- Sweden

- /

- Real Estate

- /

- OM:WIHL

Did Capio Hjärnhälsan’s New Lease Just Strengthen Wihlborgs Fastigheter’s (OM:WIHL) Healthcare Property Strategy?

Reviewed by Sasha Jovanovic

- Capio Hjärnhälsan recently announced the opening of a new 1,100 square metre psychiatric clinic, occupying an entire floor at Drottninggatan 7 in central Helsingborg, under a five-year lease agreement with Wihlborgs Fastigheter.

- This move strengthens Wihlborgs Fastigheter’s healthcare property portfolio and underlines sustained tenant demand for modern clinical space in a central location.

- We’ll examine how the new healthcare lease with Capio Hjärnhälsan supports Wihlborgs Fastigheter’s focus on core asset expansion and income stability.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Wihlborgs Fastigheter Investment Narrative Recap

To take a positive view on Wihlborgs Fastigheter, investors need to see value in the company’s growing regional property portfolio and ongoing leasing activity, especially amid a shifting Nordic real estate market. The new Capio Hjärnhälsan psychiatric clinic lease reinforces short-term catalysts like strong leasing growth, but does not immediately offset concerns about elevated vacancy rates in office and industrial properties or the implications of the company’s high leverage if financing costs rise.

One of the latest and most relevant announcements was the new 5-year lease at Drottninggatan 7 in Helsingborg with Capio Hjärnhälsan, which echoes recent successes in attracting stable tenants such as NP Innovation’s relocation and Malmö University’s new building plans. These agreements support revenue continuity, but the persistence of higher vacancy levels remains a critical factor for near-term momentum.

By contrast, investors should be alert to the risk that even robust lease signings cannot fully insulate results if...

Read the full narrative on Wihlborgs Fastigheter (it's free!)

Wihlborgs Fastigheter is projected to achieve SEK5.1 billion in revenue and SEK2.2 billion in earnings by 2028. This outlook assumes annual revenue growth of 6.3% and reflects a SEK0.3 billion increase in earnings from the current level of SEK1.9 billion.

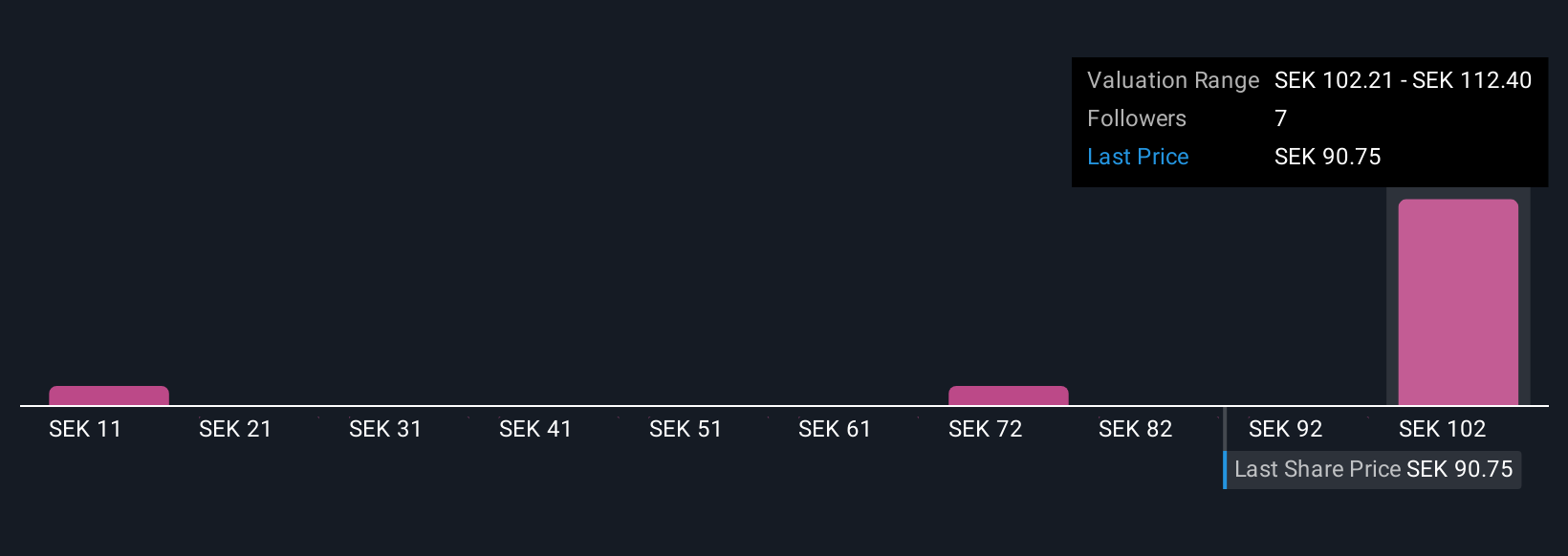

Uncover how Wihlborgs Fastigheter's forecasts yield a SEK109.60 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates on Wihlborgs Fastigheter range from SEK32.84 to SEK109.60 per share, highlighting wide disagreement. Despite recent leasing wins, persistent vacancies could still weigh on earnings, consider alternative viewpoints before forming your own outlook.

Explore 3 other fair value estimates on Wihlborgs Fastigheter - why the stock might be worth as much as 18% more than the current price!

Build Your Own Wihlborgs Fastigheter Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wihlborgs Fastigheter research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Wihlborgs Fastigheter research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wihlborgs Fastigheter's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wihlborgs Fastigheter might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:WIHL

Wihlborgs Fastigheter

A property company, owns, develops, rents, and manages commercial properties in the Öresund region, Sweden.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives