- United Kingdom

- /

- Capital Markets

- /

- AIM:BPM

3 Top Undervalued European Small Caps With Recent Insider Activity

Reviewed by Simply Wall St

In recent weeks, European markets have shown resilience, with the STOXX Europe 600 Index and major national indices posting gains amid improving business activity and consumer confidence. As the Eurozone experiences its strongest business activity since May 2024, investors are increasingly attentive to small-cap stocks that may offer growth potential in this dynamic environment. Identifying promising stocks often involves looking at those with solid fundamentals and recent insider activity, as these factors can indicate confidence in a company's prospects.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 16.4x | 4.0x | 21.26% | ★★★★★☆ |

| Boozt | 18.0x | 0.8x | 48.72% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 29.01% | ★★★★★☆ |

| Eastnine | 12.4x | 7.9x | 48.20% | ★★★★☆☆ |

| J D Wetherspoon | 10.6x | 0.3x | 2.98% | ★★★★☆☆ |

| Senior | 24.8x | 0.8x | 26.15% | ★★★★☆☆ |

| Pexip Holding | 36.5x | 5.4x | 40.13% | ★★★☆☆☆ |

| Renold | 10.8x | 0.7x | -0.58% | ★★★☆☆☆ |

| Social Housing REIT | NA | 6.9x | 34.93% | ★★★☆☆☆ |

| Fastighets AB Trianon | 14.2x | 4.6x | -221.76% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

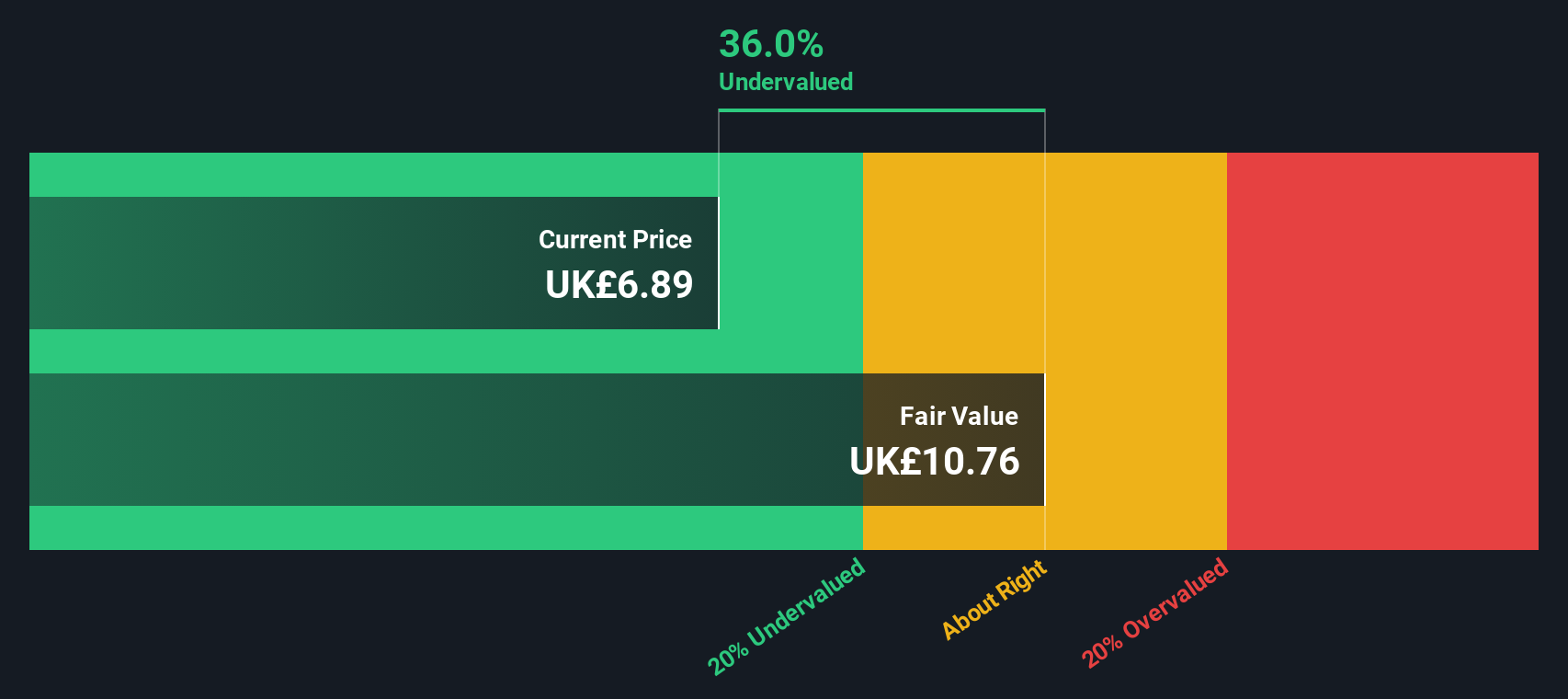

B.P. Marsh & Partners (AIM:BPM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: B.P. Marsh & Partners is a specialist private equity investor focusing on providing consultancy services and trading investments within the financial services sector, with a market cap of £0.15 billion.

Operations: B.P. Marsh & Partners generates revenue primarily from consultancy services and trading investments in financial services, with recent figures showing a revenue of £118.87 million. The company has seen its net income margin increase to 87.85% as of the latest period, reflecting efficient cost management and strong profitability relative to its revenue streams.

PE: 2.3x

B.P. Marsh & Partners, a European investment firm, recently reported strong financial performance for the half year ending July 31, 2025, with revenue climbing to £36.14 million from £32.51 million the previous year and net income increasing to £31.55 million from £26.62 million. Insider confidence is evident as insiders have been purchasing shares within this period, reflecting belief in its growth potential despite reliance on external borrowing for funding. The company completed a follow-on equity offering of approximately £23.57 million in August 2025 at a price of £6.5 per share, indicating strategic capital raising efforts amidst its small-cap nature and potential undervaluation in the market.

- Get an in-depth perspective on B.P. Marsh & Partners' performance by reading our valuation report here.

Evaluate B.P. Marsh & Partners' historical performance by accessing our past performance report.

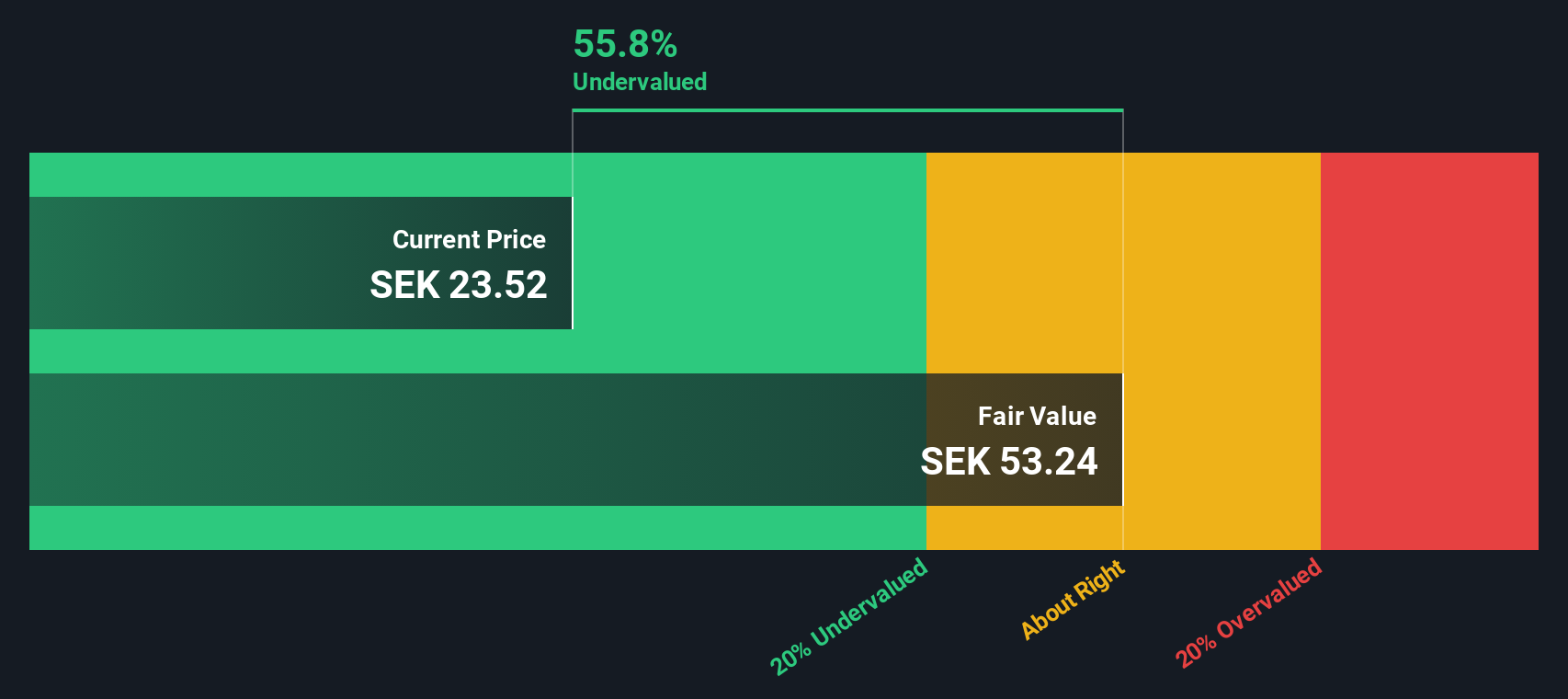

BHG Group (OM:BHG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: BHG Group operates as a leading European online retailer specializing in home improvement and living products, with a market capitalization of SEK 3.14 billion.

Operations: The company's revenue is primarily driven by its Home Improvement and Value Home segments, contributing significantly to the overall sales. Over recent periods, the gross profit margin has seen fluctuations, reaching as high as 19.15% in June 2021 before declining to 16.64% by September 2025. Operating expenses have consistently been a significant portion of costs, with general and administrative expenses forming a substantial part of these outlays.

PE: -15.6x

BHG Group, a European small-cap stock, recently reported a turnaround with third-quarter sales hitting SEK 2.6 billion and net income at SEK 11.2 million, up from last year's loss. Insider confidence is evident as they increased their shareholdings earlier this year. Despite relying on higher-risk external borrowing for funding, BHG's earnings are expected to grow significantly at 81% annually. This positions the company with potential for future growth amidst its financial restructuring efforts.

- Click here and access our complete valuation analysis report to understand the dynamics of BHG Group.

Understand BHG Group's track record by examining our Past report.

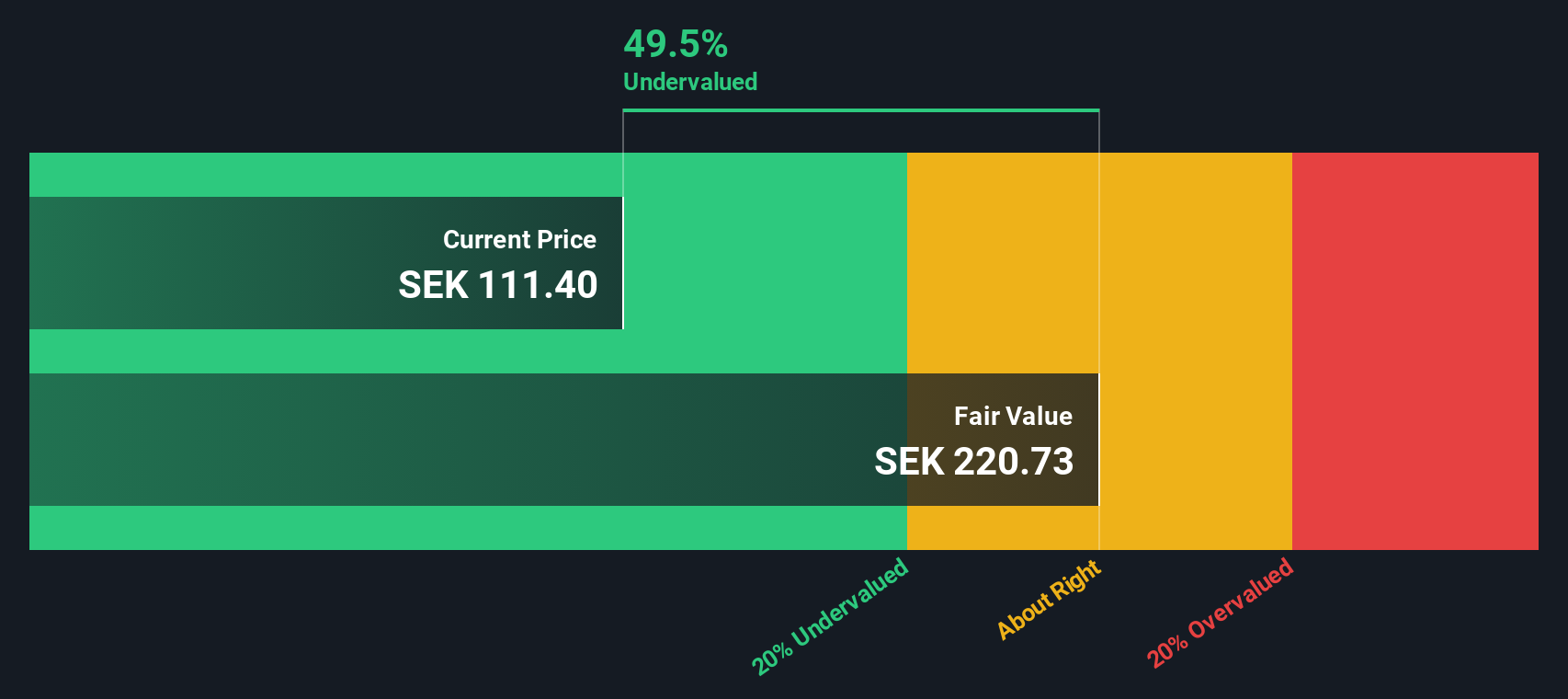

Knowit (OM:KNOW)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Knowit is a consultancy firm specializing in IT, design, and digital transformation services, with a market cap of SEK 4.47 billion.

Operations: The company's primary revenue streams are derived from Solutions, Experience, Insight, and Connectivity segments. Over recent periods, the gross profit margin has shown variability, with a notable figure of 18.44% in March 2017 and a decrease to 13.71% by June 2025. Operating expenses have consistently impacted profitability across these periods.

PE: 34.3x

Knowit, a player in digital transformation and management consulting, is gaining traction with strategic alliances like the Kammarkollegiet framework agreement, enhancing its role in Sweden's public sector modernization. Despite a dip in sales to SEK 4.3 billion for the first nine months of 2025 from SEK 4.8 billion last year, net income rose to SEK 58.4 million from SEK 67.1 million due to improved profit margins and earnings per share growth. The company’s recent collaboration with Coop Norge SA on a core banking system underscores its expertise in IT solutions, promising potential future growth despite current reliance on external borrowing for funding.

- Dive into the specifics of Knowit here with our thorough valuation report.

Gain insights into Knowit's historical performance by reviewing our past performance report.

Where To Now?

- Embark on your investment journey to our 57 Undervalued European Small Caps With Insider Buying selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if B.P. Marsh & Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BPM

B.P. Marsh & Partners

Invests in early-stage and SME financial services intermediary businesses in the United Kingdom and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives