What trends should we look for it we want to identify stocks that can multiply in value over the long term? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. So, when we ran our eye over DevPort's (STO:DEVP B) trend of ROCE, we really liked what we saw.

What Is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on DevPort is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.37 = kr45m ÷ (kr264m - kr143m) (Based on the trailing twelve months to December 2022).

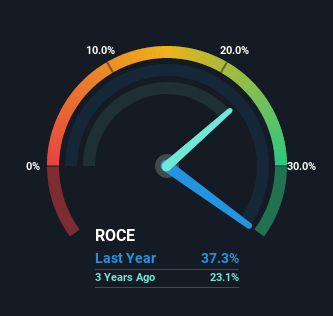

Therefore, DevPort has an ROCE of 37%. That's a fantastic return and not only that, it outpaces the average of 19% earned by companies in a similar industry.

View our latest analysis for DevPort

Historical performance is a great place to start when researching a stock so above you can see the gauge for DevPort's ROCE against it's prior returns. If you're interested in investigating DevPort's past further, check out this free graph of past earnings, revenue and cash flow.

The Trend Of ROCE

It's hard not to be impressed by DevPort's returns on capital. The company has consistently earned 37% for the last five years, and the capital employed within the business has risen 131% in that time. With returns that high, it's great that the business can continually reinvest its money at such appealing rates of return. You'll see this when looking at well operated businesses or favorable business models.

On a side note, DevPort's current liabilities are still rather high at 54% of total assets. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

Our Take On DevPort's ROCE

DevPort has demonstrated its proficiency by generating high returns on increasing amounts of capital employed, which we're thrilled about. And given the stock has only risen 28% over the last five years, we'd suspect the market is beginning to recognize these trends. So to determine if DevPort is a multi-bagger going forward, we'd suggest digging deeper into the company's other fundamentals.

If you want to continue researching DevPort, you might be interested to know about the 2 warning signs that our analysis has discovered.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:DEVP B

DevPort

Engages in the product development, production development and supply chain management, and digital solutions businesses in Sweden.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

A fully integrated LNG business seems to be ignored by the market.

Hims & Hers Health aims for three dimensional revenue expansion

A Quality Compounder Marked Down on Overblown Fears

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale