Stock Analysis

- Sweden

- /

- Real Estate

- /

- OM:PNDX B

Swedish Growth Companies With High Insider Ownership To Watch In July 2024

Reviewed by Simply Wall St

As global markets navigate through a period of cautious optimism and political uncertainties in Europe, Sweden's economic landscape presents an intriguing scenario for investors. In this context, focusing on Swedish growth companies with high insider ownership could offer valuable insights into firms that potentially have a strong alignment between management’s and shareholders' interests, especially during these fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 21.6% |

| BioArctic (OM:BIOA B) | 34% | 50.9% |

| Biovica International (OM:BIOVIC B) | 18.5% | 73.8% |

| Sileon (OM:SILEON) | 33.3% | 109.3% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

| InCoax Networks (OM:INCOAX) | 18.1% | 104.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| Yubico (OM:YUBICO) | 37.5% | 43.8% |

| SaveLend Group (OM:YIELD) | 23.3% | 103.4% |

Let's explore several standout options from the results in the screener.

Betsson (OM:BETS B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Betsson AB (publ) operates an online gaming business across the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, and Central Asia, with a market capitalization of approximately SEK 17.94 billion.

Operations: The company generates its revenue primarily from its Casinos & Resorts segment, which reported earnings of €974.50 million.

Insider Ownership: 10.9%

Betsson, a Swedish company with high insider ownership, is trading at 69.5% below its estimated fair value and shows promising financial forecasts. Earnings are expected to grow by 14% annually, slightly above the Swedish market's average of 13.8%. However, its revenue growth forecast of 9.9% per year, although faster than the market average of 1.7%, does not meet the high-growth threshold of over 20%. Recent strategic expansions include entering Peru's newly regulated online casino and sports betting markets, enhancing its South American footprint alongside existing licenses in Colombia and Argentina. This geographical diversification could bolster future revenue streams despite an unstable dividend track record.

- Unlock comprehensive insights into our analysis of Betsson stock in this growth report.

- Our comprehensive valuation report raises the possibility that Betsson is priced lower than what may be justified by its financials.

Pandox (OM:PNDX B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pandox AB (publ) is a global hotel property company that owns, develops, and leases hotel properties, with a market capitalization of approximately SEK 35.89 billion.

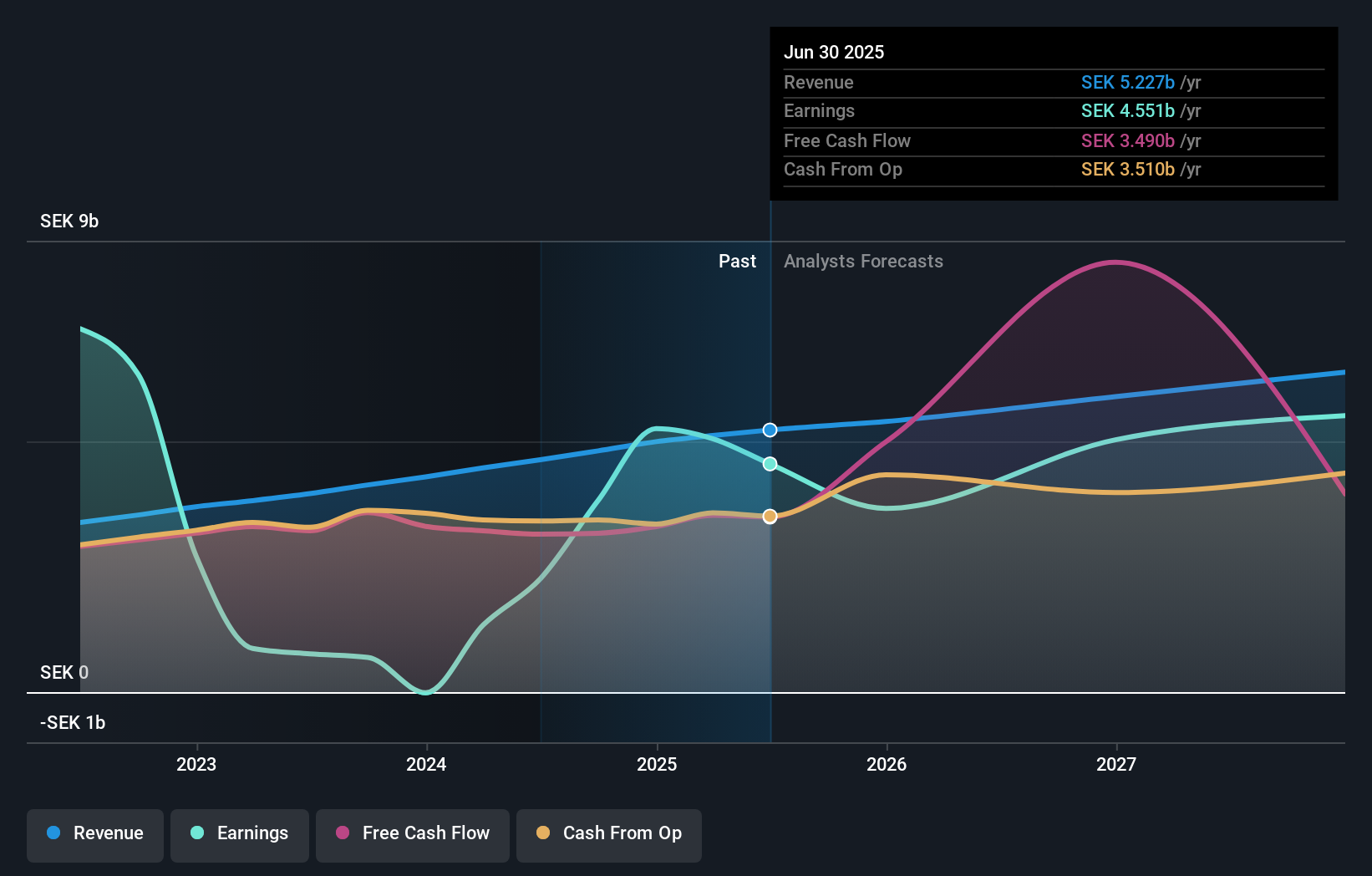

Operations: The company generates revenue primarily through two segments: Own operation, which brought in SEK 3.24 billion, and Rental Agreement, contributing SEK 3.76 billion.

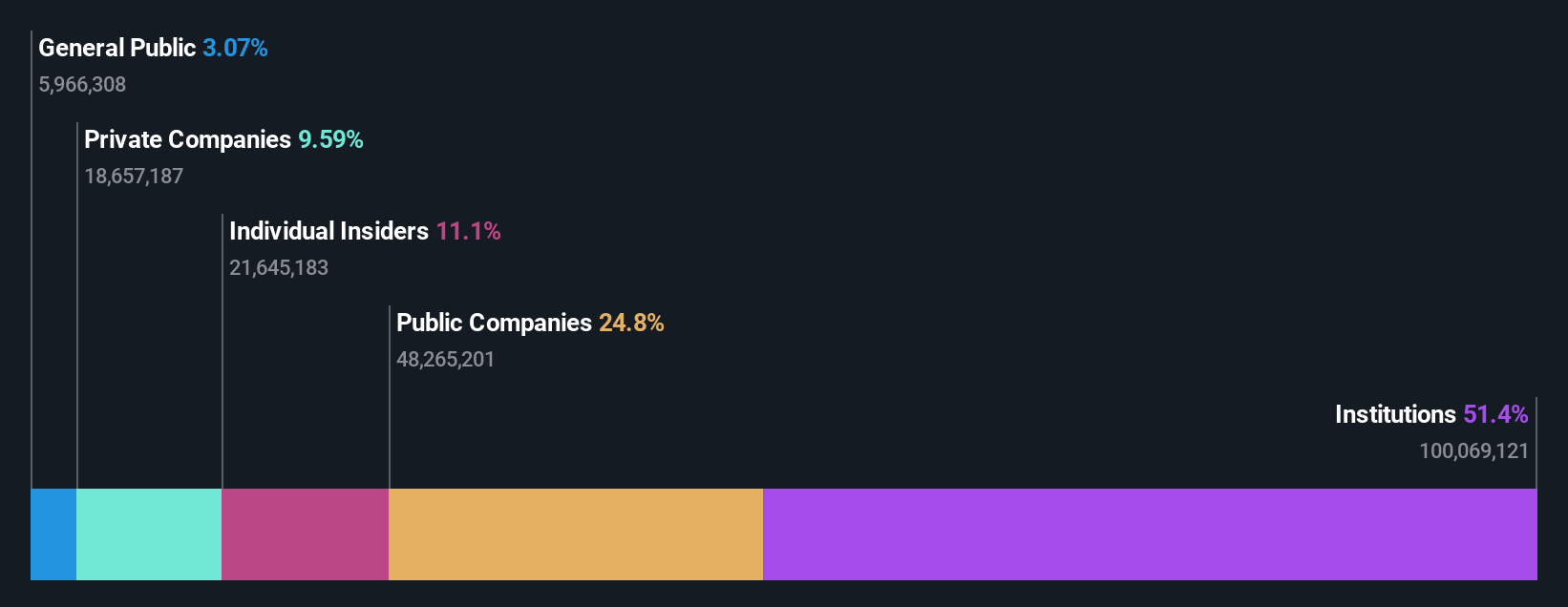

Insider Ownership: 12.3%

Pandox, a Swedish growth company with high insider ownership, faces challenges despite some positive trends. Its net profit margin declined significantly to 1.1% from last year's 49.2%, and its dividend coverage by earnings is weak. However, Pandox's revenue and earnings are forecasted to grow at 2.2% and 41.6% per year respectively, outpacing the Swedish market averages of 1.7% and 13.8%. Recent financial results show substantial improvement with a net income of SEK 447 million compared to a loss in the previous year.

- Delve into the full analysis future growth report here for a deeper understanding of Pandox.

- Our valuation report here indicates Pandox may be overvalued.

AB Sagax (OM:SAGA A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AB Sagax (publ) is a property company with operations across Sweden, Finland, France, Benelux, Spain, Germany, and other European countries, boasting a market capitalization of approximately SEK 100.83 billion.

Operations: The company generates its revenue primarily from real estate rentals, amounting to SEK 4.47 billion.

Insider Ownership: 28.3%

AB Sagax, a Swedish growth company with high insider ownership, has demonstrated robust financial activities recently. The company's earnings have surged by 53.3% over the past year and are projected to grow at 33.5% annually over the next three years, surpassing Sweden's market average of 14.2%. Despite this, revenue growth is moderate at 9.3% annually but still exceeds the national market pace of 1.8%. Recent capital-raising efforts include a €500 million unsecured green bond issue aimed at supporting sustainable corporate initiatives.

- Take a closer look at AB Sagax's potential here in our earnings growth report.

- The valuation report we've compiled suggests that AB Sagax's current price could be inflated.

Turning Ideas Into Actions

- Unlock more gems! Our Fast Growing Swedish Companies With High Insider Ownership screener has unearthed 83 more companies for you to explore.Click here to unveil our expertly curated list of 86 Fast Growing Swedish Companies With High Insider Ownership.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Pandox is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:PNDX B

Pandox

A hotel property company, owns, develops, and leases hotel properties worldwide.

Reasonable growth potential low.