- Sweden

- /

- Specialty Stores

- /

- OM:BOKUS

Bokusgruppen (OM:BOKUS) Earnings Growth Misses Five-Year Pace, Challenging Bullish Narratives

Reviewed by Simply Wall St

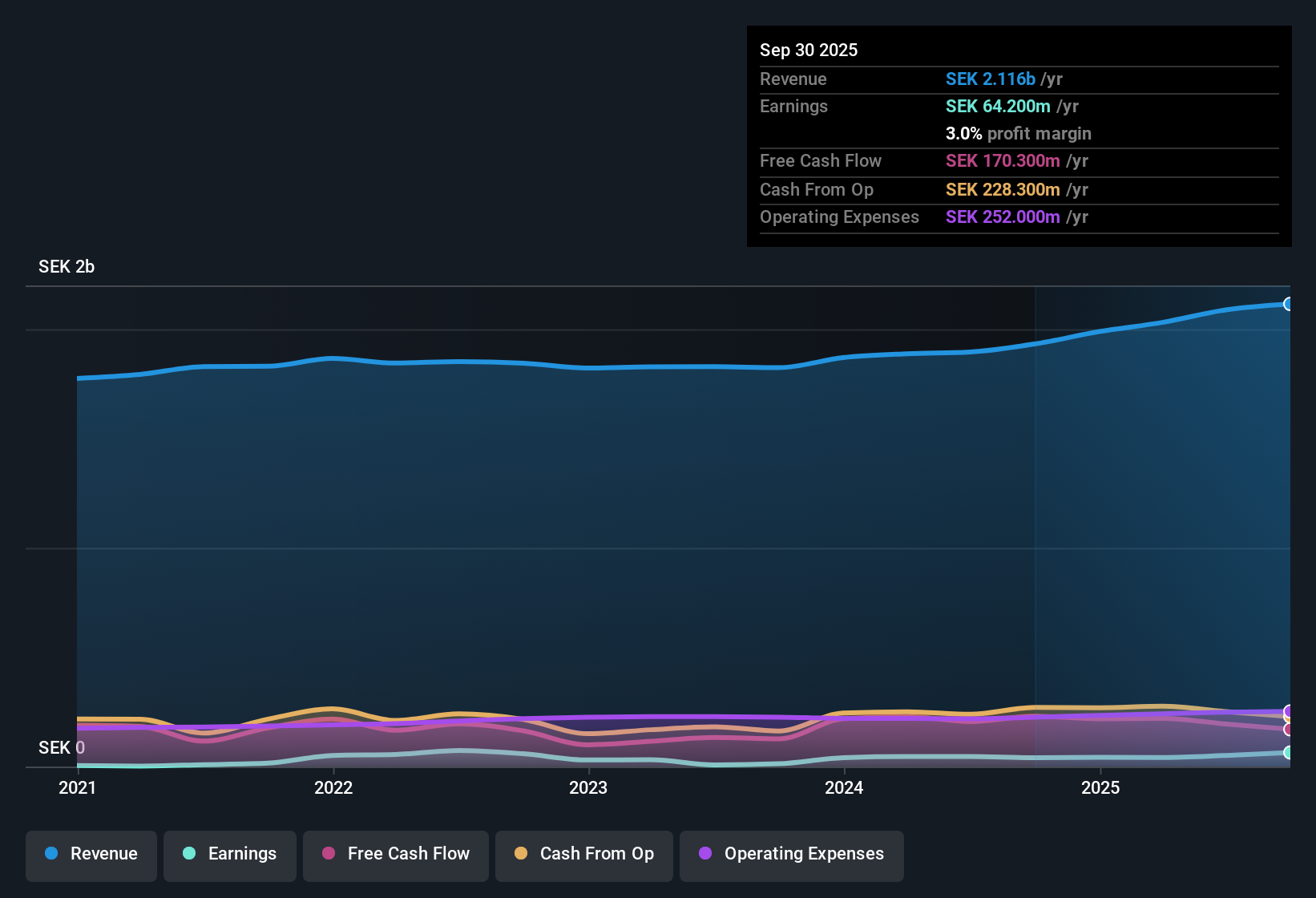

Bokusgruppen (OM:BOKUS) reported earnings growth of 10.9% over the past year, slipping below its five-year annual average of 17.1%. Net profit margins held steady at 2.4%, while revenue is projected to grow by 3% annually, slightly behind the broader Swedish market’s anticipated 3.6% per year. Investors are likely to weigh Bokusgruppen’s solid earnings track record and attractive price-to-earnings ratio of 25.5x, well beneath the peer average, against concerns about dividend sustainability and the company trading at SEK 80.2, below its estimated fair value of SEK 98.63.

See our full analysis for Bokusgruppen.Now, let’s see how these results compare to the widely followed narratives. This next section will measure the numbers against the conversation happening at Simply Wall St; some market views may be confirmed, others might be up for debate.

Curious how numbers become stories that shape markets? Explore Community Narratives

Five-Year Profit Growth Stands Out

- Bokusgruppen’s profit growth rate averaged 17.1% annually over the last five years, far outpacing the most recent growth of 10.9%.

- Bulls point to this stretch of high quality earnings as evidence that management’s strategy is working, even as recent growth moderates.

- The consistent five-year rate of 17.1% strongly supports the bullish case, suggesting that last year’s 10.9% growth is likely part of typical business cycles rather than a structural downturn.

- In addition, the maintenance of a 2.4% net profit margin indicates that the company’s profitability foundations remain intact through different market conditions.

Dividend Sustainability Questioned

- The main risk raised is sustainability of Bokusgruppen’s dividend, as the filing notes concerns about whether profit levels are sufficient to maintain current payouts.

- Bears caution that, while profit margins did not deteriorate, slower projected revenue growth of 3% may limit future dividend increases.

- Critics point out that the company’s sales outlook trails the Swedish market’s forecast of 3.6% annual growth, potentially pressuring management if profit levels soften.

- The most recent net profit margin holding steady at 2.4% offers some reassurance, but this does not fully address the risk of sustaining generous distributions as topline momentum cools.

Trading Below DCF Fair Value

- Shares currently trade at SEK 80.2, well below the DCF fair value estimate of SEK 98.63, which may offer a valuation cushion compared to sector peers.

- The price-to-earnings ratio of 25.5x, much lower than the sector average of 58.7x, suggests the company is attractively valued, even as revenue forecasts are more muted than those of the broader market.

- Despite weaker near-term sales guidance, the stock’s substantial discount to both DCF value and peer multiples indicates that investors may be underestimating future improvements or the durability of its earnings base.

- For value-oriented investors, this gap versus fair value could be a reason for optimism if the company delivers steadier growth than the market projects.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Bokusgruppen's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Bokusgruppen’s slower projected revenue, modest recent profit growth, and concerns about sustaining dividends may limit future shareholder rewards compared to peers.

If you’re looking for reliable income opportunities instead, check out these 1979 dividend stocks with yields > 3% for companies offering strong yields and well-supported dividend histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bokusgruppen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BOKUS

Moderate growth potential with acceptable track record.

Market Insights

Community Narratives