Exsitec Holding (OM:EXS): Net Profit Margin Falls to 7%, Challenging Bullish Consensus Narratives

Reviewed by Simply Wall St

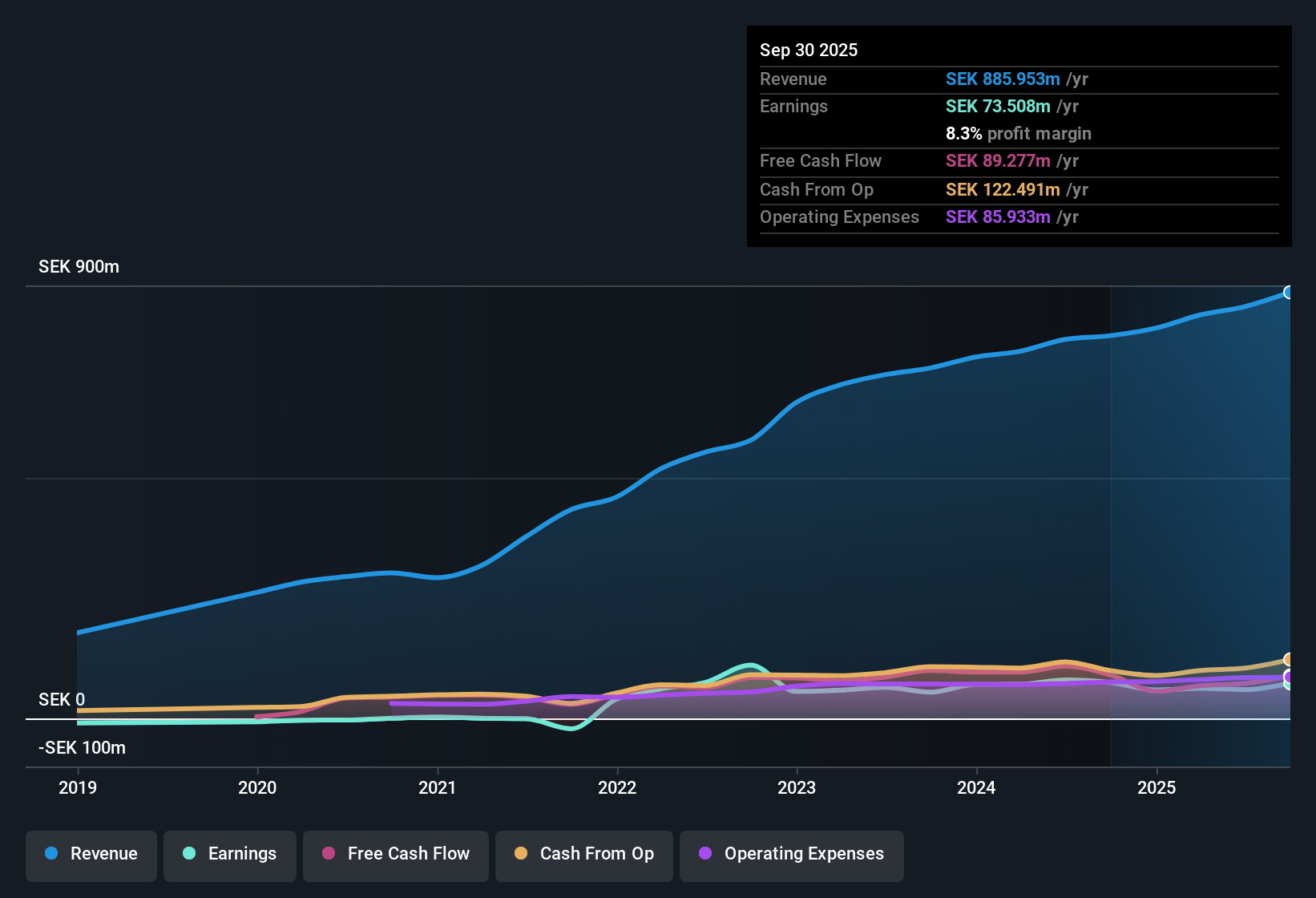

Exsitec Holding (OM:EXS) reported forecasted revenue growth of 7.6% per year, outpacing the Swedish market average of 3.9%. EPS growth is even more striking, with projections at 19.87% per year versus the local market’s 12.6%. However, recent net profit margins narrowed to 7% from last year’s 10.2%. Shares are trading at SEK160, which is below the estimated fair value of SEK234.59, despite carrying a higher Price-to-Earnings Ratio (35.9x) than both sector and peer averages. In the longer term, earnings have climbed at a 30.7% annual growth rate over five years, but most recently, earnings dipped into negative territory. This nuance may weigh on sentiment despite a compelling discount to fair value and strong projected growth drivers.

See our full analysis for Exsitec Holding.Next, we’ll see how the latest numbers compare with the dominant narratives followed by the market and the community, identifying where consensus is confirmed and where perceptions might need a rethink.

See what the community is saying about Exsitec Holding

Analyst Target Sits Above Current Price

- At SEK160, Exsitec's share price remains 10% below the analyst price target of SEK177.50, as well as 32% below the DCF fair value of SEK234.59. This suggests significant upside potential if profit and margin forecasts are met.

- Analysts' consensus view notes that for this price target to be realized, investors would need to see revenues reach SEK1.1 billion and earnings SEK118.4 million by 2028, with a future PE of 24.2x, which is well above the current sector average of 14.9x.

- Despite trading below both analyst and DCF fair value targets, the company's high current PE of 35.9x means expectations are elevated. This contrasts with the ongoing challenge of restoring margins from 7% back toward longer-term targets.

- Consensus narrative highlights a balance between growth optimism and high relative valuation. Those anticipating a quick rerate should remain mindful that these targets depend on sustained top-line and margin expansion.

- To see how this valuation story plays out against a wider range of perspectives, check the full consensus narrative for Exsitec Holding. 📊 Read the full Exsitec Holding Consensus Narrative.

Margin Pressures Amid Integration and Expansion

- Net profit margins have slipped to 7% from 10.2% last year, even as the business integrates acquisitions and expands offerings like Power BI integration through BrightCom.

- Analysts' consensus view highlights that short-term margin pressures are being driven by costs related to M&A activity and a sizable trainee program. These factors could drag on profitability if new hires take longer to ramp up or if recently acquired Scandinavian businesses face slower operational integration.

- Consensus notes efficiency improvements in Norway have contributed positively, but ongoing lower utilization in Sweden and currency headwinds may offset gains and require careful monitoring.

- Analysts point to the tension between operational expansion and earnings quality, cautioning that expectations for margin recovery might be too ambitious if integration hurdles persist.

Growth Outlook Rests on Execution

- Core revenues are projected by analysts to grow by 8.3% annually over the next 3 years. Profit margins are seen rising from 7.0% to 10.9% over that span, assuming integration and cross-selling strategies deliver as planned.

- Analysts' consensus view emphasizes that strategic acquisitions such as the ECIT Denmark customer base provide a strong foundation for future growth. However, they highlight that lead conversion and client ramp-up will be critical:

- Consensus credits a 50% jump in qualified leads in Q1 as a promising sign. However, this momentum must be converted into actual sales to realize projected capacity and margin gains.

- The large trainee program is expected to yield a sustainable talent pipeline over time, though consensus notes that persistent cost or utilization drag could restrain earnings momentum if onboarding does not proceed at pace.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Exsitec Holding on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a distinct take on these figures? You can shape your own independent view in just a few minutes: Do it your way

A great starting point for your Exsitec Holding research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While Exsitec Holding’s growth forecasts are strong, margin pressure and high valuation multiples raise concerns about the reliability of future earnings expansion.

If you want to avoid lofty valuations and focus on stocks trading at a more attractive price, check out these 877 undervalued stocks based on cash flows for better value opportunities right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exsitec Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EXS

Exsitec Holding

Provides digital solutions to medium-sized companies in Sweden, Norway, Denmark, and Finland.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives