- Sweden

- /

- Real Estate

- /

- OM:WIHL

Wihlborgs Fastigheter (OM:WIHL): Evaluating Valuation Following New Five-Year Lease With Capio Hjärnhälsan in Helsingborg

Reviewed by Simply Wall St

Capio Hjärnhälsan has opened a new psychiatric clinic at Drottninggatan 7 in Helsingborg, securing a five-year lease with Wihlborgs Fastigheter (OM:WIHL). This agreement improves Wihlborgs’ tenant mix and adds rental stability in a demanding market.

See our latest analysis for Wihlborgs Fastigheter.

Wihlborgs Fastigheter’s share price has softened in 2024, with a year-to-date return of -10.65%. However, longer-term total shareholder returns have shown resilience, rising nearly 20% over five years. The new lease with Capio Hjärnhälsan helps reinforce the company’s profile as a stable, long-term landlord, which may support renewed investor confidence as momentum in the stock consolidates after an uncertain period.

If you’re searching for what’s next in the market, it’s a great moment to expand your scope and discover fast growing stocks with high insider ownership

With the stock trading below analyst price targets and recent business developments adding to its appeal, the question is whether Wihlborgs is currently undervalued or if the market has already accounted for this growth in its share price.

Most Popular Narrative: 14.2% Undervalued

At SEK 94, Wihlborgs Fastigheter's latest close remains below the narrative's fair value estimate of SEK 109.60. This gap is energizing debate over whether recent business wins represent a turning point for the share price.

The acquisition of property from Granitor is expected to contribute positively to financial results in future quarters, potentially impacting both revenue and asset valuations. Improved occupancy rates anticipated by the end of 2025, with the largest effect from new leases expected in 2026, could lead to higher revenue and better net margins as a result of economies of scale.

Want to know why the narrative sets such a confident target? Upside potential is pinned on ambitious revenue forecasts and healthy margins. Curious about which future profit metric really tips the scale? The answer lies in the bold assumptions framing this valuation. Numbers that might surprise even seasoned investors. Dive into the full breakdown to unpack the key figures that make this fair value stand out.

Result: Fair Value of $109.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer growth projections and increased competition in key regions could test whether Wihlborgs' recent progress is enough to sustain momentum in the period ahead.

Find out about the key risks to this Wihlborgs Fastigheter narrative.

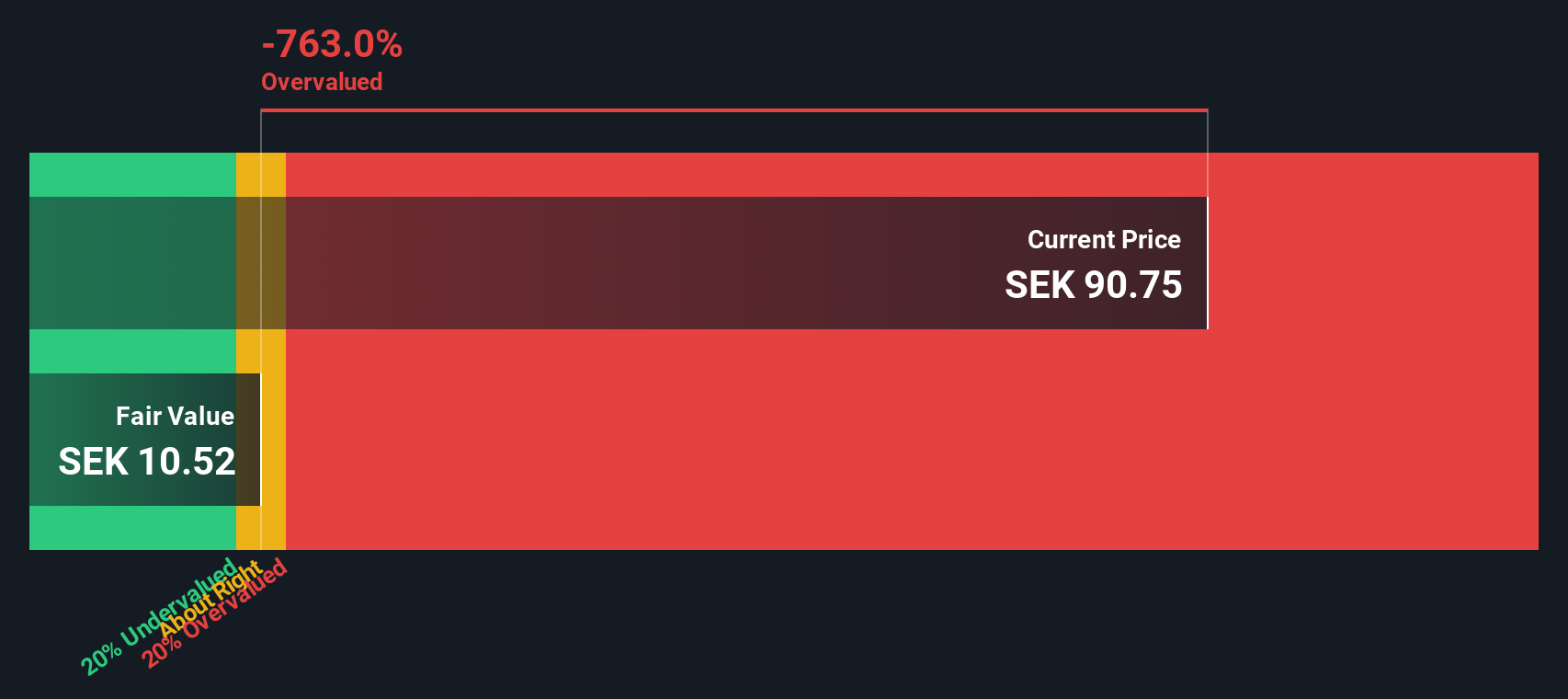

Another View: The SWS DCF Model’s Perspective

Looking through the lens of the SWS DCF model gives a different take on Wihlborgs Fastigheter’s value. This approach calculates future cash flows and discounts them back to today, which can often reveal a more conservative or cautious estimate than relying on market multiples. Does this method strengthen or challenge the optimism of fair value narratives?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Wihlborgs Fastigheter for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Wihlborgs Fastigheter Narrative

If you see the valuation differently, or enjoy forming your own conclusions, dive into the numbers and shape a narrative in just a few minutes. Do it your way

A great starting point for your Wihlborgs Fastigheter research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Opportunities?

Get ahead of the curve by ensuring these investment trends do not pass you by. The Simply Wall Street Screener makes it fast and easy to spot your next big move.

- Spot overlooked value by comparing fundamentals with these 874 undervalued stocks based on cash flows, offering potential hidden gems that others miss.

- Seize emerging tech’s upside when you review these 24 AI penny stocks, which are poised to benefit from rapid advances in artificial intelligence and automation.

- Capture stable yields for your portfolio through these 16 dividend stocks with yields > 3%, featuring companies known for solid dividend payouts above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wihlborgs Fastigheter might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:WIHL

Wihlborgs Fastigheter

A property company, owns, develops, rents, and manages commercial properties in the Öresund region, Sweden.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives