- Sweden

- /

- Specialty Stores

- /

- OM:NELLY

There's Reason For Concern Over Nelly Group AB (publ)'s (STO:NELLY) Massive 35% Price Jump

Despite an already strong run, Nelly Group AB (publ) (STO:NELLY) shares have been powering on, with a gain of 35% in the last thirty days. The last month tops off a massive increase of 254% in the last year.

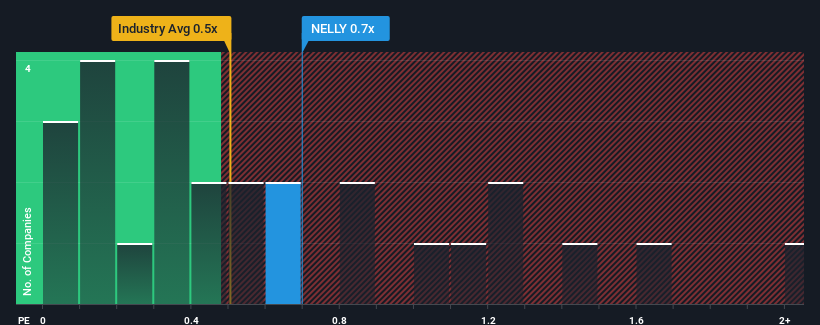

Although its price has surged higher, there still wouldn't be many who think Nelly Group's price-to-sales (or "P/S") ratio of 0.7x is worth a mention when the median P/S in Sweden's Specialty Retail industry is similar at about 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Nelly Group

How Nelly Group Has Been Performing

For example, consider that Nelly Group's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Nelly Group will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

Nelly Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 10%. As a result, revenue from three years ago have also fallen 24% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 3.4% shows it's an unpleasant look.

With this in mind, we find it worrying that Nelly Group's P/S exceeds that of its industry peers. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Final Word

Nelly Group's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that Nelly Group currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Nelly Group that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Nelly Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NELLY

Nelly Group

Operates as a fashion company in Sweden, rest of Nordics, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives