- Sweden

- /

- Real Estate

- /

- OM:WBGR B

Revenues Working Against Wästbygg Gruppen AB (publ)'s (STO:WBGR B) Share Price Following 28% Dive

The Wästbygg Gruppen AB (publ) (STO:WBGR B) share price has softened a substantial 28% over the previous 30 days, handing back much of the gains the stock has made lately. The last month has meant the stock is now only up 9.1% during the last year.

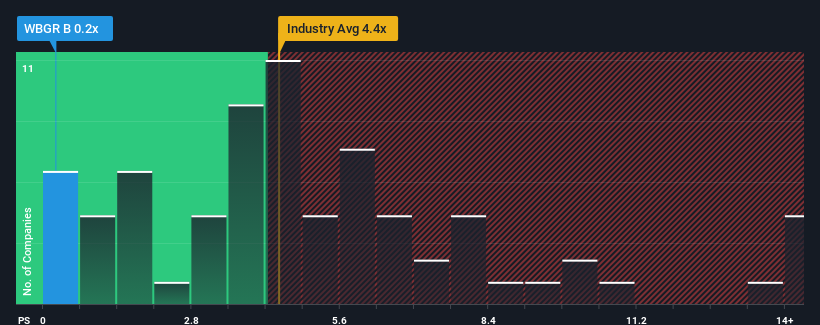

After such a large drop in price, Wästbygg Gruppen may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Real Estate industry in Sweden have P/S ratios greater than 4.4x and even P/S higher than 7x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Wästbygg Gruppen

What Does Wästbygg Gruppen's P/S Mean For Shareholders?

Wästbygg Gruppen could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Wästbygg Gruppen's future stacks up against the industry? In that case, our free report is a great place to start.How Is Wästbygg Gruppen's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Wästbygg Gruppen's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.7%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 38% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 0.2% each year over the next three years. That's shaping up to be materially lower than the 4.5% each year growth forecast for the broader industry.

With this information, we can see why Wästbygg Gruppen is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Having almost fallen off a cliff, Wästbygg Gruppen's share price has pulled its P/S way down as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Wästbygg Gruppen's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Wästbygg Gruppen that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Wästbygg Gruppen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:WBGR B

Wästbygg Gruppen

Operates as a construction and project development company in Sweden, Norway, Denmark, and Finland.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success