- Sweden

- /

- Real Estate

- /

- OM:WBGR B

Wästbygg Gruppen AB (publ)'s (STO:WBGR B) Share Price Boosted 28% But Its Business Prospects Need A Lift Too

The Wästbygg Gruppen AB (publ) (STO:WBGR B) share price has done very well over the last month, posting an excellent gain of 28%. Looking back a bit further, it's encouraging to see the stock is up 37% in the last year.

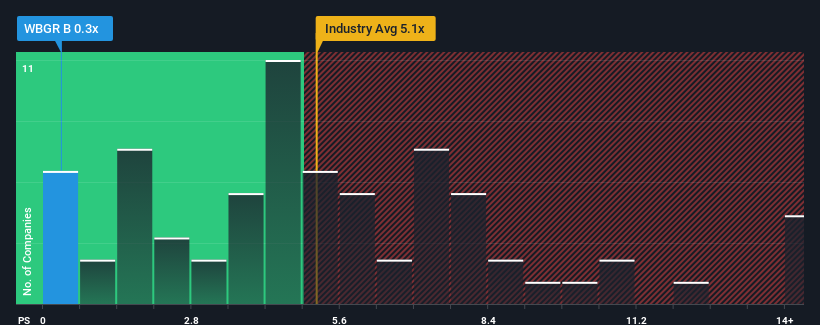

Even after such a large jump in price, Wästbygg Gruppen may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.3x, considering almost half of all companies in the Real Estate industry in Sweden have P/S ratios greater than 5.1x and even P/S higher than 8x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Wästbygg Gruppen

What Does Wästbygg Gruppen's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Wästbygg Gruppen's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Wästbygg Gruppen's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Wästbygg Gruppen?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Wästbygg Gruppen's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. Even so, admirably revenue has lifted 30% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue growth is heading into negative territory, declining 11% over the next year. That's not great when the rest of the industry is expected to grow by 3.2%.

In light of this, it's understandable that Wästbygg Gruppen's P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Shares in Wästbygg Gruppen have risen appreciably however, its P/S is still subdued. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Wästbygg Gruppen's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, Wästbygg Gruppen's poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

You should always think about risks. Case in point, we've spotted 1 warning sign for Wästbygg Gruppen you should be aware of.

If these risks are making you reconsider your opinion on Wästbygg Gruppen, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Wästbygg Gruppen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:WBGR B

Wästbygg Gruppen

Operates as a construction and project development company in Sweden, Norway, Denmark, and Finland.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives