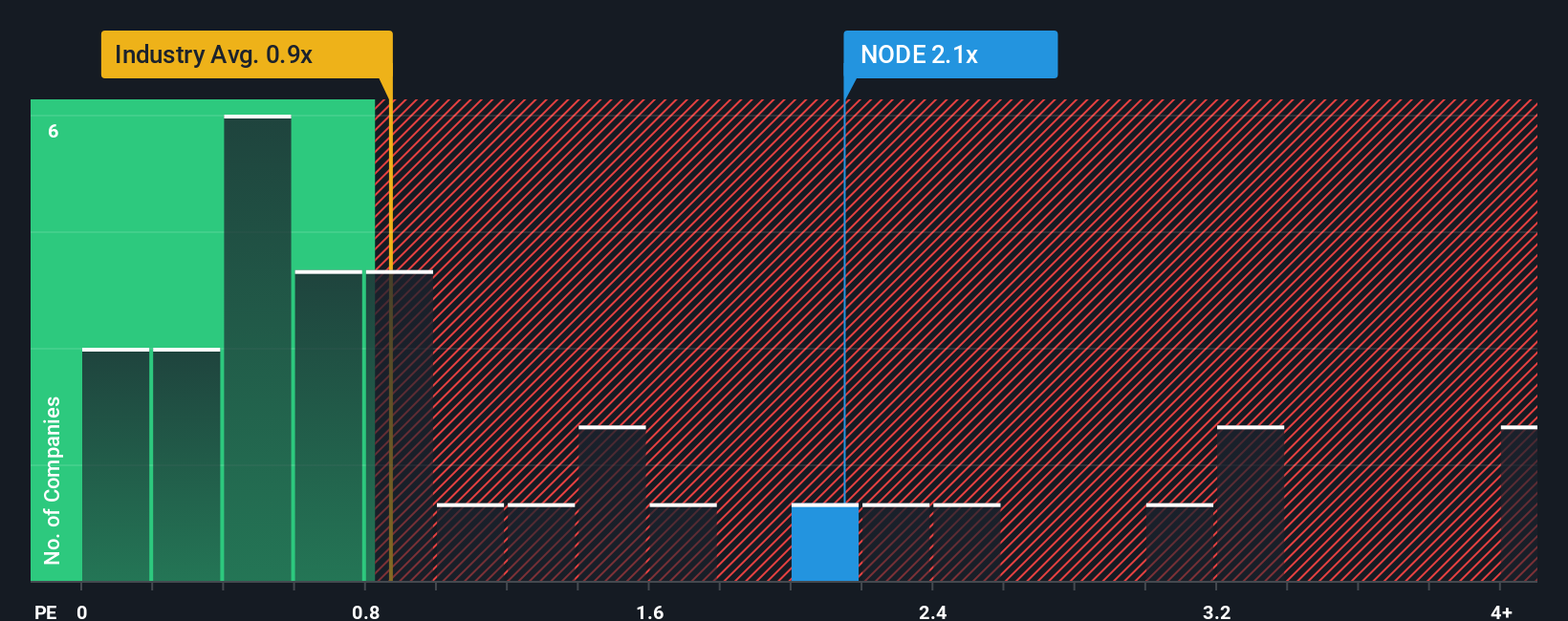

When you see that almost half of the companies in the IT industry in Sweden have price-to-sales ratios (or "P/S") below 0.9x, Nodebis Applications AB (publ) (NGM:NODE) looks to be giving off some sell signals with its 2.1x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Nodebis Applications

What Does Nodebis Applications' Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, Nodebis Applications has been doing very well. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Nodebis Applications will help you shine a light on its historical performance.How Is Nodebis Applications' Revenue Growth Trending?

Nodebis Applications' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 72%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is only predicted to deliver 6.5% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in consideration, it's not hard to understand why Nodebis Applications' P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Nodebis Applications' P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Nodebis Applications revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

You need to take note of risks, for example - Nodebis Applications has 5 warning signs (and 2 which shouldn't be ignored) we think you should know about.

If you're unsure about the strength of Nodebis Applications' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Nodebis Applications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:NODE

Nodebis Applications

Provides digital support services in Sweden and the Nordic region.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Investing in Resilience: The Case for DXN Holdings Berhad in 2026

Quanta Services (PWR): Strengthening the Backbone of the AI Power Grid.

KLA Corporation (KLAC): Engineering Yield in the Age of Chiplets and Sub-2nm Nodes.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks