David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Stendörren Fastigheter AB (publ) (STO:STEF B) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Stendörren Fastigheter

What Is Stendörren Fastigheter's Net Debt?

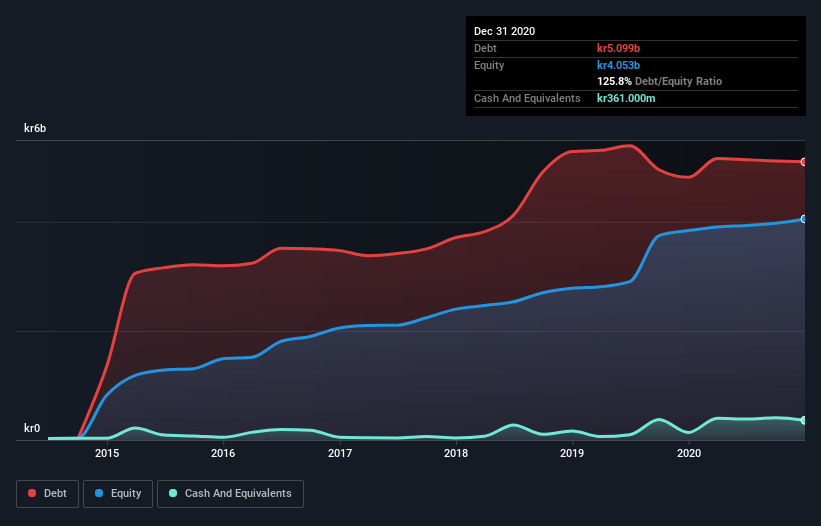

As you can see below, at the end of December 2020, Stendörren Fastigheter had kr5.10b of debt, up from kr4.82b a year ago. Click the image for more detail. However, because it has a cash reserve of kr361.0m, its net debt is less, at about kr4.74b.

A Look At Stendörren Fastigheter's Liabilities

According to the last reported balance sheet, Stendörren Fastigheter had liabilities of kr1.25b due within 12 months, and liabilities of kr4.94b due beyond 12 months. Offsetting these obligations, it had cash of kr361.0m as well as receivables valued at kr95.0m due within 12 months. So it has liabilities totalling kr5.72b more than its cash and near-term receivables, combined.

Given this deficit is actually higher than the company's market capitalization of kr5.39b, we think shareholders really should watch Stendörren Fastigheter's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Stendörren Fastigheter has a rather high debt to EBITDA ratio of 12.2 which suggests a meaningful debt load. But the good news is that it boasts fairly comforting interest cover of 2.9 times, suggesting it can responsibly service its obligations. On the other hand, Stendörren Fastigheter grew its EBIT by 28% in the last year. If it can maintain that kind of improvement, its debt load will begin to melt away like glaciers in a warming world. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Stendörren Fastigheter can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the most recent three years, Stendörren Fastigheter recorded free cash flow worth 57% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Stendörren Fastigheter's net debt to EBITDA was a real negative on this analysis, although the other factors we considered cast it in a significantly better light. For example its EBIT growth rate was refreshing. When we consider all the factors discussed, it seems to us that Stendörren Fastigheter is taking some risks with its use of debt. While that debt can boost returns, we think the company has enough leverage now. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 4 warning signs we've spotted with Stendörren Fastigheter (including 1 which is potentially serious) .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade Stendörren Fastigheter, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:STEF B

Stendörren Fastigheter

A real estate company, engages in managing, developing, and acquiring properties and building rights in logistics, warehouse, and light industry primarily located in Greater Stockholm, Västerås, and Mälardalen.

Reasonable growth potential with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.