- Sweden

- /

- Specialty Stores

- /

- OM:HAYPP

Why We're Not Concerned Yet About Haypp Group AB (publ)'s (STO:HAYPP) 27% Share Price Plunge

To the annoyance of some shareholders, Haypp Group AB (publ) (STO:HAYPP) shares are down a considerable 27% in the last month, which continues a horrid run for the company. Looking at the bigger picture, even after this poor month the stock is up 29% in the last year.

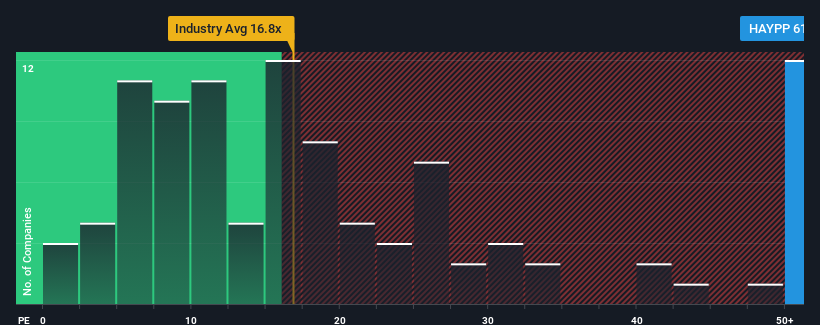

Although its price has dipped substantially, Haypp Group's price-to-earnings (or "P/E") ratio of 61.9x might still make it look like a strong sell right now compared to the market in Sweden, where around half of the companies have P/E ratios below 22x and even P/E's below 15x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Haypp Group certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Haypp Group

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Haypp Group's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered an exceptional 105% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should generate growth of 295% as estimated by the only analyst watching the company. With the market only predicted to deliver 31%, the company is positioned for a stronger earnings result.

With this information, we can see why Haypp Group is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Haypp Group's P/E

Even after such a strong price drop, Haypp Group's P/E still exceeds the rest of the market significantly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Haypp Group maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about this 1 warning sign we've spotted with Haypp Group.

You might be able to find a better investment than Haypp Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Haypp Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:HAYPP

Haypp Group

Operates as an online retailer of tobacco-free nicotine pouches and snus products in Sweden, Norway, the rest of Europe, and the United States.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives