As global markets grapple with geopolitical tensions and economic uncertainties, the pan-European STOXX Europe 600 Index has seen a decline, reflecting investor caution. In this environment, small-cap stocks in Sweden present unique opportunities for diversification and growth potential. Identifying promising companies requires a keen eye for innovation, strong fundamentals, and resilience amidst broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Bahnhof | NA | 9.02% | 15.02% | ★★★★★★ |

| Duni | 29.33% | 10.78% | 22.98% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| Firefly | NA | 16.04% | 32.29% | ★★★★★★ |

| AQ Group | 7.30% | 14.89% | 22.26% | ★★★★★★ |

| Svolder | NA | -22.68% | -24.17% | ★★★★★★ |

| Byggmästare Anders J Ahlström Holding | NA | 30.31% | -9.00% | ★★★★★★ |

| Creades | NA | -28.54% | -27.09% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Cloetta (OM:CLA B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cloetta AB (publ) is a confectionery company with a market capitalization of approximately SEK7.22 billion.

Operations: Cloetta's revenue primarily comes from packaged branded goods, generating SEK6.24 billion, followed by candy not packed in small bags at SEK2.22 billion.

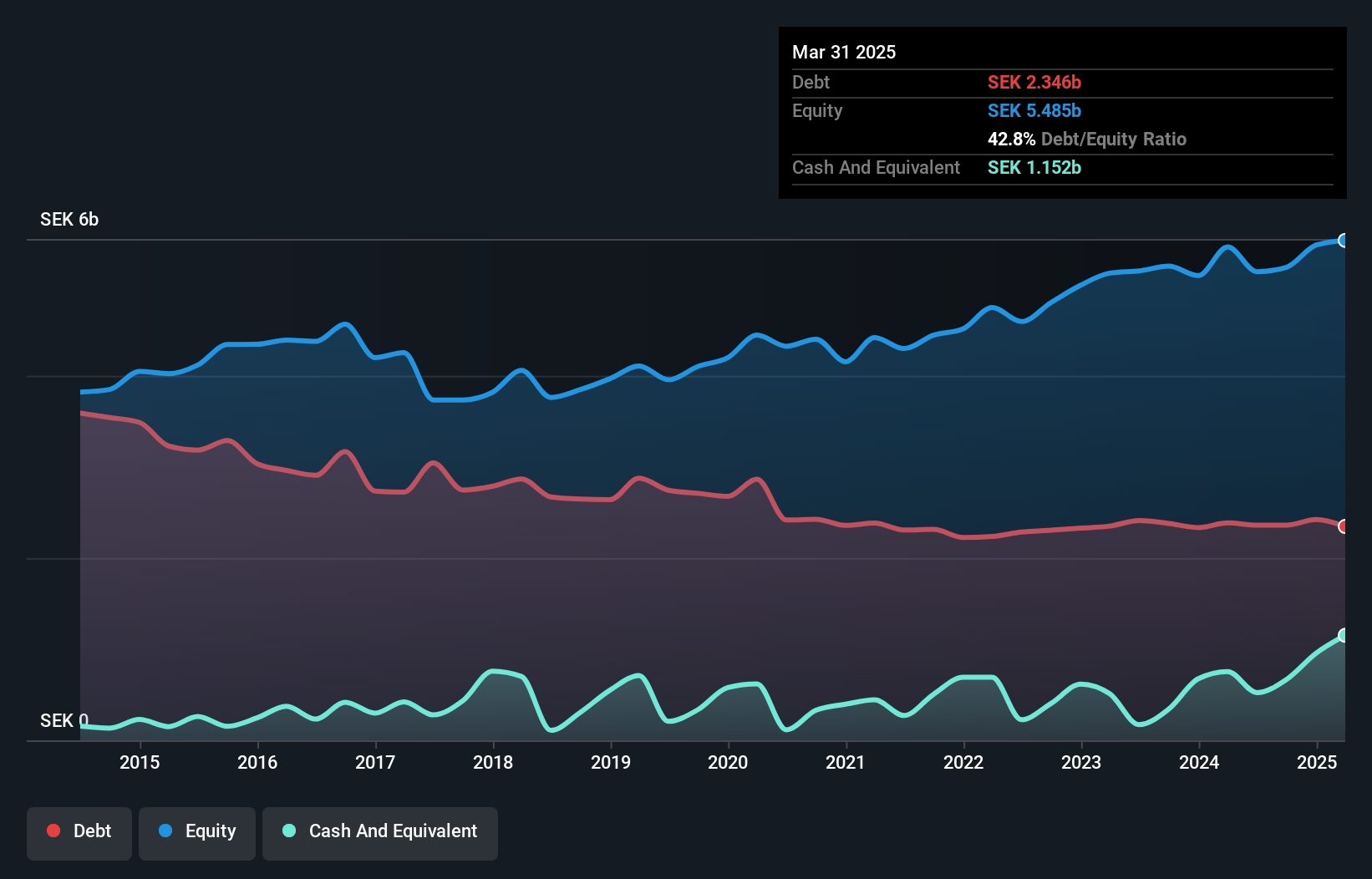

Cloetta, a confectionery player, is navigating a dynamic landscape with its debt to equity ratio improving from 69% to 46% over five years. Trading at nearly 17% below estimated fair value suggests potential upside. Recent earnings show growth, with Q2 sales at SEK 2.04 billion and net income reaching SEK 82 million. However, insider selling raises questions about internal confidence despite high-quality earnings and satisfactory net debt levels of around 36%.

- Get an in-depth perspective on Cloetta's performance by reading our health report here.

Explore historical data to track Cloetta's performance over time in our Past section.

Rusta (OM:RUSTA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Rusta AB (publ) is a retailer specializing in home and leisure products across Sweden, Norway, Finland, and Germany with a market cap of approximately SEK12.40 billion.

Operations: Rusta generates revenue primarily from its operations in Sweden, Norway, and other markets, with Sweden contributing SEK6.43 billion and Norway SEK2.39 billion.

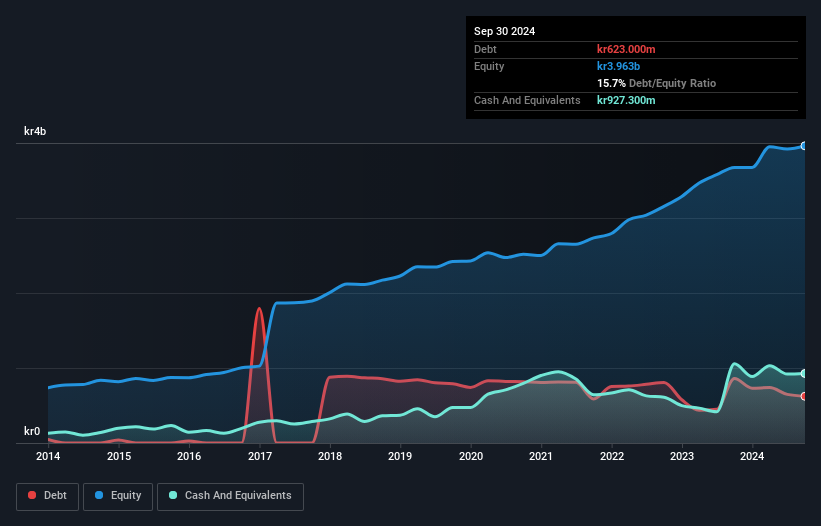

Rusta has been making waves with its robust earnings growth of 47.5% over the past year, surpassing the Multiline Retail industry's -5%. Trading at 69.3% below estimated fair value, it presents an attractive proposition for investors. The company recently expanded by opening new stores in Hoor and Lorenskog, bringing its total to 217 outlets. Rusta's first-quarter sales reached SEK 3,069 million, with net income climbing to SEK 231 million from SEK 189 million a year prior.

- Navigate through the intricacies of Rusta with our comprehensive health report here.

Assess Rusta's past performance with our detailed historical performance reports.

VBG Group (OM:VBG B)

Simply Wall St Value Rating: ★★★★★★

Overview: VBG Group AB (publ) is a company that develops, manufactures, markets, and sells various industrial products across Sweden, Germany, other Nordic countries and Europe, North America, Brazil, Australia/New Zealand, China, and internationally with a market cap of approximately SEK9.58 billion.

Operations: The company's revenue primarily comes from three segments: Mobile Thermal Solutions (SEK3.33 billion), Truck & Trailer Equipment (SEK1.62 billion), and RINGFEDER Power Transmission (SEK962.30 million).

VBG Group, a notable player in Sweden's machinery sector, has shown impressive earnings growth of 50.3% over the past year, significantly outpacing the industry's 0.9%. The company trades at a value 2.8% below its estimated fair value and boasts high-quality earnings with interest payments well-covered by EBIT at a ratio of 31.2x. Recent strategic moves include consolidating operations in Toronto to enhance efficiency, with investments totaling CAD 108 million planned through 2026.

- Delve into the full analysis health report here for a deeper understanding of VBG Group.

Review our historical performance report to gain insights into VBG Group's's past performance.

Summing It All Up

- Gain an insight into the universe of 55 Swedish Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:RUSTA

Rusta

Rusta AB (publ) retails home and leisure products in Sweden, Norway, Finland, and Germany.

High growth potential with solid track record.