As global markets face heightened tensions and economic uncertainties, the Swedish market remains a focal point for investors seeking stability and income through dividend stocks. In this environment, selecting stocks that offer reliable dividends can provide a buffer against volatility, making them an attractive option for those looking to balance risk with steady returns.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.57% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 3.82% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.20% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.01% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.63% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.82% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.81% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 3.90% | ★★★★☆☆ |

| Afry (OM:AFRY) | 3.07% | ★★★★☆☆ |

| SSAB (OM:SSAB A) | 9.85% | ★★★★☆☆ |

Click here to see the full list of 22 stocks from our Top Swedish Dividend Stocks screener.

We'll examine a selection from our screener results.

BioGaia (OM:BIOG B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BioGaia AB (publ) is a healthcare company that offers probiotic products globally, with a market capitalization of approximately SEK10.94 billion.

Operations: BioGaia AB (publ) generates revenue primarily from its Pediatrics segment, which accounts for SEK1072.93 million, and its Adult Health segment, contributing SEK288.68 million.

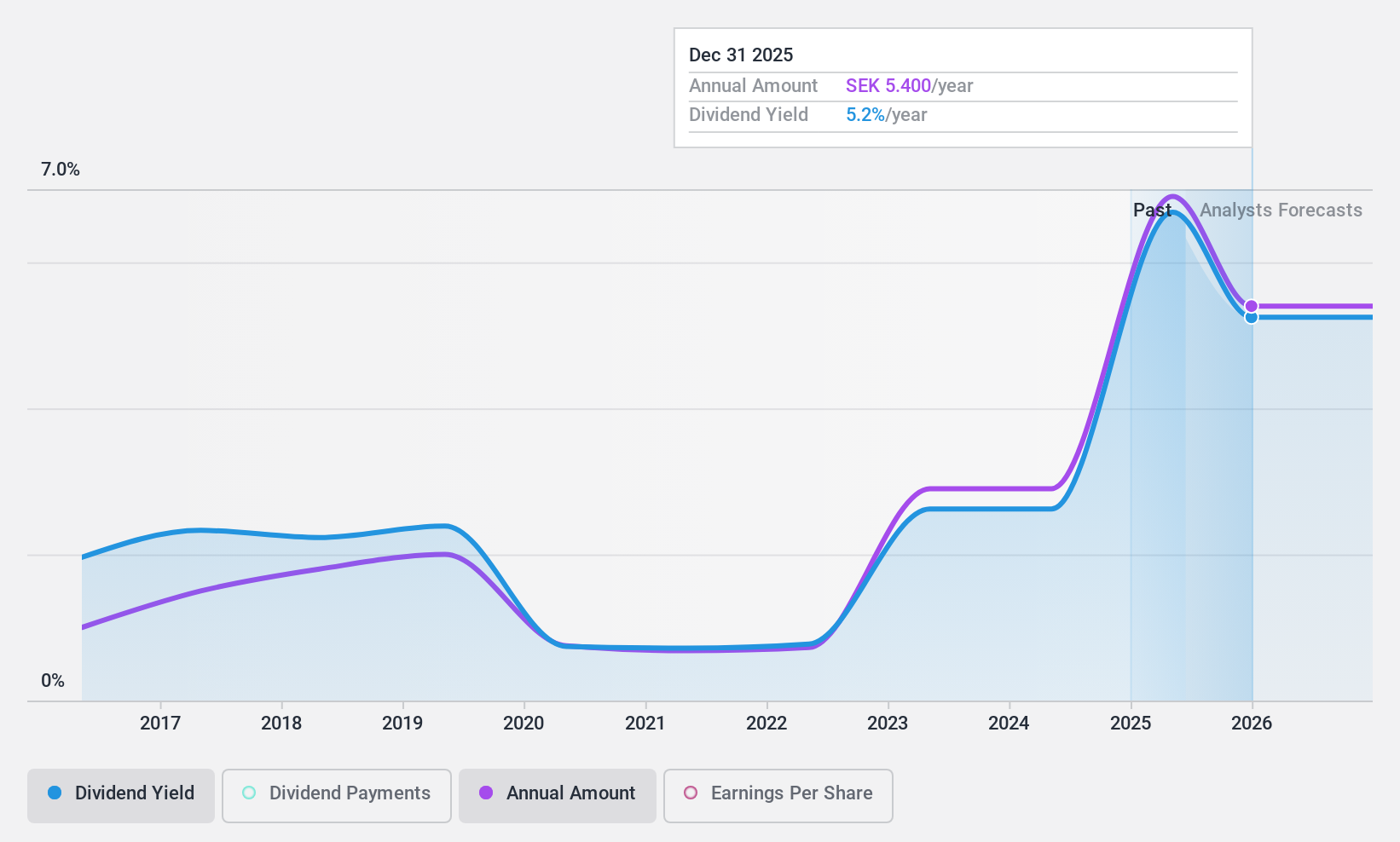

Dividend Yield: 6.4%

BioGaia's dividend yield of 6.38% ranks among the top 25% in Sweden, yet its reliability is questionable due to volatility and a high cash payout ratio of 193.8%, indicating dividends aren't well covered by cash flows. Despite a low earnings payout ratio of 47.8%, suggesting coverage by profits, the sustainability remains uncertain without strong cash flow backing. Recent earnings growth shows promise, with Q2 sales at SEK 384.12 million and net income rising to SEK 111.01 million.

- Get an in-depth perspective on BioGaia's performance by reading our dividend report here.

- Our valuation report here indicates BioGaia may be undervalued.

Bredband2 i Skandinavien (OM:BRE2)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Bredband2 i Skandinavien AB (publ) offers data communication and security solutions to individuals and companies in Sweden, with a market cap of approximately SEK1.89 billion.

Operations: Bredband2 i Skandinavien AB (publ) generates revenue primarily from its National Broadband Service segment, which accounts for SEK1.65 billion.

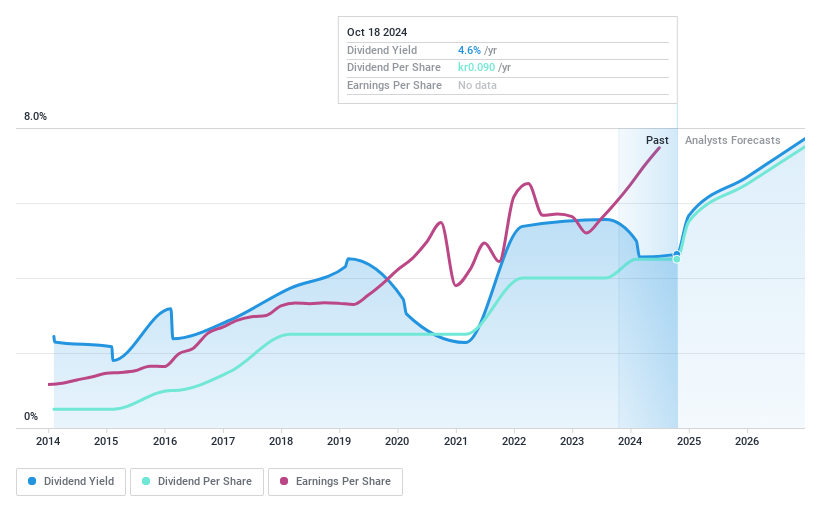

Dividend Yield: 4.6%

Bredband2 i Skandinavien offers a stable dividend profile, with a yield of 4.57% placing it among the top 25% of Swedish dividend payers. The company's dividends are reliably covered by earnings (payout ratio: 87.6%) and cash flows (cash payout ratio: 39.1%). Recent financial results show growth, with Q2 sales increasing to SEK 429.55 million and net income rising to SEK 24.35 million, supporting continued dividend payments amidst consistent earnings growth over the past year.

- Delve into the full analysis dividend report here for a deeper understanding of Bredband2 i Skandinavien.

- The analysis detailed in our Bredband2 i Skandinavien valuation report hints at an inflated share price compared to its estimated value.

HEXPOL (OM:HPOL B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HEXPOL AB (publ) develops, manufactures, and sells various polymer compounds and engineered products across Sweden, Europe, the Americas, and Asia with a market cap of approximately SEK36.06 billion.

Operations: HEXPOL AB generates its revenue primarily from HEXPOL Compounding, which accounts for SEK20.18 billion, and HEXPOL Engineered Products, contributing SEK1.61 billion.

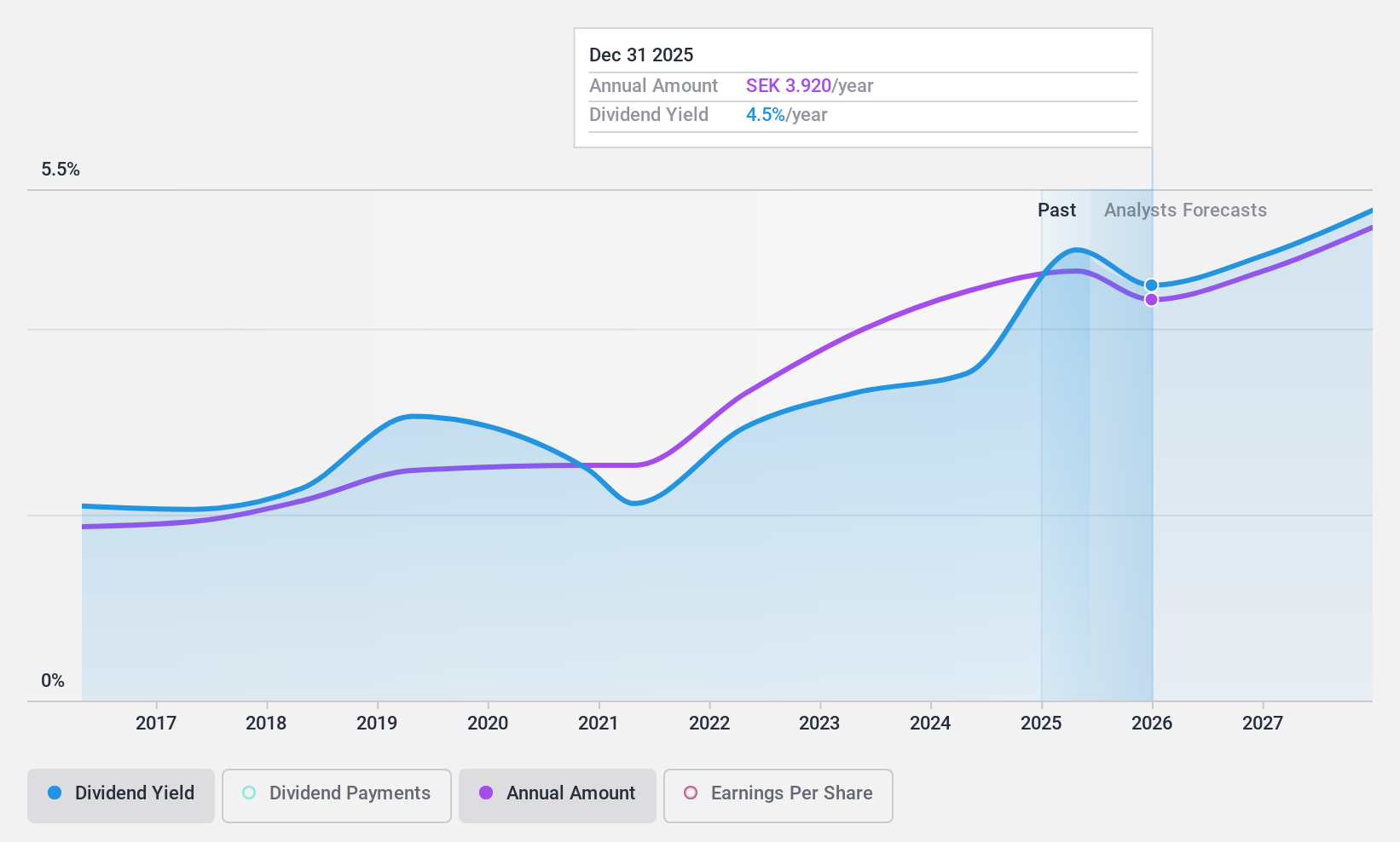

Dividend Yield: 3.8%

HEXPOL AB maintains a reliable dividend profile, with dividends growing steadily over the past decade and a payout ratio of 55.4% ensuring coverage by earnings. Despite recent earnings showing a slight decline, the company's dividends remain stable and supported by cash flows (cash payout ratio: 57.8%). Although its dividend yield of 3.82% is below the top tier in Sweden, HEXPOL trades at good value relative to peers, offering potential for capital appreciation alongside its consistent dividends.

- Click here to discover the nuances of HEXPOL with our detailed analytical dividend report.

- Our expertly prepared valuation report HEXPOL implies its share price may be lower than expected.

Make It Happen

- Navigate through the entire inventory of 22 Top Swedish Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioGaia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BIOG B

Flawless balance sheet with reasonable growth potential and pays a dividend.