Cint Group (OM:CINT): One-Off Gain Drives Profit, Putting Sustainable Earnings Narrative to the Test

Reviewed by Simply Wall St

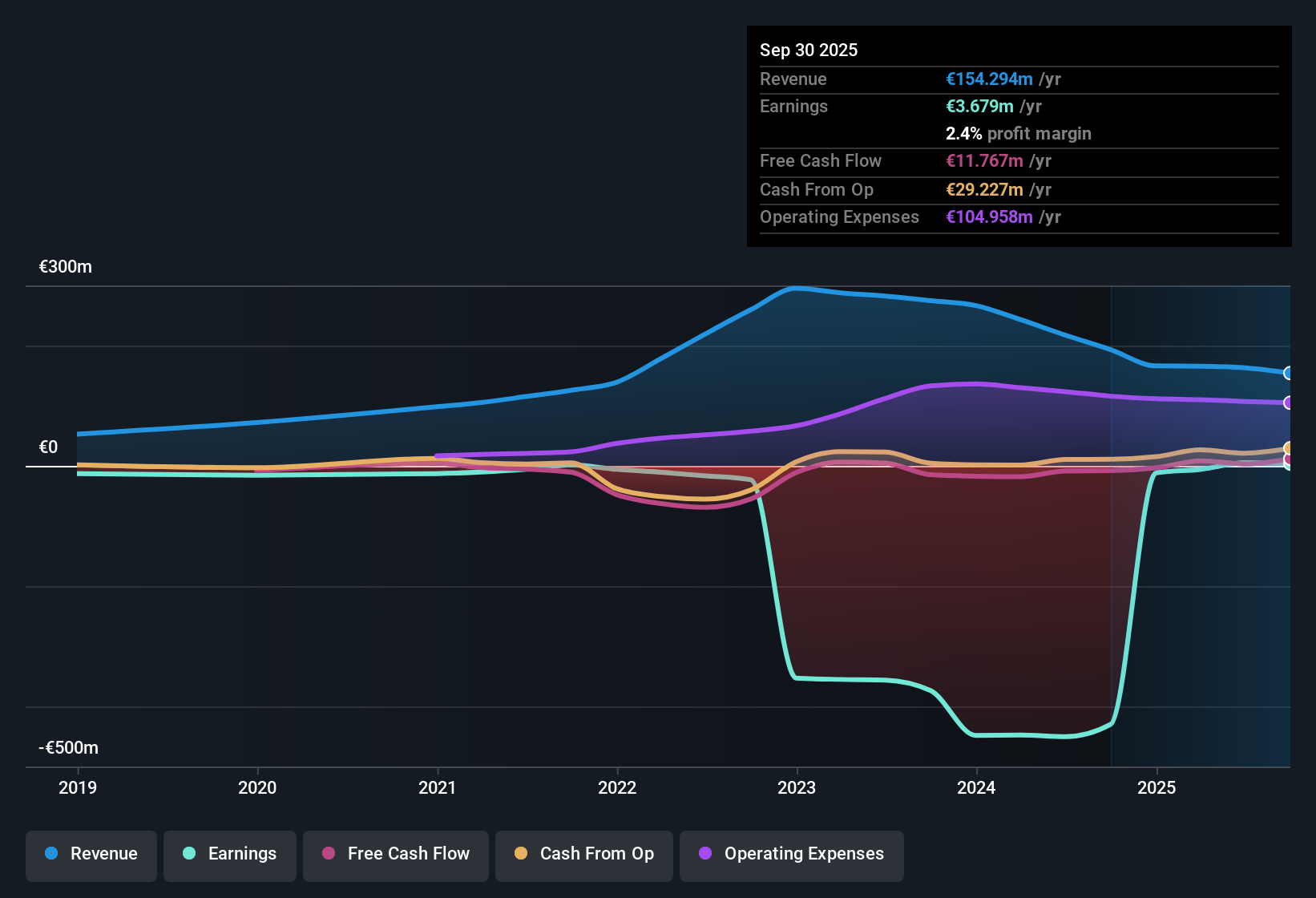

Cint Group (OM:CINT) just turned the corner to profitability, buoyed by a large one-off gain of €2.3 million that lifted earnings over the past 12 months. Looking ahead, earnings are forecast to grow 35.2% per year, with revenue expected to climb 4.3% annually. Both metrics are expected to outpace the broader Swedish market. While the company’s five-year average earnings growth has been negative at -33.7% per year, recent momentum and a share price of SEK4.33 put the focus squarely on Cint’s rebound story.

See our full analysis for Cint Group.The next section lines up these headline numbers with Simply Wall St’s most widely held narratives to see which stories hold up, and which could be in for a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Jump Skewed by €2.3 Million One-Off

- The last twelve months saw profitability boosted by a €2.3 million non-recurring gain, an outlier that inflates Cint Group’s earnings figure.

- The argument that Cint’s recent profit is a sign of business health is tested by the fact that overall earnings growth averaged a negative 33.7% per year over five years, creating tension with optimism about a permanent turnaround.

- Supporters of the stock point to the new annual profit and tight cost controls as signals of momentum.

- However, the lack of sustained, high-quality profit before this period means the recent gain may not indicate a structural shift.

Share Price Trades Far Below Its DCF Fair Value

- With a current share price of SEK4.33 and a DCF fair value estimate of SEK11.62, the stock trades at a substantial discount by this measure.

- Addressing concerns that peer comparisons overstate the value gap, the company’s price-to-earnings ratio of 27x is not only below Swedish software industry peers (31.6x), but is also much lower than the broader peer group’s 94.2x, suggesting room for re-rating if strong growth materializes.

- It is notable that attractive valuation multiples support the case for a discounted share price.

- Yet, the sustainability of these multiples depends on Cint’s ability to turn recent profit into a reliable trend rather than another blip.

Growth Outlook Beats Market but Comes With Quality Caveats

- Earnings are forecast to grow rapidly at 35.2% per year, outperforming the Swedish market’s 12.6% rate and setting high future expectations.

- Though the market view leans positive on tech-driven expansion and platform innovation, the reliance on a one-off profit gain leaves some skepticism about recurring underlying growth.

- Investors are drawn to the strong guidance, but are aware that headline forecasts could mask the effects of non-core profit boosts.

- This dynamic keeps sentiment cautiously optimistic, favoring progress but watching for confirmation in core metrics next period.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Cint Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Cint Group’s eye-catching forecast, questions linger about the reliability of its recent profitability and whether growth will truly be sustainable.

If you want more consistent track records, check out stable growth stocks screener (2098 results) to discover companies producing dependable earnings and revenue growth, rather than one-off surprises.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CINT

Cint Group

Provides software solutions for digital insights and research technology worldwide.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives