positive economic signals. With this backdrop, identifying growth companies with high insider ownership can be particularly rewarding as these stocks often reflect strong internal confidence and potential for robust performance. In this article, we will explore three top Swedish growth companies with significant insider ownership for September 2024.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Truecaller (OM:TRUE B) | 29.6% | 21.6% |

| Fortnox (OM:FNOX) | 21.1% | 22.6% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| Yubico (OM:YUBICO) | 37.5% | 42.3% |

| Biovica International (OM:BIOVIC B) | 18.8% | 78.5% |

| BioArctic (OM:BIOA B) | 34% | 98.4% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| InCoax Networks (OM:INCOAX) | 19.5% | 115.5% |

| C-Rad (OM:CRAD B) | 16.1% | 33.9% |

Here's a peek at a few of the choices from the screener.

EQT (OM:EQT)

Simply Wall St Growth Rating: ★★★★★☆

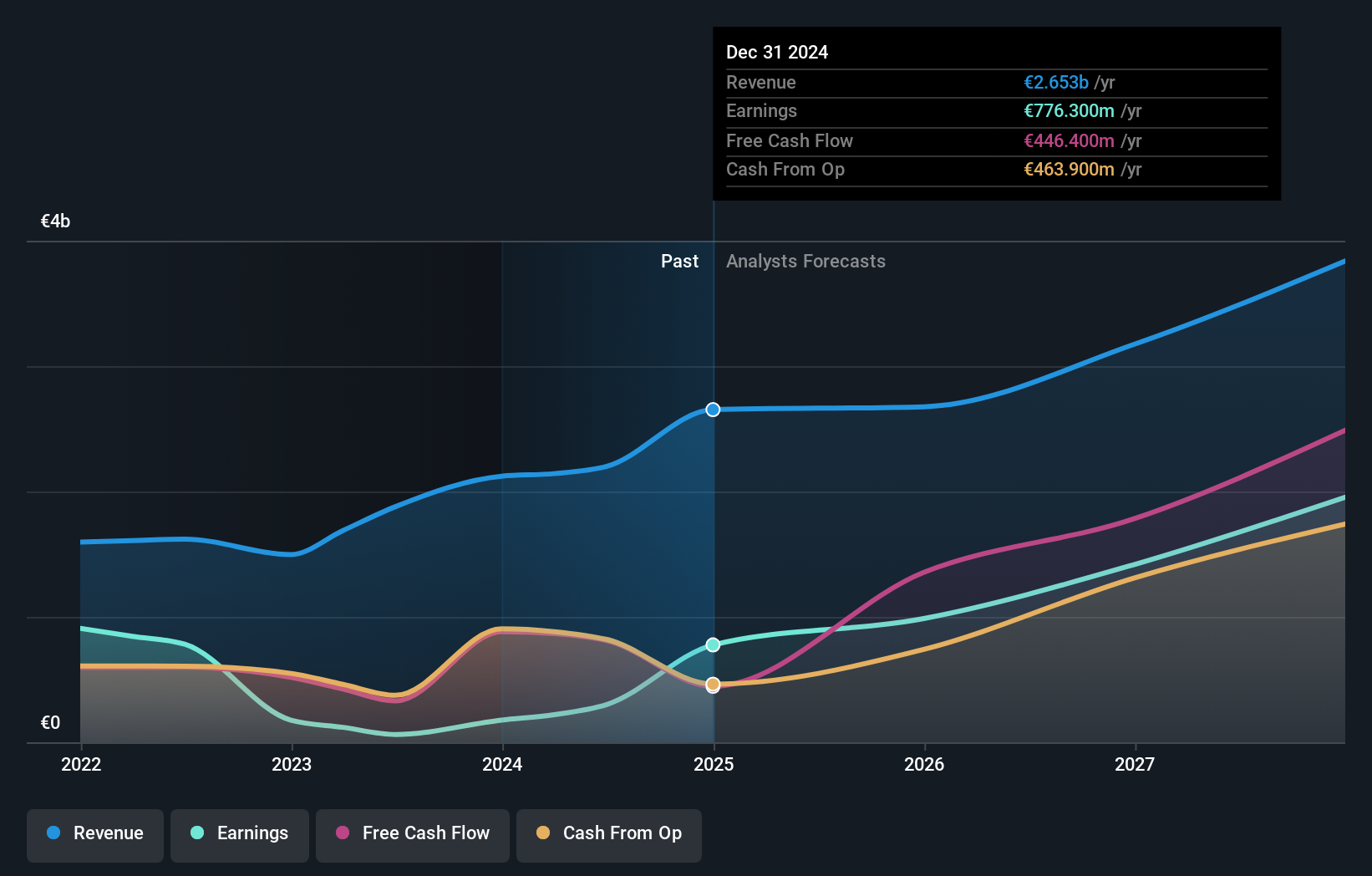

Overview: EQT AB (publ) is a global private equity firm specializing in private capital and real asset segments, with a market cap of approximately SEK418.07 billion.

Operations: The company's revenue segments include Central (€37.20 million), Real Assets (€878.70 million), and Private Capital (€1.28 billion).

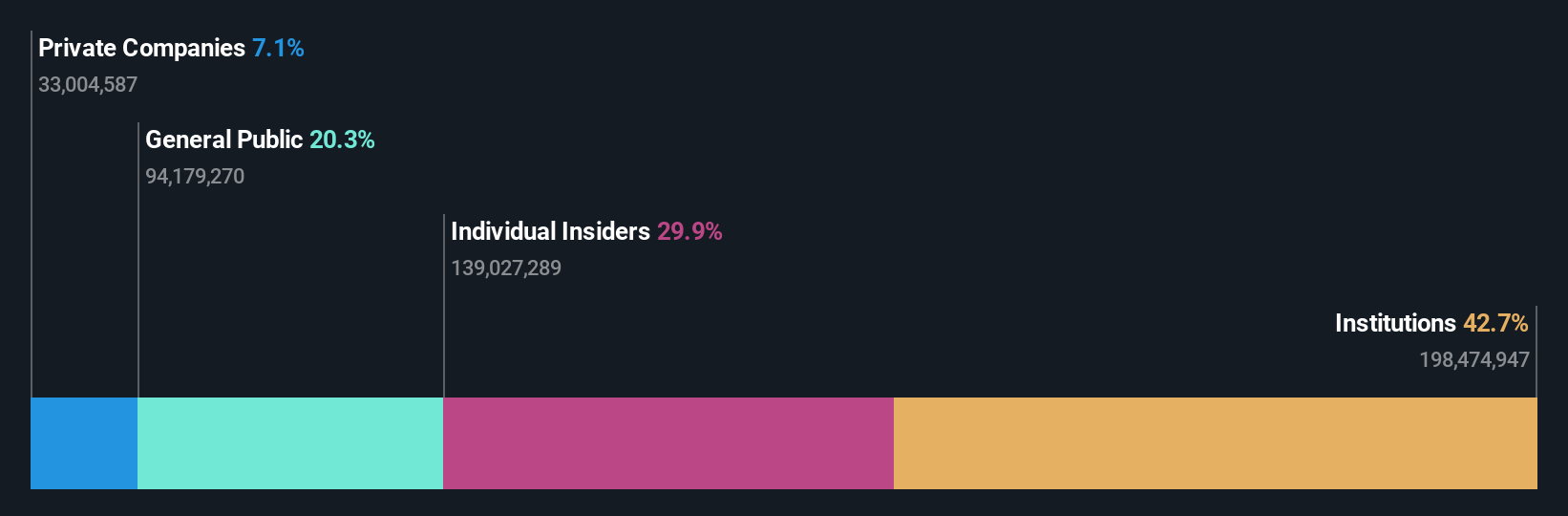

Insider Ownership: 30.9%

Earnings Growth Forecast: 35.6% p.a.

EQT is a growth company with high insider ownership, forecasted to achieve annual earnings growth of 35.6%, outpacing the Swedish market's 15.3%. Despite no substantial insider buying recently, the company's Return on Equity is expected to reach 23% in three years. Recent activities include multiple M&A discussions and a share repurchase program aimed at optimizing capital structure and enabling strategic acquisitions. However, significant one-off items have impacted financial results.

- Get an in-depth perspective on EQT's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that EQT's current price could be inflated.

Fortnox (OM:FNOX)

Simply Wall St Growth Rating: ★★★★★★

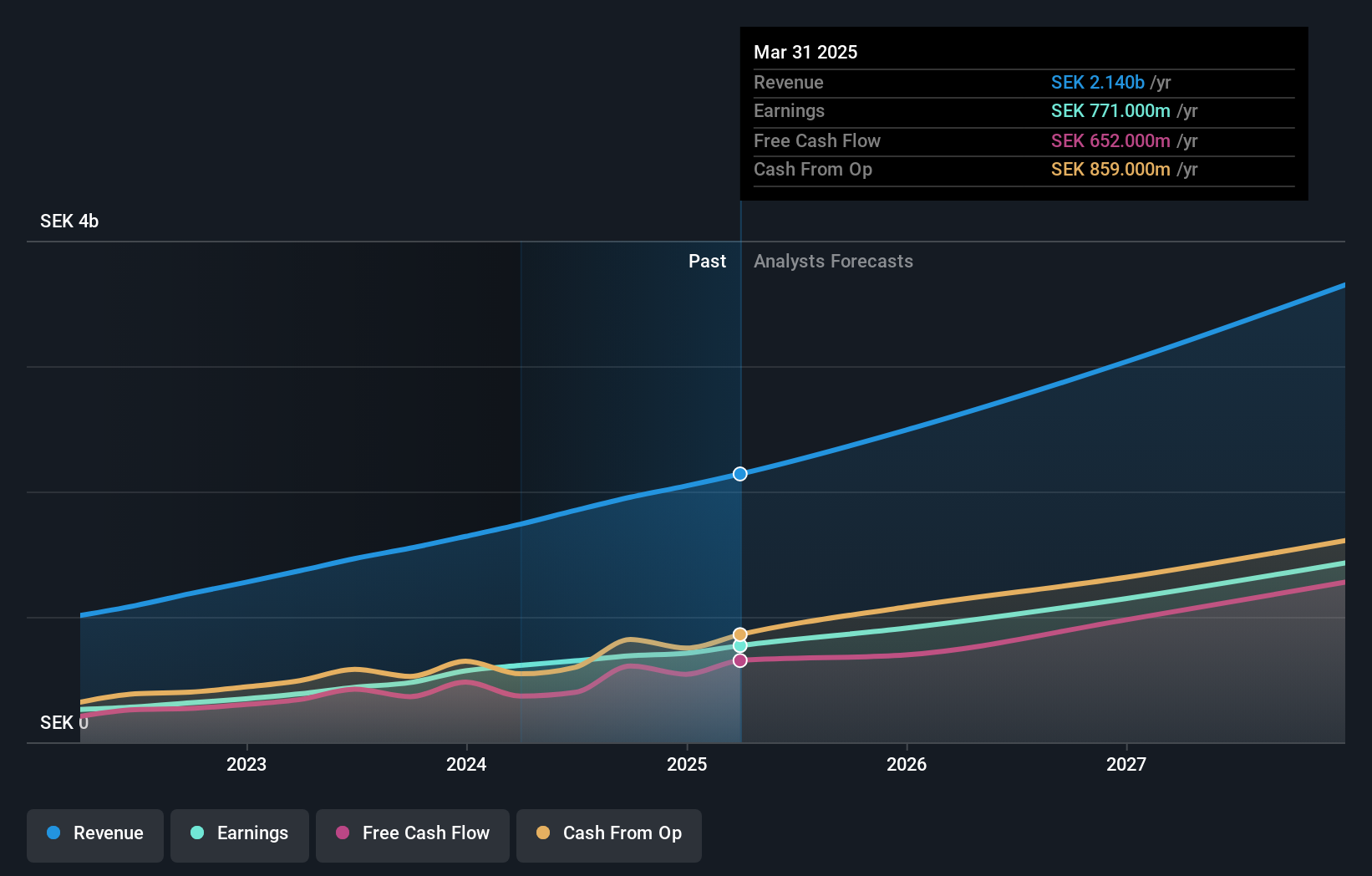

Overview: Fortnox AB (publ) offers financial and administrative software solutions for small and medium-sized businesses, accounting firms, and organizations, with a market cap of SEK38.49 billion.

Operations: Fortnox's revenue segments include Businesses (SEK378 million), Marketplaces (SEK160 million), Core Products (SEK734 million), Accounting Firms (SEK352 million), and Financial Services (SEK249 million).

Insider Ownership: 21.1%

Earnings Growth Forecast: 22.6% p.a.

Fortnox demonstrates strong growth potential with substantial insider buying over the past 3 months. Earnings are forecasted to grow significantly at 22.6% per year, outpacing the Swedish market's average. The company recently reported impressive second-quarter results, with revenue reaching SEK 521 million and net income rising to SEK 164 million. Trading below its estimated fair value by 19.3%, Fortnox is well-positioned for continued expansion, supported by high insider confidence and robust financial performance.

- Unlock comprehensive insights into our analysis of Fortnox stock in this growth report.

- The analysis detailed in our Fortnox valuation report hints at an deflated share price compared to its estimated value.

AB Sagax (OM:SAGA A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AB Sagax (publ) is a property company operating in Sweden, Finland, France, Benelux, Spain, Germany, and other European countries with a market cap of SEK95.37 billion.

Operations: AB Sagax's revenue primarily comes from its Real Estate - Rental segment, amounting to SEK4.63 billion.

Insider Ownership: 28.6%

Earnings Growth Forecast: 28.7% p.a.

AB Sagax shows robust growth potential with significant insider ownership. The company reported strong earnings for the second quarter of 2024, with sales reaching SEK 1.20 billion and net income at SEK 978 million, a substantial increase from the previous year. Forecasted to grow earnings by 28.7% annually over the next three years, AB Sagax is expected to outperform the Swedish market's average growth rate of 15.3%. However, shareholders have experienced dilution in the past year.

- Take a closer look at AB Sagax's potential here in our earnings growth report.

- Our valuation report here indicates AB Sagax may be overvalued.

Turning Ideas Into Actions

- Unlock our comprehensive list of 90 Fast Growing Swedish Companies With High Insider Ownership by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if EQT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EQT

EQT

A global private equity & venture capital firm specializing in private capital and real asset segments.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives