- Sweden

- /

- Healthtech

- /

- OM:RAY B

Three Undiscovered Gems In Sweden Backed By Solid Fundamentals

Reviewed by Simply Wall St

As global markets continue to navigate economic uncertainties, the European Central Bank's recent rate cut has provided a boost to the pan-European STOXX Europe 600 Index, which ended the week 1.85% higher. Amid these developments, Sweden's market presents intriguing opportunities for investors seeking undiscovered gems with solid fundamentals. In this dynamic landscape, a good stock is characterized by strong financial health, robust growth prospects, and resilience in volatile conditions—qualities that are particularly pertinent given current market events.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Bahnhof | NA | 9.02% | 15.02% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| Firefly | NA | 16.04% | 32.29% | ★★★★★★ |

| AQ Group | 7.30% | 14.89% | 22.26% | ★★★★★★ |

| Creades | NA | -28.54% | -27.09% | ★★★★★★ |

| Svolder | NA | -22.68% | -24.17% | ★★★★★★ |

| Byggmästare Anders J Ahlström Holding | NA | 30.31% | -9.00% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

| Solid Försäkringsaktiebolag | NA | 7.64% | 28.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Clas Ohlson (OM:CLAS B)

Simply Wall St Value Rating: ★★★★★★

Overview: Clas Ohlson AB (publ) is a retail company that sells hardware, electrical, multimedia, home, and leisure products in Sweden, Norway, Finland, and internationally with a market cap of SEK10.29 billion.

Operations: Clas Ohlson generates revenue primarily from its retail specialty segment, amounting to SEK10.66 billion. The company operates across Sweden, Norway, Finland, and internationally.

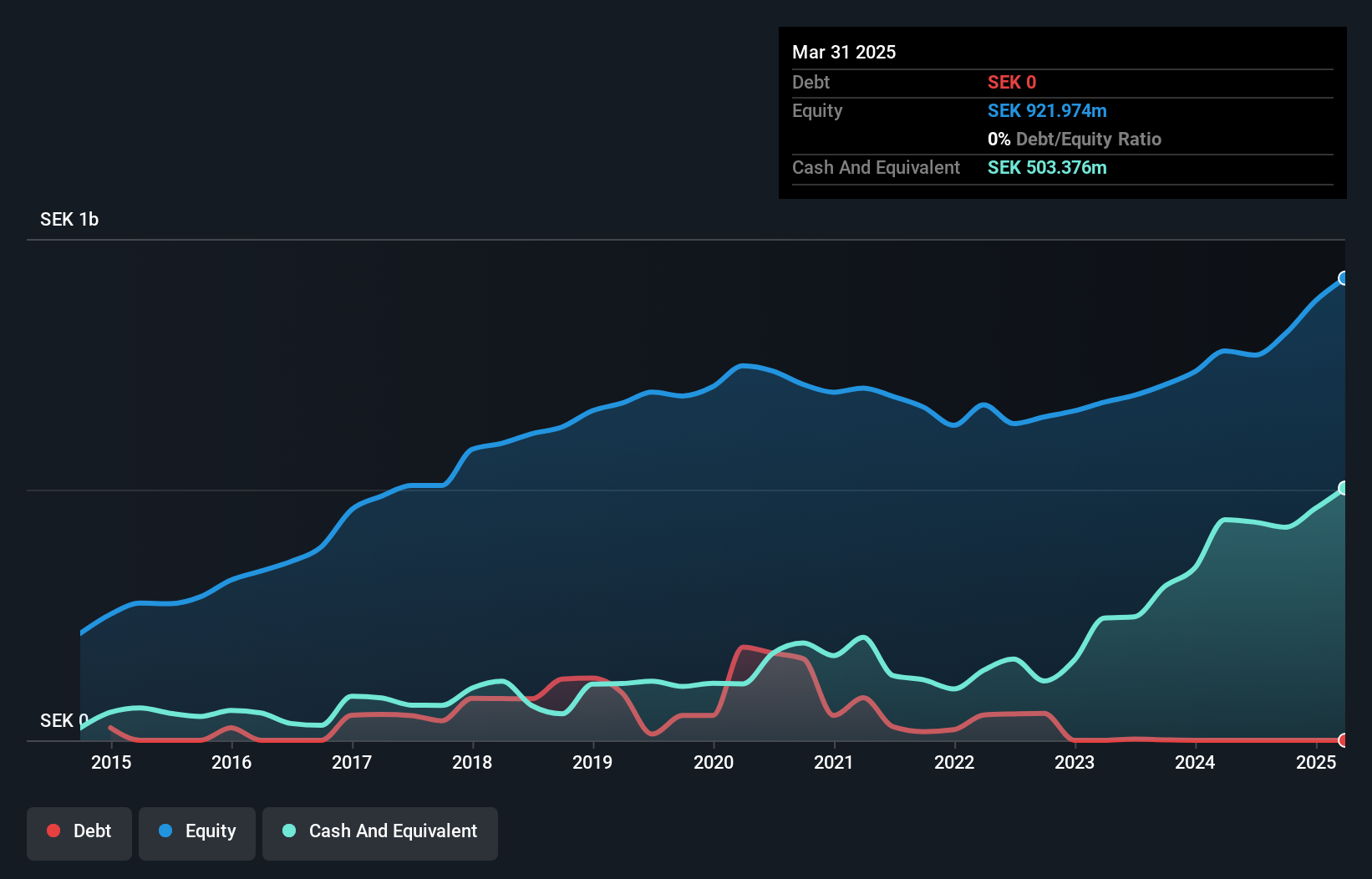

Clas Ohlson, a notable player in Sweden's specialty retail sector, has shown impressive earnings growth of 281.8%, far outpacing the industry average of 21%. The company reported first-quarter sales of SEK 2.62 billion and net income of SEK 145.8 million, reversing a net loss from the previous year. Trading at approximately 66% below its estimated fair value, Clas Ohlson also remains debt-free with high-quality earnings and forecasts an annual growth rate of 7.51%.

- Delve into the full analysis health report here for a deeper understanding of Clas Ohlson.

Understand Clas Ohlson's track record by examining our Past report.

RaySearch Laboratories (OM:RAY B)

Simply Wall St Value Rating: ★★★★★★

Overview: RaySearch Laboratories AB (publ) is a medical technology company that provides software solutions for cancer care across multiple regions, with a market cap of approximately SEK5.76 billion.

Operations: Revenue for RaySearch Laboratories AB (publ) primarily comes from its healthcare software segment, which generated SEK1.13 billion. The company has a market cap of approximately SEK5.76 billion.

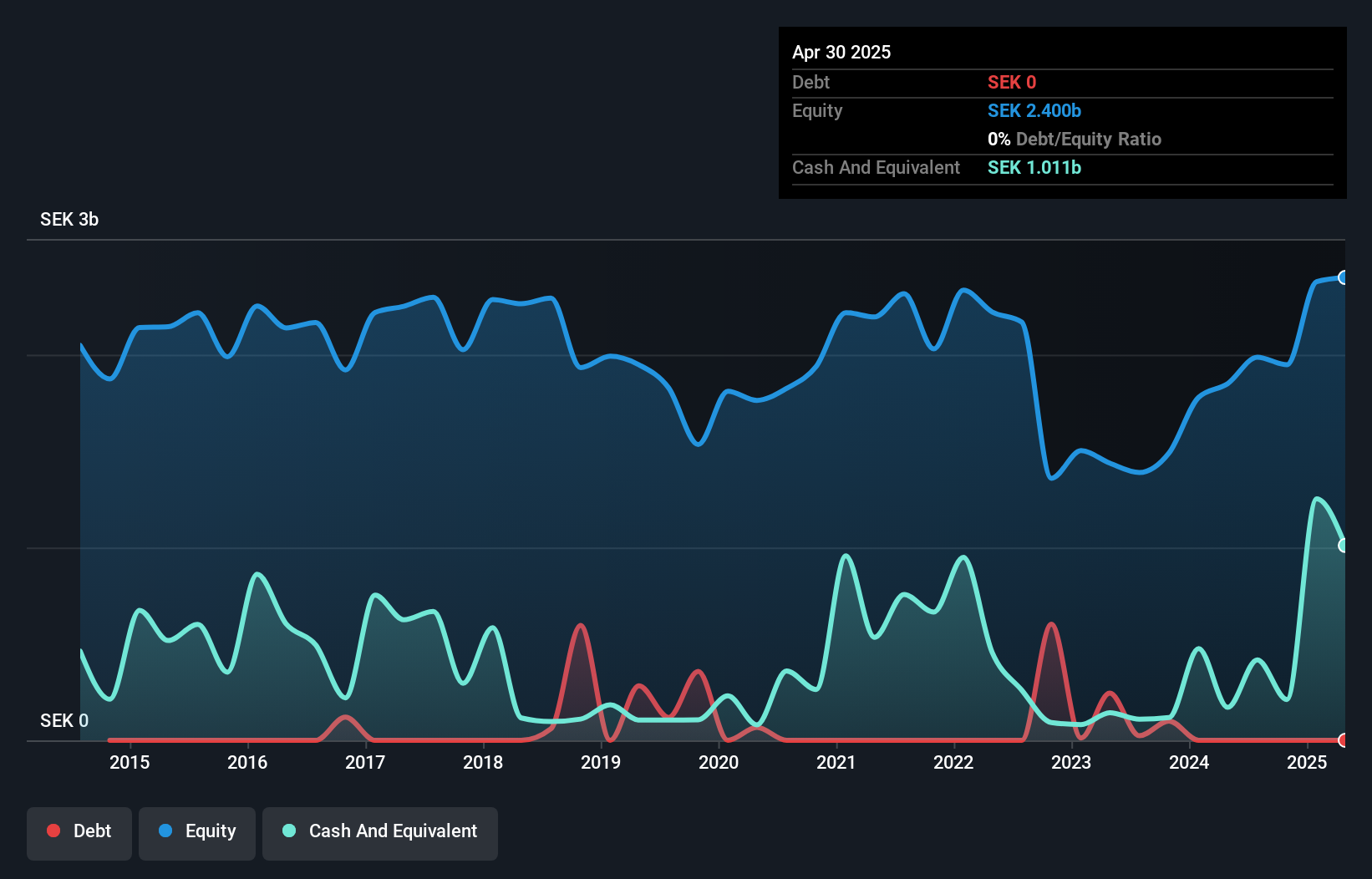

RaySearch Laboratories, a notable player in the healthcare services sector, has shown impressive growth with earnings surging by 187% over the past year. Trading at 66.3% below its estimated fair value, it stands out for its debt-free status and high-quality earnings. Recent achievements include treating the first patient using RayCare with Varian TrueBeam and securing significant orders from Connecticut Proton Therapy Center. The company reported Q2 sales of SEK 318.87 million and net income of SEK 61.43 million, reflecting robust performance improvements compared to last year.

Rusta (OM:RUSTA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Rusta AB (publ) retails home and leisure products in Sweden, Norway, Finland, and Germany with a market cap of SEK11.36 billion.

Operations: Rusta AB (publ) generates revenue primarily from retailing home and leisure products across Sweden, Norway, Finland, and Germany. The company has a market cap of SEK11.36 billion.

Rusta has been making waves with its robust financial performance and strategic expansions. Recent earnings showed sales of SEK 3.07 billion, up from SEK 2.96 billion last year, while net income rose to SEK 231 million from SEK 189 million. The company’s earnings growth of 47.3% over the past year outpaced the industry average of -5%. Rusta also opened its 50th store in Norway, contributing significantly to its revenue stream and future growth prospects.

- Dive into the specifics of Rusta here with our thorough health report.

Examine Rusta's past performance report to understand how it has performed in the past.

Next Steps

- Explore the 57 names from our Swedish Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:RAY B

RaySearch Laboratories

A medical technology company, provides software solutions for cancer care in the Americas, Europe, Africa, the Asia-Pacific, and the Middle East.

Flawless balance sheet with solid track record.