- Sweden

- /

- Real Estate

- /

- OM:WIHL

Wihlborgs Fastigheter (OM:WIHL): Reassessing Valuation After Strong Q3 Earnings and Notable Sales Growth

Reviewed by Simply Wall St

Wihlborgs Fastigheter (OM:WIHL) just posted its third-quarter earnings, showing sharp jumps in both sales and net income compared to a year earlier. Investors are watching closely because this performance stands out for the period.

See our latest analysis for Wihlborgs Fastigheter.

The upbeat earnings news comes after a year of significant ups and downs for Wihlborgs Fastigheter. While the 1-year total shareholder return stands at -14.6%, recent momentum has shown some signs of promise, with a 2.1% gain in the past month after a noticeable dip earlier in the year. Over longer periods, though, the company’s three- and five-year total shareholder returns remain solidly positive. This suggests resilience amid market swings and shifting sentiment around property stocks.

If you’re tracking companies with improving financial momentum, this could be a good moment to expand your search and discover fast growing stocks with high insider ownership

With shares still down for the year but analyst price targets sitting nearly 17% above recent levels, investors may wonder whether the current surge signals an undervalued opportunity or if the market is already factoring in Wihlborgs Fastigheter’s future growth.

Most Popular Narrative: 15.4% Undervalued

Wihlborgs Fastigheter is currently priced at SEK93.35, notably below the most popular narrative’s fair value estimate of SEK110.4. Investor attention is focused on whether recent earnings momentum can justify higher valuations in a sector facing ongoing headwinds.

Record high volume of new leases in 2024 and continued strong leasing activity in 2025 indicates potential for increased rental income, especially as new leases come into effect and contribute to revenue growth. Ongoing project investments with successful outcomes suggest future enhancements in rental value and operating surplus, which can boost earnings and profit margins.

Curious what’s driving the confidence behind this fair value? The narrative pins its estimate on ambitious growth assumptions and future profit margins that could even surprise seasoned investors. Which factors are they focusing on to power this potential jump? Explore the data points quietly shaping the market’s major calls.

Result: Fair Value of SEK110.4 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, higher vacancy rates in key markets or a spike in borrowing costs could challenge the optimistic outlook and weaken recent valuation assumptions.

Find out about the key risks to this Wihlborgs Fastigheter narrative.

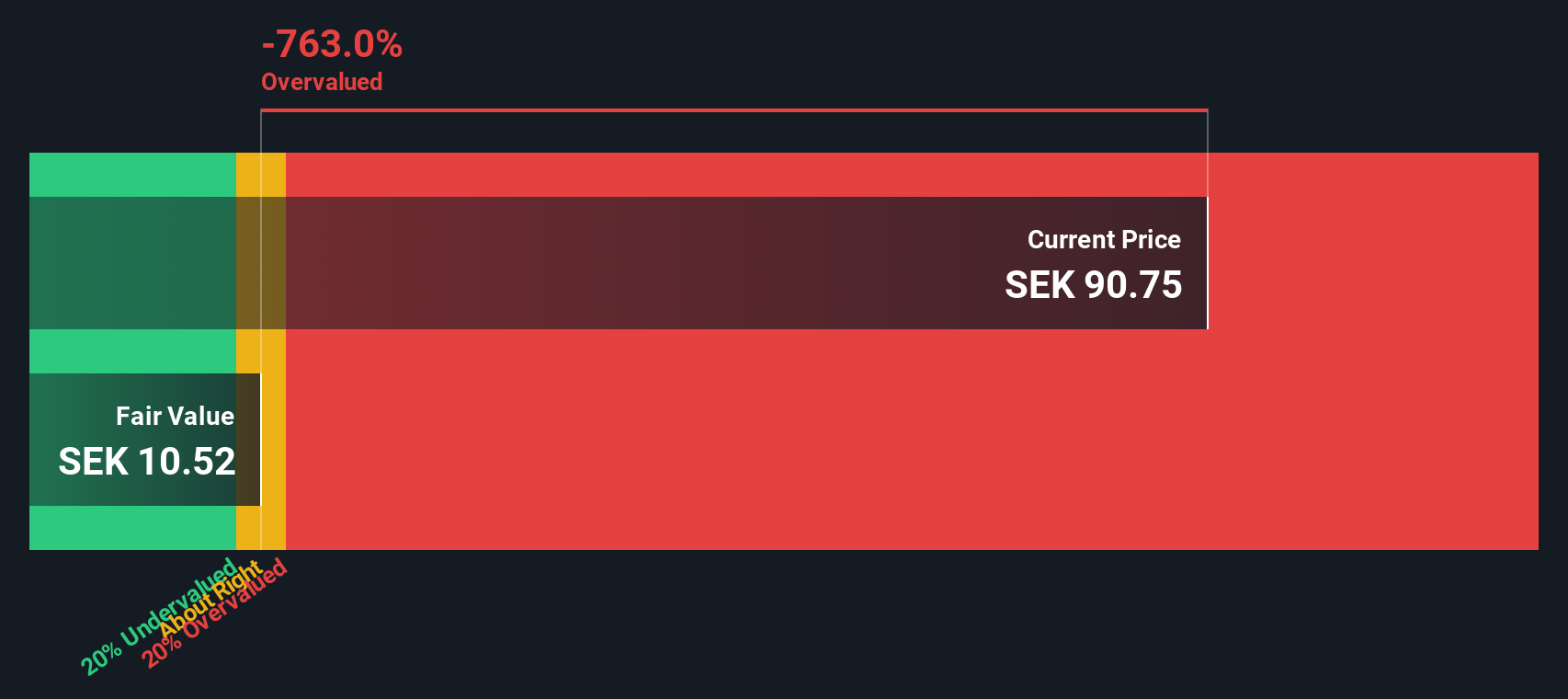

Another View: Discounted Cash Flow Model

While the most popular fair value estimate points to Wihlborgs Fastigheter being undervalued, our SWS DCF model challenges that conclusion. According to this approach, the shares trade well above the model's fair value estimate, which raises questions about just how much optimism is already priced in. Which perspective is closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Wihlborgs Fastigheter for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 853 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Wihlborgs Fastigheter Narrative

Want to take a different approach or prefer digging into the numbers yourself? You can craft your own story in just a few minutes. Do it your way

A great starting point for your Wihlborgs Fastigheter research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors seize fresh opportunities before the crowd. Don’t limit your search. There are stand-out stocks you could be missing right now by sticking to just one sector. Use these handpicked ideas to move ahead with confidence:

- Accelerate your portfolio with market leaders in artificial intelligence by tapping into these 26 AI penny stocks transforming industries with innovative tech.

- Unlock hidden value in high-yield businesses by scanning these 21 dividend stocks with yields > 3% that consistently outperform with steady returns and attractive payouts.

- Keep pace with rapid changes in digital finance and blockchain by uncovering competitive names through these 81 cryptocurrency and blockchain stocks pushing boundaries in this evolving space.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wihlborgs Fastigheter might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:WIHL

Wihlborgs Fastigheter

A property company, owns, develops, rents, and manages commercial properties in the Öresund region, Sweden.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives