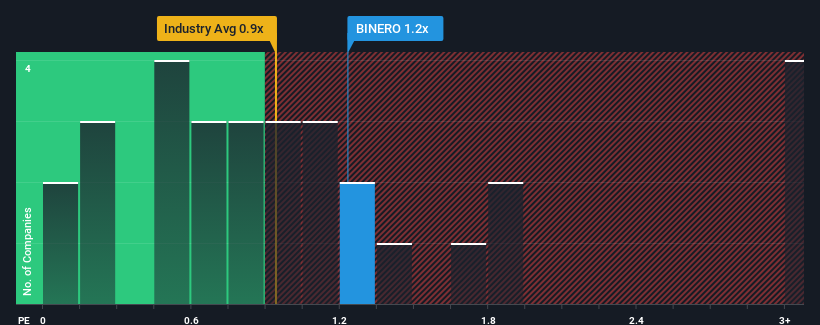

It's not a stretch to say that Binero Group AB (publ)'s (STO:BINERO) price-to-sales (or "P/S") ratio of 1.2x right now seems quite "middle-of-the-road" for companies in the IT industry in Sweden, where the median P/S ratio is around 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Binero Group

What Does Binero Group's Recent Performance Look Like?

Binero Group certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Binero Group.How Is Binero Group's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Binero Group's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 153% last year. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 73% during the coming year according to the only analyst following the company. With the rest of the industry predicted to shrink by 1.3%, that would be a fantastic result.

In light of this, it's peculiar that Binero Group's P/S sits in-line with the majority of other companies. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We note that even though Binero Group trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. The market could be pricing in the event that tough industry conditions will impact future revenues. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Binero Group (of which 2 are a bit unpleasant!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Binero Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BINERO

Binero Group

Develops and delivers cloud and platform services in Sweden, Norway, Denmark, and Finland.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026