- Sweden

- /

- Real Estate

- /

- OM:ALM

These 4 Measures Indicate That ALM Equity (STO:ALM) Is Using Debt Extensively

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, ALM Equity AB (publ) (STO:ALM) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for ALM Equity

What Is ALM Equity's Net Debt?

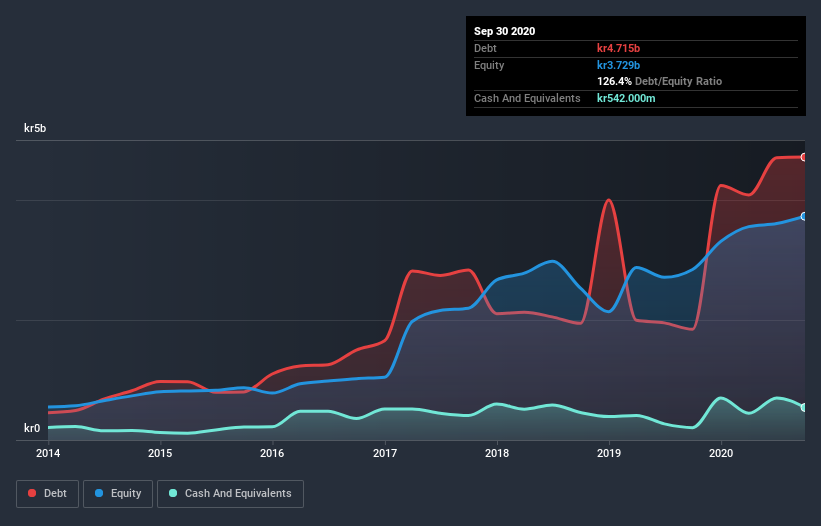

The image below, which you can click on for greater detail, shows that at September 2020 ALM Equity had debt of kr4.71b, up from kr1.85b in one year. However, it does have kr542.0m in cash offsetting this, leading to net debt of about kr4.17b.

A Look At ALM Equity's Liabilities

The latest balance sheet data shows that ALM Equity had liabilities of kr2.83b due within a year, and liabilities of kr2.65b falling due after that. Offsetting these obligations, it had cash of kr542.0m as well as receivables valued at kr527.0m due within 12 months. So it has liabilities totalling kr4.41b more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of kr7.15b, so it does suggest shareholders should keep an eye on ALM Equity's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Weak interest cover of 2.5 times and a disturbingly high net debt to EBITDA ratio of 12.1 hit our confidence in ALM Equity like a one-two punch to the gut. The debt burden here is substantial. One redeeming factor for ALM Equity is that it turned last year's EBIT loss into a gain of kr336m, over the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But it is ALM Equity's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. In the last year, ALM Equity created free cash flow amounting to 19% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

We'd go so far as to say ALM Equity's net debt to EBITDA was disappointing. Having said that, its ability to grow its EBIT isn't such a worry. Looking at the bigger picture, it seems clear to us that ALM Equity's use of debt is creating risks for the company. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with ALM Equity (at least 1 which is concerning) , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade ALM Equity, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:ALM

ALM Equity

Through its subsidiaries, acquires and develops housing property assets in Sweden.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives