After Leaping 34% Clavister Holding AB (publ.) (STO:CLAV) Shares Are Not Flying Under The Radar

Despite an already strong run, Clavister Holding AB (publ.) (STO:CLAV) shares have been powering on, with a gain of 34% in the last thirty days. This latest share price bounce rounds out a remarkable 313% gain over the last twelve months.

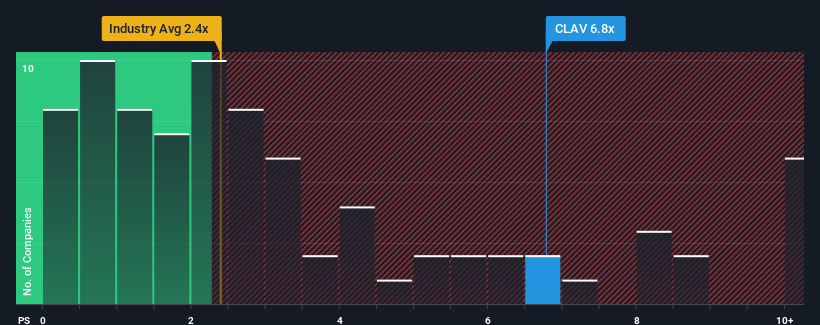

Following the firm bounce in price, you could be forgiven for thinking Clavister Holding AB (publ.) is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 6.8x, considering almost half the companies in Sweden's Software industry have P/S ratios below 2.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Clavister Holding AB (publ.)

What Does Clavister Holding AB (publ.)'s P/S Mean For Shareholders?

Clavister Holding AB (publ.) certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Clavister Holding AB (publ.)'s future stacks up against the industry? In that case, our free report is a great place to start.How Is Clavister Holding AB (publ.)'s Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Clavister Holding AB (publ.)'s is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. Pleasingly, revenue has also lifted 53% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 21% as estimated by the sole analyst watching the company. With the industry only predicted to deliver 16%, the company is positioned for a stronger revenue result.

With this information, we can see why Clavister Holding AB (publ.) is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Clavister Holding AB (publ.)'s P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Clavister Holding AB (publ.) maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Software industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Clavister Holding AB (publ.) (2 can't be ignored!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:CLAV

Clavister Holding AB (publ.)

Develops, produces, and sells cybersecurity solutions in Sweden, rest of Europe, Asia, and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success