- Sweden

- /

- Real Estate

- /

- OM:WBGR B

Why Investors Shouldn't Be Surprised By Wästbygg Gruppen AB (publ)'s (STO:WBGR B) 27% Share Price Plunge

Wästbygg Gruppen AB (publ) (STO:WBGR B) shares have had a horrible month, losing 27% after a relatively good period beforehand. Still, a bad month hasn't completely ruined the past year with the stock gaining 37%, which is great even in a bull market.

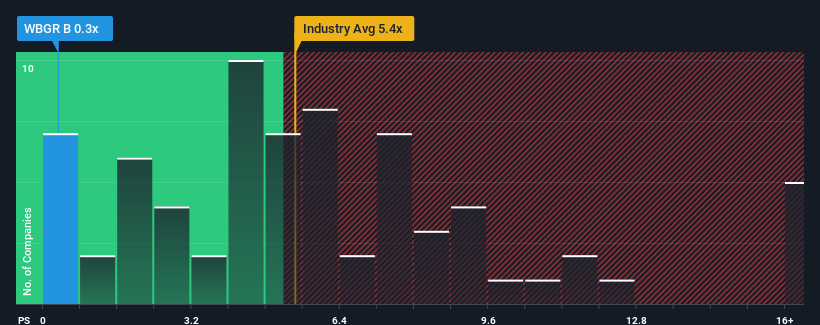

Since its price has dipped substantially, Wästbygg Gruppen's price-to-sales (or "P/S") ratio of 0.3x might make it look like a strong buy right now compared to the wider Real Estate industry in Sweden, where around half of the companies have P/S ratios above 5.4x and even P/S above 9x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Wästbygg Gruppen

How Wästbygg Gruppen Has Been Performing

Wästbygg Gruppen could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Wästbygg Gruppen's future stacks up against the industry? In that case, our free report is a great place to start.How Is Wästbygg Gruppen's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Wästbygg Gruppen's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 23% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue growth is heading into negative territory, declining 1.6% over the next year. That's not great when the rest of the industry is expected to grow by 2.6%.

With this information, we are not surprised that Wästbygg Gruppen is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Wästbygg Gruppen's P/S

Having almost fallen off a cliff, Wästbygg Gruppen's share price has pulled its P/S way down as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's clear to see that Wästbygg Gruppen maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware Wästbygg Gruppen is showing 1 warning sign in our investment analysis, you should know about.

If you're unsure about the strength of Wästbygg Gruppen's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Wästbygg Gruppen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:WBGR B

Wästbygg Gruppen

Operates as a construction and project development company in Sweden, Norway, Denmark, and Finland.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives