Stock Analysis

Swedish Growth Companies With High Insider Ownership Spotlight May 2024

Reviewed by Simply Wall St

As global markets exhibit mixed signals with tech sectors showing strength while others falter, Sweden's market presents a unique landscape for investors focusing on growth companies with high insider ownership. These firms often benefit from aligned interests between shareholders and management, which can be particularly appealing in uncertain economic times.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 21.6% |

| BioArctic (OM:BIOA B) | 35.1% | 50.5% |

| Spago Nanomedical (OM:SPAGO) | 16.1% | 52.1% |

| Sileon (OM:SILEON) | 33.3% | 109.3% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 50.3% |

| Dignitana (OM:DIGN) | 30.2% | 139% |

| edyoutec (NGM:EDYOU) | 14.0% | 63.1% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Yubico (OM:YUBICO) | 37.5% | 42.5% |

| SaveLend Group (OM:YIELD) | 24.9% | 106.8% |

Let's take a closer look at a couple of our picks from the screened companies.

Calliditas Therapeutics (OM:CALTX)

Simply Wall St Growth Rating: ★★★★★★

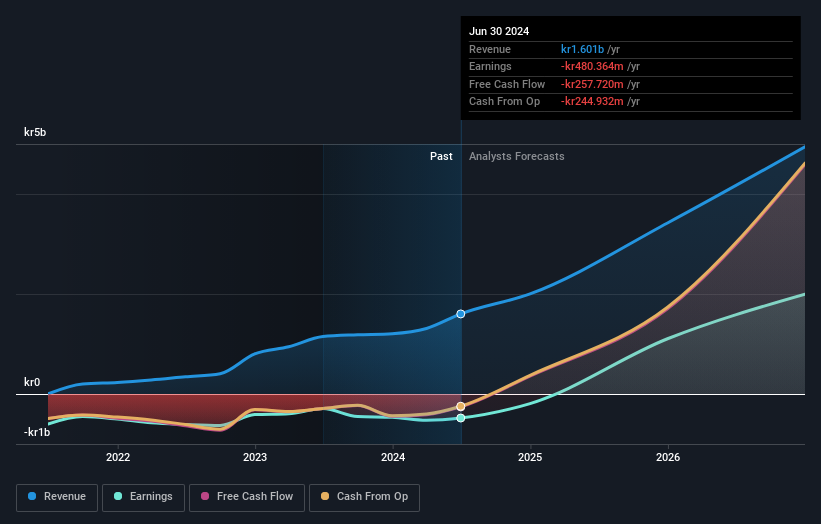

Overview: Calliditas Therapeutics is a commercial-stage biopharmaceutical company that develops and markets novel treatments for orphan renal and hepatic diseases, with operations in the United States, Europe, and Asia, boasting a market cap of SEK 11.16 billion.

Operations: The company generates its revenue primarily from the pharmaceuticals segment, totaling SEK 1.21 billion.

Insider Ownership: 11.6%

Return On Equity Forecast: 86% (2026 estimate)

Calliditas Therapeutics, a Swedish biopharma company, is expected to grow revenues by 29% annually, outpacing the domestic market's 2.1%. The firm's anticipated profitability within three years aligns with its robust forecasted Return on Equity of 86.4%. Recently, Asahi Kasei proposed acquiring Calliditas for SEK 11.2 billion, reflecting confidence in its value and strategy. Despite trading at a significant discount to fair value and high insider ownership stability, the company faces challenges from a highly volatile share price and ongoing losses as evidenced by a recent net loss of SEK 246.16 million in Q1 2024.

- Delve into the full analysis future growth report here for a deeper understanding of Calliditas Therapeutics.

- Our expertly prepared valuation report Calliditas Therapeutics implies its share price may be lower than expected.

Pandox (OM:PNDX B)

Simply Wall St Growth Rating: ★★★★☆☆

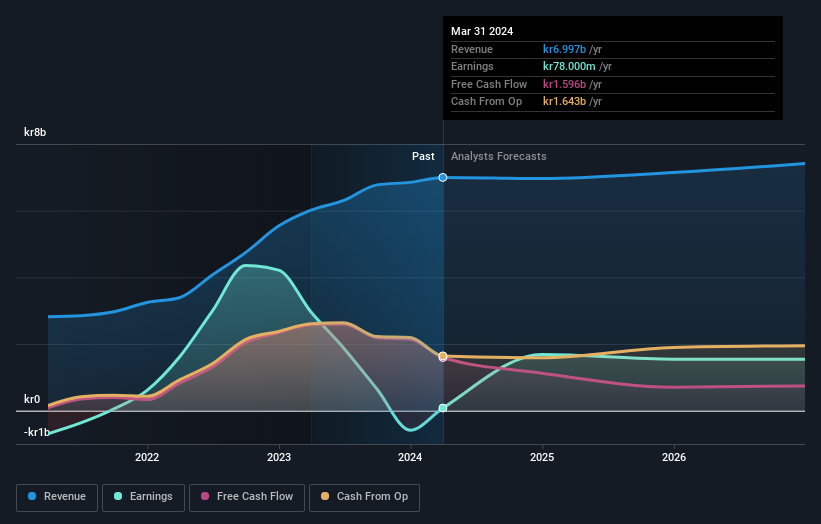

Overview: Pandox AB is a hotel property company that specializes in owning, operating, and leasing hotel properties, with a market capitalization of approximately SEK 33.09 billion.

Operations: The company generates its revenue primarily through two segments: own operations, which brought in SEK 3.24 billion, and rental agreements, contributing SEK 3.76 billion.

Insider Ownership: 12.3%

Return On Equity Forecast: N/A (2027 estimate)

Pandox, a Swedish hotel operator, reported a strong rebound with Q1 2024 earnings turning to SEK 447 million profit from a loss last year, alongside revenue growth to SEK 1.5 billion. Despite this recovery and insider buying activity in the past three months, the company's dividends are poorly covered by earnings and interest payments strain finances. While Pandox's revenue is expected to grow slightly above the market rate at 2.2% annually, its profit margins remain low at 1.1%, reflecting ongoing challenges in achieving high-quality earnings without reliance on one-off items.

- Navigate through the intricacies of Pandox with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Pandox is priced lower than what may be justified by its financials.

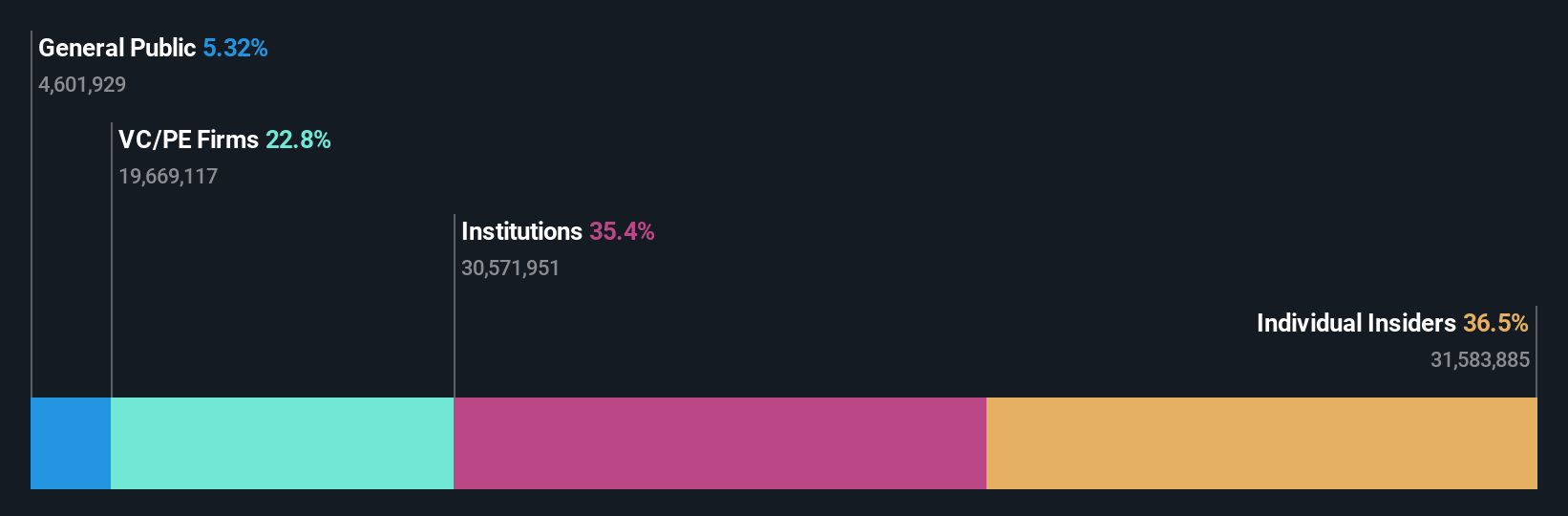

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Yubico AB specializes in providing authentication solutions for computers, networks, and online services, with a market capitalization of SEK 20.75 billion.

Operations: The company generates SEK 1.93 billion from its Security Software & Services segment.

Insider Ownership: 37.5%

Return On Equity Forecast: 27% (2027 estimate)

Yubico AB, a Swedish growth company with significant insider ownership, recently elected Jaya Baloo as a new director and reported robust first-quarter earnings with sales increasing to SEK 504.4 million from SEK 419 million year-over-year. However, despite strong sales growth, the basic earnings per share declined slightly from SEK 1.1 to SEK 0.9. The company also announced technological advancements with its upcoming YubiKey 5.7 firmware release aimed at enhancing enterprise security solutions, signaling ongoing innovation and market responsiveness in cybersecurity solutions.

- Click here to discover the nuances of Yubico with our detailed analytical future growth report.

- Our expertly prepared valuation report Yubico implies its share price may be too high.

Where To Now?

- Access the full spectrum of 87 Fast Growing Swedish Companies With High Insider Ownership by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Calliditas Therapeutics is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CALTX

Calliditas Therapeutics

A commercial-stage bio-pharmaceutical company, focused on identifying, developing, and commercializing novel treatments in orphan indications with an initial focus on renal and hepatic diseases with significant unmet medical needs in the United States, Europe, and Asia.

Exceptional growth potential and good value.