- France

- /

- Capital Markets

- /

- ENXTPA:BSD

Undiscovered Gems in Europe to Explore This October 2025

Reviewed by Simply Wall St

Amidst a backdrop of political turmoil in France and trade tensions impacting European markets, the pan-European STOXX Europe 600 Index recently experienced a slight decline after reaching record highs. This environment of uncertainty presents an intriguing opportunity to explore lesser-known stocks that may offer potential growth, particularly those resilient to broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sparta | NA | nan | nan | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Freetrailer Group | 0.01% | 22.96% | 31.56% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Funkwerk (DB:FEW0)

Simply Wall St Value Rating: ★★★★★☆

Overview: Funkwerk AG is an international company specializing in the development and sale of communication, information, and security systems, with a market cap of €257.91 million.

Operations: Funkwerk AG generates revenue primarily through its communication, information, and security systems. The company's financial performance is influenced by its ability to manage costs effectively while focusing on these core areas.

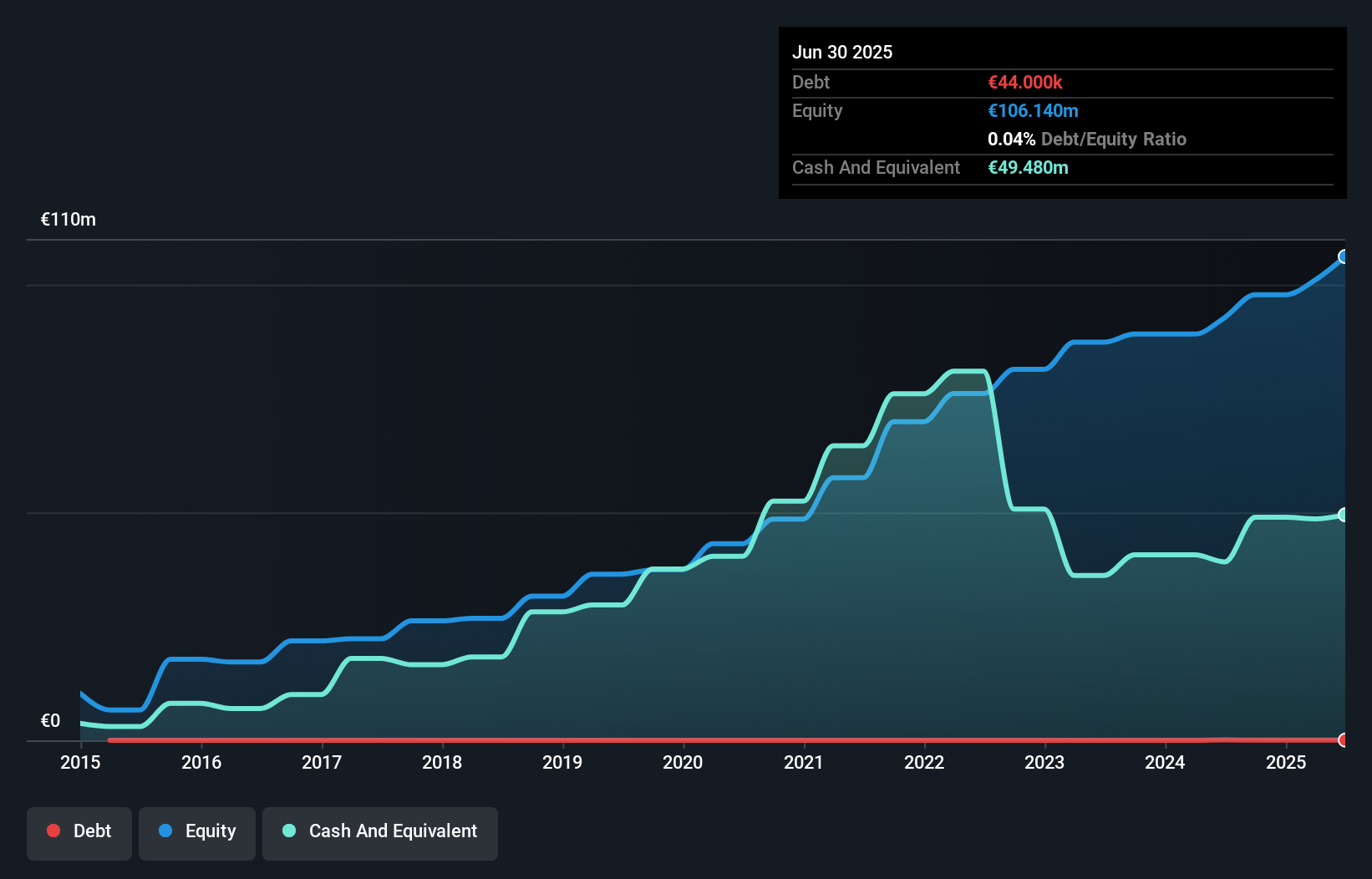

Funkwerk, a nimble player in its field, has shown impressive resilience with earnings growth of 16.9% over the past year, outpacing the broader Communications sector's -10.7%. The company’s price-to-earnings ratio stands at 13.7x, offering a more attractive valuation compared to the German market average of 18.6x. Despite an increase in its debt-to-equity ratio from 0% to 0.04% over five years, Funkwerk remains financially sound with more cash than total debt and robust interest coverage capabilities, suggesting it is well-positioned to navigate future challenges while maintaining high-quality earnings performance.

- Click to explore a detailed breakdown of our findings in Funkwerk's health report.

Gain insights into Funkwerk's past trends and performance with our Past report.

Bourse Direct (ENXTPA:BSD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bourse Direct SA operates as an Internet stock brokerage service provider in France with a market capitalization of €219.34 million.

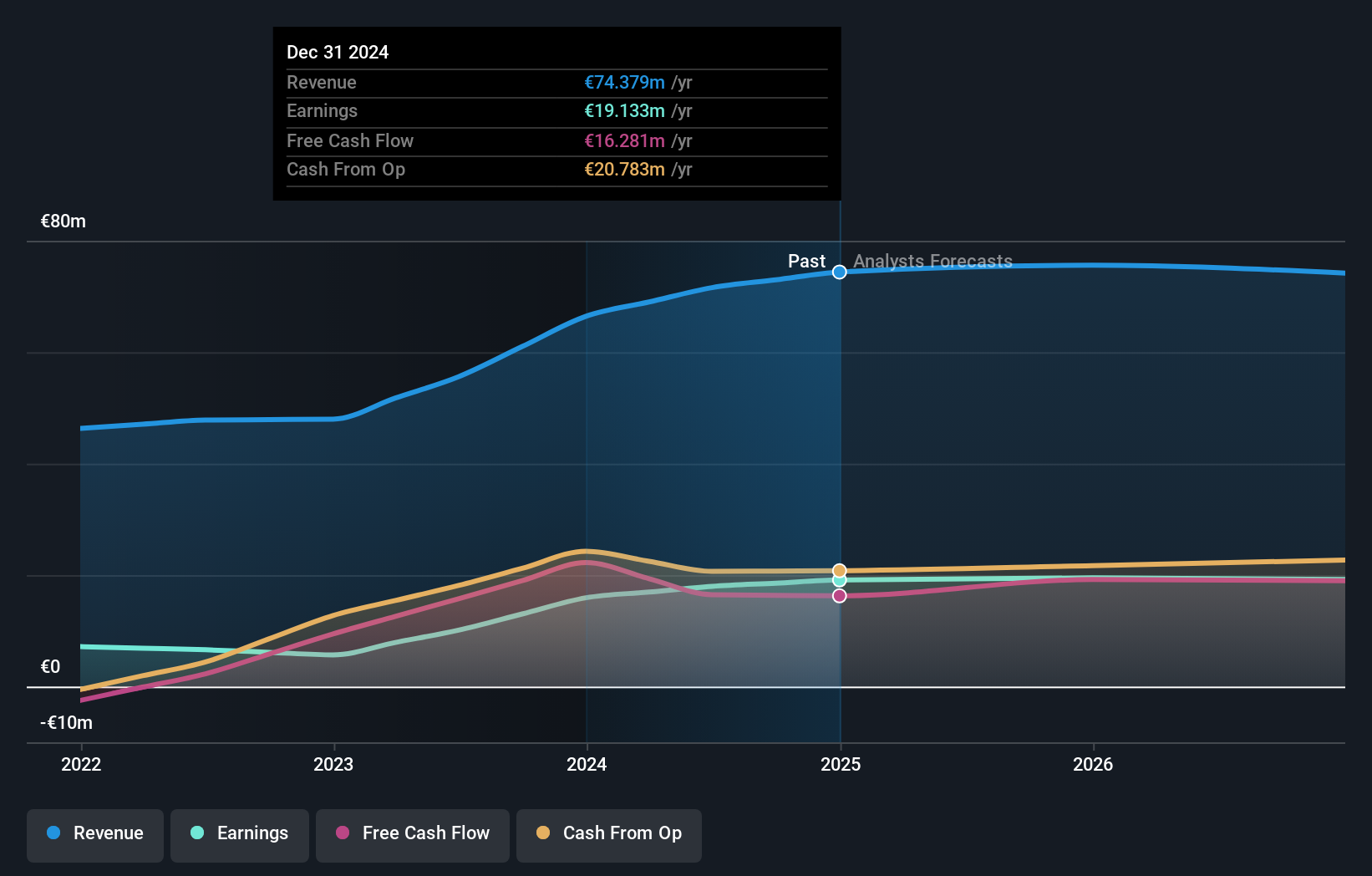

Operations: The company generates revenue primarily through its Stock Exchange Online segment (€61.19 million) and Financial Intermediation (€7.52 million).

Bourse Direct, a small player in the European market, has shown resilience with earnings growing 30% annually over the past five years. Despite trailing the industry growth of 8.7% last year with just a 1.9% increase, it trades at nearly 7% below estimated fair value, suggesting room for appreciation. The firm’s net debt to equity ratio stands at a satisfactory 27%, having improved significantly from 181% five years ago, indicating prudent financial management. Recent half-year results showed net income of €9.3 million compared to €10.2 million previously, hinting at some pressure but still reflecting solid performance overall.

- Click here to discover the nuances of Bourse Direct with our detailed analytical health report.

Explore historical data to track Bourse Direct's performance over time in our Past section.

Nelly Group (OM:NELLY)

Simply Wall St Value Rating: ★★★★★★

Overview: Nelly Group AB (publ) is a fashion company operating in Sweden, the rest of the Nordics, and internationally, with a market cap of approximately SEK 2.84 billion.

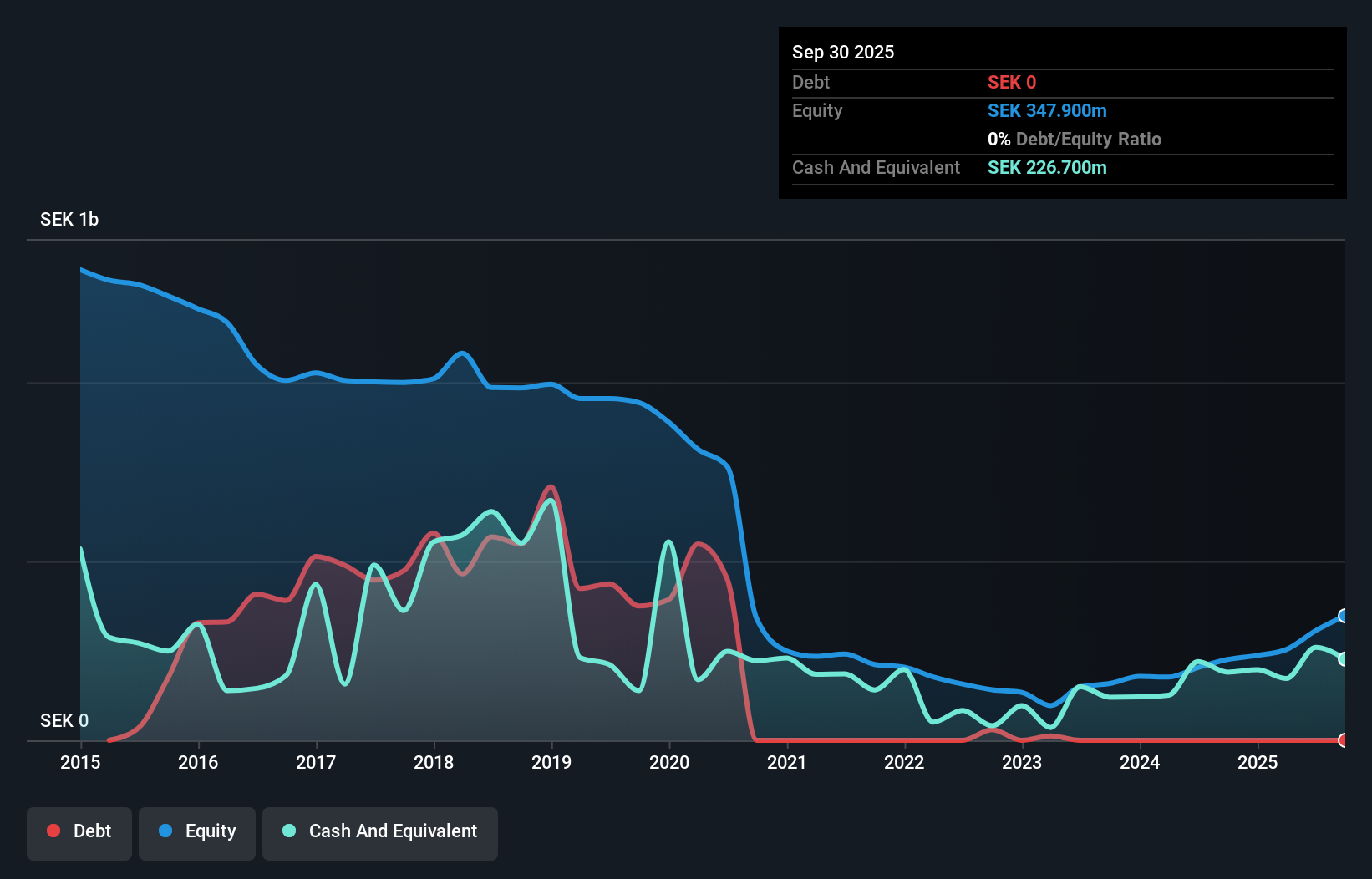

Operations: Nelly Group generates revenue of SEK 1.17 billion primarily from its fashion segment. The company's financial data highlights a focus on optimizing its cost structure to enhance profitability within this core revenue stream.

Nelly Group, a player in the Specialty Retail sector, has shown impressive financial health with no debt compared to five years ago when its debt-to-equity ratio was 58.9%. The company boasts high-quality earnings and achieved a remarkable 137.7% earnings growth over the past year, outpacing the industry's 10.9%. With a Price-To-Earnings ratio of 22.3x lower than the Swedish market's average of 23.1x, Nelly appears attractively valued for investors seeking opportunities in smaller firms with robust financials and growth potential. Additionally, positive free cash flow further underscores its strong operational performance and promising outlook within its industry context.

- Take a closer look at Nelly Group's potential here in our health report.

Assess Nelly Group's past performance with our detailed historical performance reports.

Next Steps

- Discover the full array of 326 European Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bourse Direct might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BSD

Good value with adequate balance sheet.

Market Insights

Community Narratives