- Sweden

- /

- Real Estate

- /

- OM:WIHL

We Think The Compensation For Wihlborgs Fastigheter AB (publ)'s (STO:WIHL) CEO Looks About Right

Key Insights

- Wihlborgs Fastigheter to hold its Annual General Meeting on 29th of April

- CEO Ulrika Hallengren's total compensation includes salary of kr5.12m

- The overall pay is 48% below the industry average

- Wihlborgs Fastigheter's EPS declined by 20% over the past three years while total shareholder return over the past three years was 31%

Performance at Wihlborgs Fastigheter AB (publ) (STO:WIHL) has been rather uninspiring recently and shareholders may be wondering how CEO Ulrika Hallengren plans to fix this. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 29th of April. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

See our latest analysis for Wihlborgs Fastigheter

Comparing Wihlborgs Fastigheter AB (publ)'s CEO Compensation With The Industry

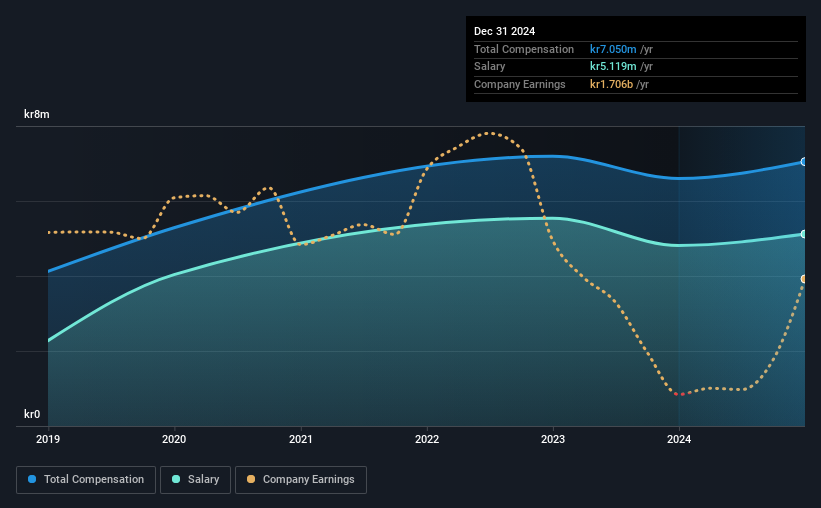

At the time of writing, our data shows that Wihlborgs Fastigheter AB (publ) has a market capitalization of kr31b, and reported total annual CEO compensation of kr7.1m for the year to December 2024. That's a modest increase of 6.8% on the prior year. Notably, the salary which is kr5.12m, represents most of the total compensation being paid.

For comparison, other companies in the Swedish Real Estate industry with market capitalizations ranging between kr19b and kr61b had a median total CEO compensation of kr14m. Accordingly, Wihlborgs Fastigheter pays its CEO under the industry median. What's more, Ulrika Hallengren holds kr25m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | kr5.1m | kr4.8m | 73% |

| Other | kr1.9m | kr1.8m | 27% |

| Total Compensation | kr7.1m | kr6.6m | 100% |

On an industry level, roughly 70% of total compensation represents salary and 30% is other remuneration. Wihlborgs Fastigheter is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Wihlborgs Fastigheter AB (publ)'s Growth Numbers

Over the last three years, Wihlborgs Fastigheter AB (publ) has shrunk its earnings per share by 20% per year. It achieved revenue growth of 6.8% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the modest revenue growth over 12 months isn't much comfort against the reduced EPS. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Wihlborgs Fastigheter AB (publ) Been A Good Investment?

Wihlborgs Fastigheter AB (publ) has generated a total shareholder return of 31% over three years, so most shareholders would be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

Despite the positive returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. Shareholders might want to question the board about these concerns, and revisit their investment thesis for the company.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 2 warning signs for Wihlborgs Fastigheter (of which 1 makes us a bit uncomfortable!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Wihlborgs Fastigheter might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:WIHL

Wihlborgs Fastigheter

A property company, owns, develops, rents, and manages commercial properties in the Öresund region, Sweden.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives