Spotlight On 3 Swedish Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

The Swedish market has been navigating a landscape shaped by recent interest rate cuts from the European Central Bank, which have buoyed major stock indexes across Europe. In this context of monetary easing, growth companies with high insider ownership can be particularly appealing as they often align management's interests with those of shareholders, potentially leading to more strategic decision-making and resilience in fluctuating economic conditions.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Truecaller (OM:TRUE B) | 29.7% | 21.8% |

| Biovica International (OM:BIOVIC B) | 18.3% | 78.5% |

| BioArctic (OM:BIOA B) | 34% | 98.4% |

| Yubico (OM:YUBICO) | 37.5% | 42.2% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| InCoax Networks (OM:INCOAX) | 20.1% | 115.5% |

| C-Rad (OM:CRAD B) | 16.1% | 33.9% |

| Catena Media (OM:CTM) | 10% | 123.9% |

| OrganoClick (OM:ORGC) | 23.1% | 109.0% |

Let's explore several standout options from the results in the screener.

Fortnox (OM:FNOX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fortnox AB (publ) offers financial and administrative software solutions for small and medium-sized businesses, accounting firms, and organizations, with a market cap of SEK36.60 billion.

Operations: The company's revenue segments include Core Products at SEK734 million, Businesses at SEK378 million, Accounting Firms at SEK352 million, Financial Services at SEK249 million, and Marketplaces at SEK160 million.

Insider Ownership: 19.1%

Fortnox, with substantial insider buying and no significant selling recently, is positioned for robust growth. Its earnings are forecast to grow significantly at 23.7% annually, outpacing the Swedish market's 15.5%. Revenue is expected to increase by 19.9% per year, surpassing the market average of 1%. Analysts agree on a potential stock price rise of 29.2%, while it trades at a notable discount to its estimated fair value.

- Dive into the specifics of Fortnox here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Fortnox's share price might be too pessimistic.

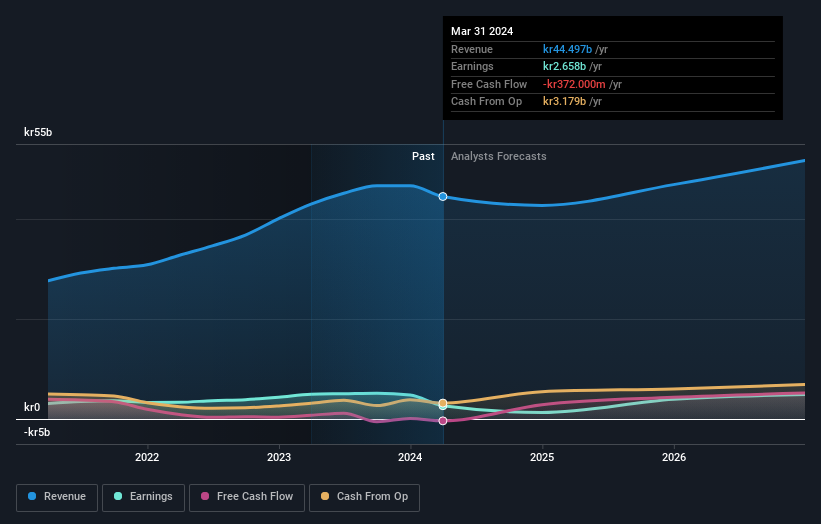

NIBE Industrier (OM:NIBE B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NIBE Industrier AB (publ) develops, manufactures, markets, and sells energy-efficient solutions for indoor climate comfort and intelligent heating and control across the Nordic countries, Europe, North America, and internationally with a market cap of approximately SEK101.45 billion.

Operations: The company's revenue segments include SEK5.33 billion from Stoves, SEK13.48 billion from Element, and SEK35.22 billion from Climate Solutions.

Insider Ownership: 20.2%

NIBE Industrier's revenue is forecast to grow at 6.7% annually, surpassing the Swedish market average of 1%, with earnings expected to increase significantly by 41.1% per year over the next three years. Despite lower profit margins compared to last year and interest payments not well covered by earnings, it trades slightly below its estimated fair value. Recent financial results showed a decline in sales and net income, but no substantial insider trading activity was reported recently.

- Navigate through the intricacies of NIBE Industrier with our comprehensive analyst estimates report here.

- Our valuation report here indicates NIBE Industrier may be overvalued.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) operates in the medical IT and cybersecurity sectors across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market cap of approximately SEK56.34 billion.

Operations: The company's revenue is primarily derived from Imaging IT Solutions (SEK2.67 billion) and Secure Communications (SEK388.55 million), with additional contributions from Business Innovation (SEK90.77 million).

Insider Ownership: 30.3%

Sectra's earnings are forecast to grow significantly at 21.2% annually, outpacing the Swedish market. Revenue growth is expected at 14.2%, faster than the market average but below 20%. Recent financials show a solid increase in sales and net income for Q1 2024. While insider buying has not been substantial recently, more shares were bought than sold over the past three months. Sectra's recent partnership with MaineGeneral Health emphasizes its strategic expansion in cloud-based medical imaging solutions.

- Click to explore a detailed breakdown of our findings in Sectra's earnings growth report.

- Upon reviewing our latest valuation report, Sectra's share price might be too optimistic.

Summing It All Up

- Investigate our full lineup of 80 Fast Growing Swedish Companies With High Insider Ownership right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if NIBE Industrier might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NIBE B

NIBE Industrier

Develops, manufactures, markets, and sells various energy-efficient solutions for indoor climate comfort, and components and solutions for intelligent heating and control in Nordic countries, rest of Europe, North America, and internationally.

Reasonable growth potential with questionable track record.