- Sweden

- /

- Specialty Stores

- /

- OM:BILI A

The Market Doesn't Like What It Sees From Bilia AB (publ)'s (STO:BILI A) Earnings Yet

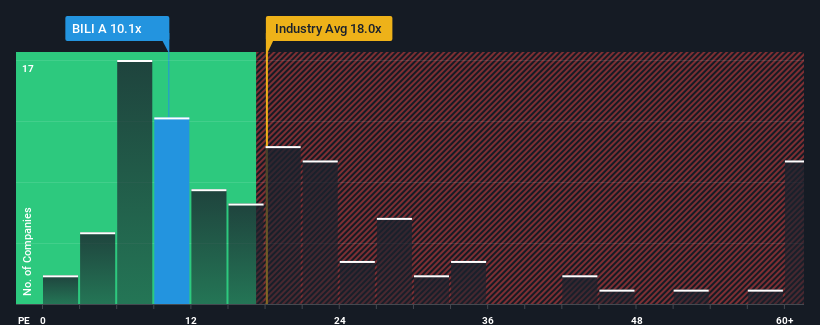

Bilia AB (publ)'s (STO:BILI A) price-to-earnings (or "P/E") ratio of 10.1x might make it look like a strong buy right now compared to the market in Sweden, where around half of the companies have P/E ratios above 22x and even P/E's above 38x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Bilia hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Bilia

Is There Any Growth For Bilia?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Bilia's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 34% decrease to the company's bottom line. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 23% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 7.9% per annum as estimated by the two analysts watching the company. With the market predicted to deliver 17% growth per year, the company is positioned for a weaker earnings result.

In light of this, it's understandable that Bilia's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Bilia's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Bilia's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Bilia (1 is significant) you should be aware of.

You might be able to find a better investment than Bilia. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Bilia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BILI A

Bilia

Operates as a full-service supplier for car ownership in Sweden, Norway, Luxemburg, and Belgium.

Undervalued average dividend payer.

Market Insights

Community Narratives