- Sweden

- /

- Real Estate

- /

- OM:TRIAN B

Here's Why Fastighets AB Trianon (STO:TRIAN B) Has A Meaningful Debt Burden

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Fastighets AB Trianon (publ) (STO:TRIAN B) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Fastighets AB Trianon

What Is Fastighets AB Trianon's Debt?

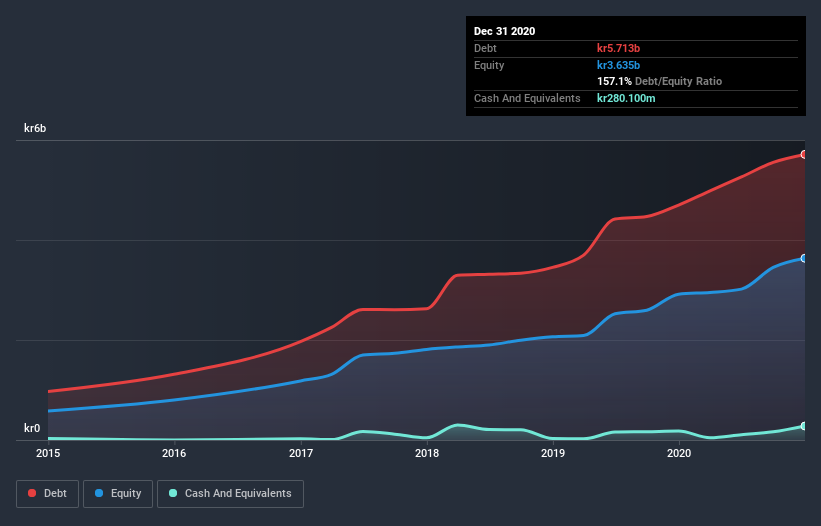

The image below, which you can click on for greater detail, shows that at December 2020 Fastighets AB Trianon had debt of kr5.71b, up from kr4.70b in one year. On the flip side, it has kr280.1m in cash leading to net debt of about kr5.43b.

How Healthy Is Fastighets AB Trianon's Balance Sheet?

The latest balance sheet data shows that Fastighets AB Trianon had liabilities of kr1.66b due within a year, and liabilities of kr5.01b falling due after that. Offsetting this, it had kr280.1m in cash and kr76.2m in receivables that were due within 12 months. So its liabilities total kr6.31b more than the combination of its cash and short-term receivables.

When you consider that this deficiency exceeds the company's kr4.95b market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

With a net debt to EBITDA ratio of 13.4, it's fair to say Fastighets AB Trianon does have a significant amount of debt. However, its interest coverage of 3.4 is reasonably strong, which is a good sign. The good news is that Fastighets AB Trianon grew its EBIT a smooth 61% over the last twelve months. Like a mother's loving embrace of a newborn that sort of growth builds resilience, putting the company in a stronger position to manage its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Fastighets AB Trianon's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Fastighets AB Trianon produced sturdy free cash flow equating to 57% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Neither Fastighets AB Trianon's ability handle its debt, based on its EBITDA, nor its level of total liabilities gave us confidence in its ability to take on more debt. But the good news is it seems to be able to grow its EBIT with ease. Taking the abovementioned factors together we do think Fastighets AB Trianon's debt poses some risks to the business. While that debt can boost returns, we think the company has enough leverage now. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 6 warning signs for Fastighets AB Trianon you should be aware of, and 2 of them are significant.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading Fastighets AB Trianon or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:TRIAN B

Fastighets AB Trianon

A real estate company, owns, builds, develops, and manages residential and commercial properties in Sweden.

Good value with very low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success