- Sweden

- /

- Real Estate

- /

- OM:WALL B

Wallenstam (OM:WALL B) Turns Profitable on One-Off Gain, Challenging Quality of Earnings Narrative

Reviewed by Simply Wall St

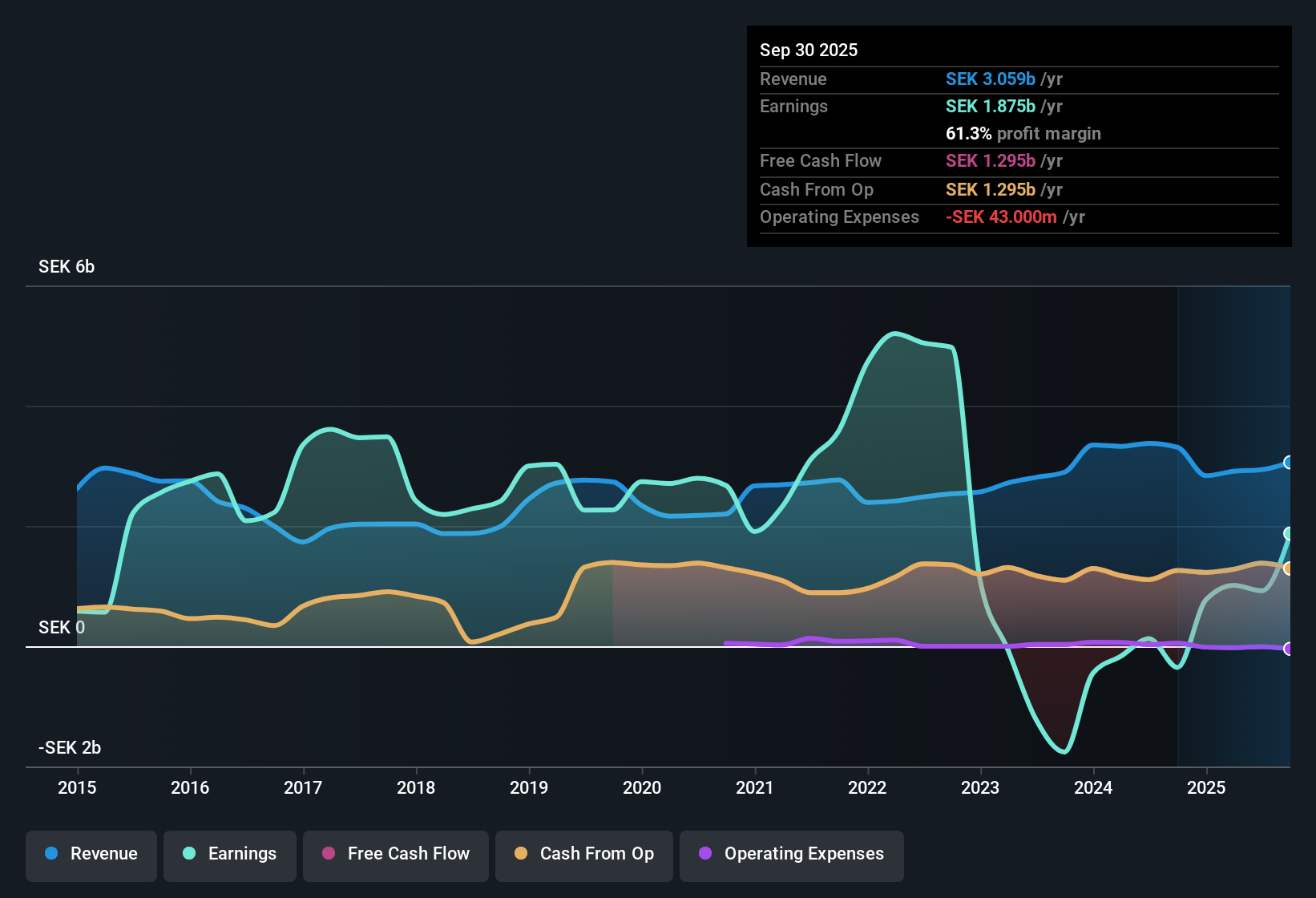

Wallenstam (OM:WALL B) just turned profitable, boosted by a SEK1.1 billion one-off gain, even as average annual earnings have dropped 36.2% per year over the past five years. Looking ahead, analysts forecast revenue growth of 6.1% annually, well above the Swedish market’s 3.3%, but expect earnings to fall at an average rate of 8% per year through 2027. With contrasting signals from recent profitability, one-offs, and diverging revenue and earnings trends, investors face a nuanced backdrop as they weigh Wallenstam's current valuation.

See our full analysis for Wallenstam.Next up, we’ll see how these numbers stack up against the key narratives followed by investors and the Simply Wall St community, spotlighting where the data reinforces expectations and where the consensus might be off the mark.

See what the community is saying about Wallenstam

Margin Expansion on the Horizon: Profit Margins Seen Rising from 31.4% to 49.8%

- Analysts forecast Wallenstam will lift profit margins from 31.4% to 49.8% over the next three years, even as earnings shrink by an average of 8% annually. This suggests that cost controls and efficiency efforts could cushion the bottom line against weaker absolute profit numbers.

- According to the analysts' consensus view, margin expansion is expected to come from targeted efficiency moves.

- Ongoing investments in energy-efficient property upgrades and renewable energy projects are anticipated to lower operating costs. This could support margin improvement even if revenue growth outpaces earnings in the short term.

- Disciplined project execution, with 1,038 apartments under construction or recently completed, positions the company to harness future rental income gains and scale up portfolio efficiency.

- For investors, the prospect of rising margins despite falling headline profits puts the onus on management to execute on cost savings and energy projects. Failure to deliver could leave actual margins well below the optimistic consensus trajectory. If you're weighing how these profit forecasts fit the broader investment story, you can dig deeper in the full consensus narrative for Wallenstam. 📊 Read the full Wallenstam Consensus Narrative.

Debt Load at SEK 33 Billion Raises Interest Rate Sensitivity

- Wallenstam's high interest-bearing liabilities now stand at SEK 33 billion with a loan-to-value (LTV) ratio of 48%. A reduced proportion of interest rate hedging and exposure to partially floating rates leaves the company vulnerable to higher future refinancing costs.

- According to the analysts' consensus view, this substantial debt exposure remains a key area of concern.

- Bears argue that rising administrative expenses, including IT investments, personnel, and security, are already outpacing rental income growth. Any further uptick in refinancing costs could squeeze earnings and cash flow.

- The concentrated focus on the Swedish property market, specifically Stockholm and Gothenburg, makes the company especially sensitive to local economic headwinds and potential legislative changes. This compounds interest rate risk for current investors.

Shares Priced Well Above DCF Fair Value Despite Lower-Than-Peers PE

- Wallenstam’s stock trades at SEK 45.64, more than quadruple the estimated DCF fair value of SEK 9.49, yet is at a 15.7x price-to-earnings ratio. This represents a discount to both the Swedish real estate sector average (16.4x) and peer group (39.9x), setting up a stark valuation divergence.

- As analysts' consensus narrative notes, the current share price is just 0.8% below the consensus target of SEK 46.0, suggesting limited expected upside even as margin improvement and revenue momentum are priced in.

- For this optimism to be justified, analysts' numbers indicate that Wallenstam would need to grow earnings to SEK1.8 billion and achieve a 19.9x price-to-earnings ratio by 2028. This would be well above the sector norm and would require flawless execution on multiple fronts.

- This tension between trading discounts to peers and a rich premium over DCF fair value puts added pressure on Wallenstam to deliver on its profit and margin promises in order to support current valuations.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Wallenstam on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Wondering if there’s another angle on the results? It only takes a few minutes to put together your own perspective and share your view. Do it your way

A great starting point for your Wallenstam research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Wallenstam’s heavy debt load and rising refinancing risks could amplify earnings pressure if costs or macro conditions turn unfavorable.

Want exposure to companies with lower debt risk and greater financial stability? Start your search with solid balance sheet and fundamentals stocks screener (1980 results) to find businesses built on stronger balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wallenstam might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:WALL B

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives