- Sweden

- /

- Specialty Stores

- /

- OM:BBROOM

Investors Still Waiting For A Pull Back In New Bubbleroom Sweden AB (publ) (STO:BBROOM)

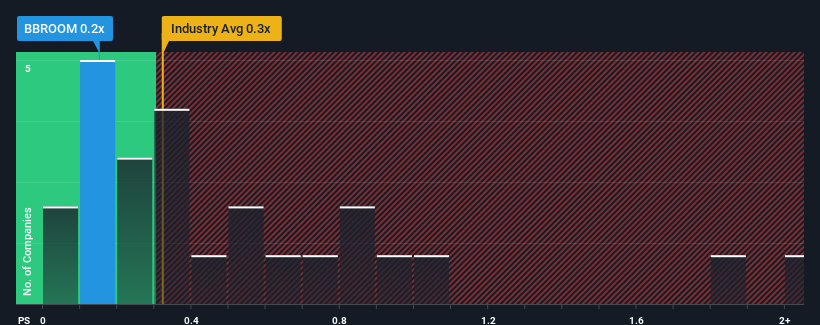

With a median price-to-sales (or "P/S") ratio of close to 0.3x in the Specialty Retail industry in Sweden, you could be forgiven for feeling indifferent about New Bubbleroom Sweden AB (publ)'s (STO:BBROOM) P/S ratio of 0.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for New Bubbleroom Sweden

How Has New Bubbleroom Sweden Performed Recently?

For example, consider that New Bubbleroom Sweden's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on New Bubbleroom Sweden will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For New Bubbleroom Sweden?

The only time you'd be comfortable seeing a P/S like New Bubbleroom Sweden's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.7%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 15% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 4.1% shows it's about the same on an annualised basis.

With this information, we can see why New Bubbleroom Sweden is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Bottom Line On New Bubbleroom Sweden's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we've seen, New Bubbleroom Sweden's three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

Having said that, be aware New Bubbleroom Sweden is showing 2 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on New Bubbleroom Sweden, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if New Bubbleroom Sweden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BBROOM

New Bubbleroom Sweden

Engages in the online retail of fashion products for women in the Nordic region and rest of Europe.

Excellent balance sheet with low risk.

Market Insights

Community Narratives