- Sweden

- /

- Specialty Stores

- /

- OM:HM B

Is Now the Right Time to Reassess H&M After Its 2025 Price Rally?

Reviewed by Bailey Pemberton

Thinking about what to do with your H & M Hennes & Mauritz shares right now? You are not alone. With the stock closing at 178.15 and notching up a 4.2% gain over the last week, plus almost 17% over the past month, there is a real sense that something is shifting. If you zoom out, the numbers become even more compelling. H & M is up nearly 20% year-to-date, more than 7% over the past year, and has delivered a whopping 75% return over the last three years. Those gains do not just happen by accident.

Much of the momentum can be traced back to recent headlines. The company’s ability to navigate supply chain disruptions, make rapid shifts in its fashion offerings, and respond to changing consumer tastes have kept it in the spotlight. There is also growing market enthusiasm about its push into more sustainable collections and digital sales. While none of these factors alone drive the stock price, together they have boosted investor confidence and changed how people assess the company’s risks and opportunities.

Of course, the big question is whether the recent rally leaves H & M’s stock looking expensive or if it still has room to run. On our value score, where one point is added for each of six checks showing the company is undervalued, the company clocks in at 3 out of 6. That suggests the market has noticed some strengths but may be overlooking others.

So how exactly do we measure whether H & M is undervalued or overpriced? Let’s dig into the numbers using a range of valuation methods. And stay tuned, because there is an even more effective way to size up valuation that we will cover at the end of this article.

Why H & M Hennes & Mauritz is lagging behind its peers

Approach 1: H & M Hennes & Mauritz Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to their value today. This approach essentially asks: how much are all of H & M Hennes & Mauritz's future cash flows worth in today's money?

Starting with a trailing free cash flow of approximately SEK 19.8 billion, analysts project continued annual growth, with cash flows reaching SEK 31.4 billion by 2028. Beyond the analysts' 5-year estimates, further cash flow figures are extrapolated. The 10-year forward projection suggests free cash flows of nearly SEK 39.1 billion by 2035. All cash flow estimates are in Swedish Kronor (SEK) billions.

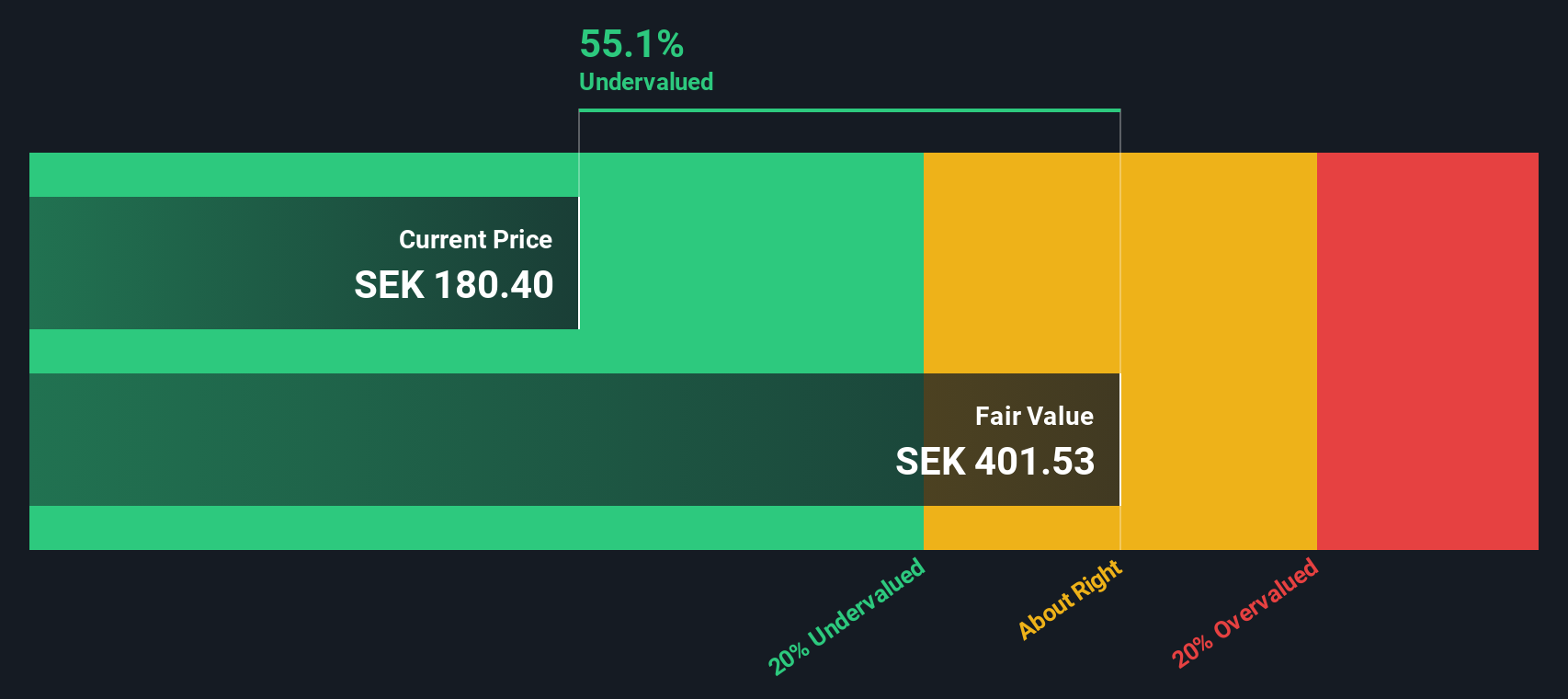

Factoring in these projections and discounting each future cash flow back to present value, the DCF model arrives at an intrinsic fair value for H & M Hennes & Mauritz of SEK 399.11 per share. Compared to the current trading price of SEK 178.15, this implies the stock is roughly 55.4 percent undervalued based on its projected cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests H & M Hennes & Mauritz is undervalued by 55.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: H & M Hennes & Mauritz Price vs Earnings

For profitable companies like H & M Hennes & Mauritz, the price-to-earnings (PE) ratio remains a favored tool for investors. This metric makes it easy to compare how much investors are paying for every unit of earnings, providing a quick gauge for whether the stock price is justified by the company’s profitability.

Growth expectations and risk both weigh heavily on what a “normal” or fair PE ratio should be. If a company is expected to grow rapidly or has lower risk than peers, a higher PE is often justified. Conversely, slower growth and elevated risk typically command a lower multiple.

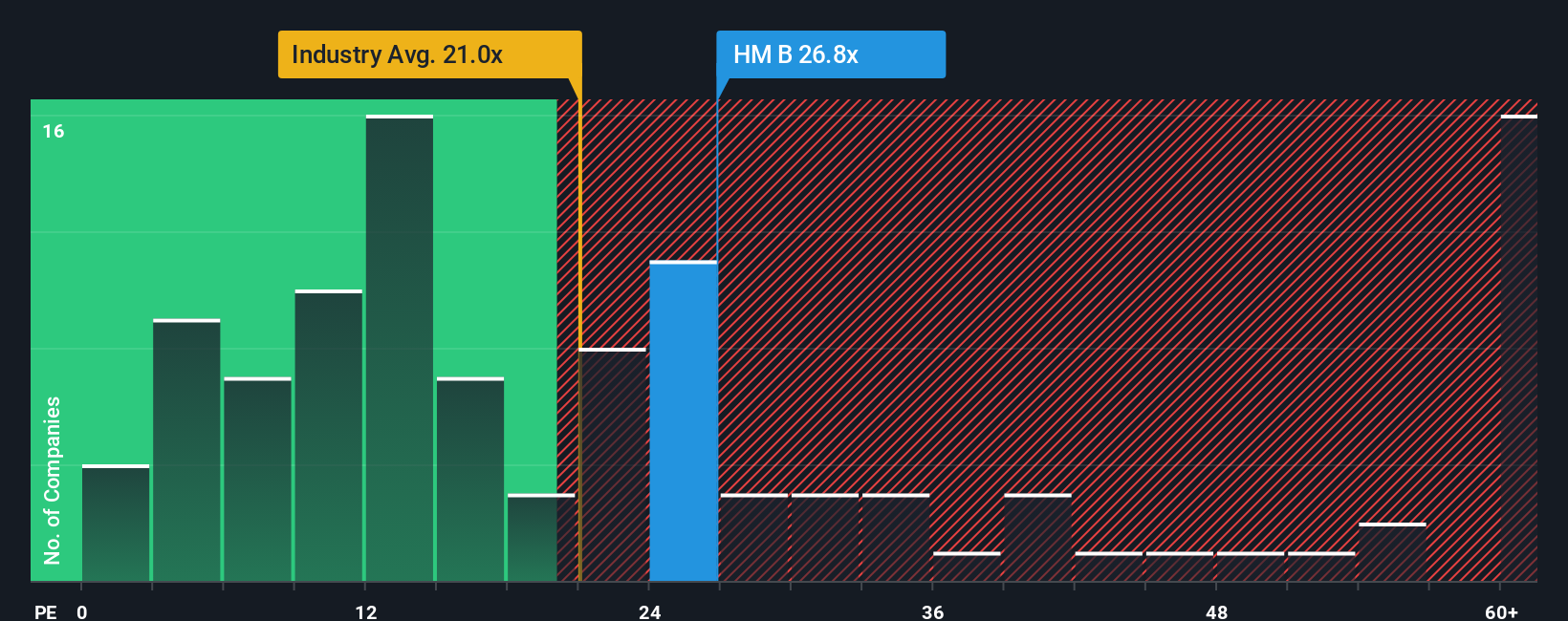

Currently, H & M Hennes & Mauritz trades at a PE of 26.5x. This is higher than the Specialty Retail industry average of 16.6x and above its peer average of 21.2x. On the surface, this premium might seem steep. However, it is also essential to consider whether this premium is deserved given the company’s growth outlook and profitability. This is where Simply Wall St’s “Fair Ratio” comes in.

The Fair Ratio, calculated here as 30.8x, combines critical factors such as H & M Hennes & Mauritz’s own earnings growth, industry landscape, profit margin, company size, and risk profile. Unlike simple comparisons with peer or industry averages, it tailors the valuation benchmark uniquely to the company’s fundamentals and outlook.

Since H & M Hennes & Mauritz’s actual PE of 26.5x is below its Fair Ratio of 30.8x, this suggests the stock may be undervalued by this measure, even with the headline premium to the sector.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your H & M Hennes & Mauritz Narrative

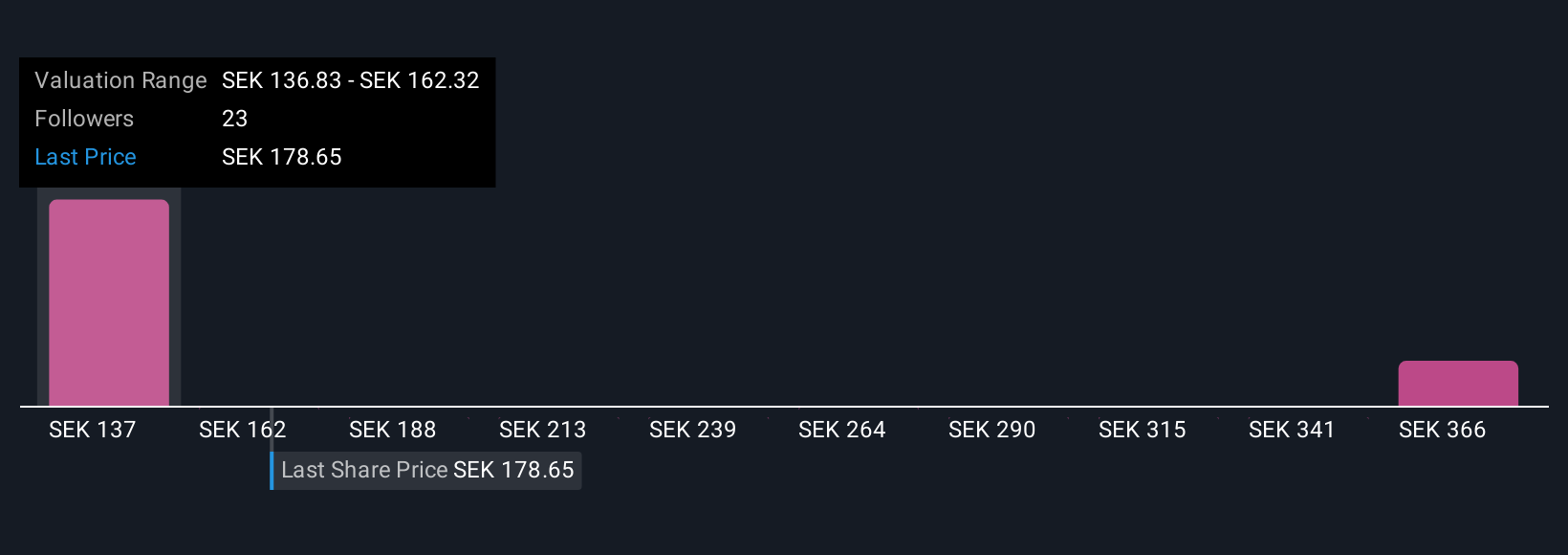

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, yet powerful tool for investors to spell out their perspective on a company by linking the story they believe will unfold with specific assumptions about future revenue, earnings, and profit margins. Narratives connect the dots between H & M Hennes & Mauritz’s strategy or recent developments, the numbers you expect to see, and what you think those mean for a fair share price today.

On Simply Wall St’s Community page, millions of investors can create and update their own Narratives, making it easy and accessible to see how different people interpret the same set of facts. Narratives help you decide when to buy or sell by letting you compare your estimated Fair Value with the current Price, and are kept dynamic because they automatically update as fresh news or earnings arrive. For example, one investor might believe H & M’s upgraded stores and secondhand expansion will drive strong revenue growth and assign a high fair value, while another might focus on rising costs and global headwinds, landing on a much lower estimate. With Narratives, you can benchmark your expectations and make investment decisions that fit your outlook.

Do you think there's more to the story for H & M Hennes & Mauritz? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if H & M Hennes & Mauritz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HM B

H & M Hennes & Mauritz

Provides clothing, accessories, footwear, cosmetics, home textiles, and homeware for women, men, and children worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives