- Sweden

- /

- Real Estate

- /

- OM:PNDX B

European Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

As global trade tensions ease, the European market has shown resilience with the pan-European STOXX Europe 600 Index rising by 3.44%, reflecting optimism despite ongoing economic uncertainties. In this environment, growth companies with strong insider ownership can be particularly appealing as they often indicate confidence from those closest to the business and a potential alignment of interests between insiders and shareholders.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| KebNi (OM:KEBNI B) | 38.3% | 67.3% |

| Vow (OB:VOW) | 13.1% | 76.9% |

| Elicera Therapeutics (OM:ELIC) | 23.8% | 97.2% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Lokotech Group (OB:LOKO) | 13.6% | 58.1% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| OrganoClick (OM:ORGC) | 33.7% | 66.8% |

Here's a peek at a few of the choices from the screener.

Hoist Finance (OM:HOFI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hoist Finance AB (publ) is a credit market company involved in loan acquisition and management operations across Europe, with a market cap of SEK7.58 billion.

Operations: Hoist Finance generates revenue through its operations in Europe with SEK1.06 billion from secured loans and SEK3.02 billion from unsecured loans.

Insider Ownership: 20%

Earnings Growth Forecast: 19.2% p.a.

Hoist Finance exhibits promising insider ownership dynamics, with substantial insider buying over the past three months. The company's earnings are forecast to grow at 19.2% annually, outpacing the Swedish market's growth rate. Despite a high debt level, Hoist's shares trade below estimated fair value and recent buybacks indicate confidence in future prospects. However, revenue growth is slower than desired for a high-growth company and executive turnover may impact stability.

- Click to explore a detailed breakdown of our findings in Hoist Finance's earnings growth report.

- In light of our recent valuation report, it seems possible that Hoist Finance is trading behind its estimated value.

Pandox (OM:PNDX B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pandox AB (publ) is a hotel property company that owns, develops, and leases hotel properties with a market cap of SEK32.23 billion.

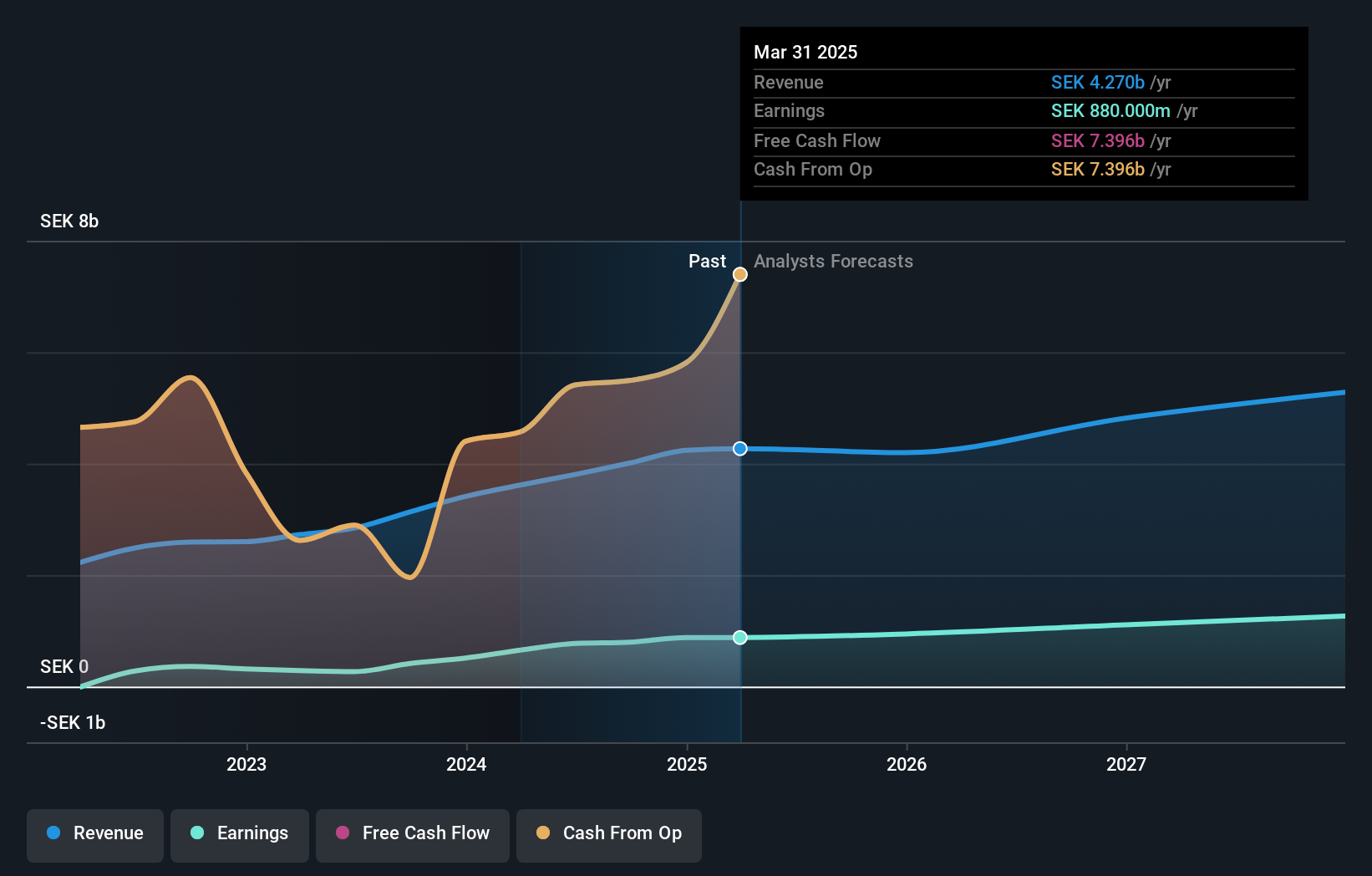

Operations: Pandox generates revenue primarily through its Leases segment, which accounts for SEK3.87 billion, and its Own Operations segment, contributing SEK3.28 billion.

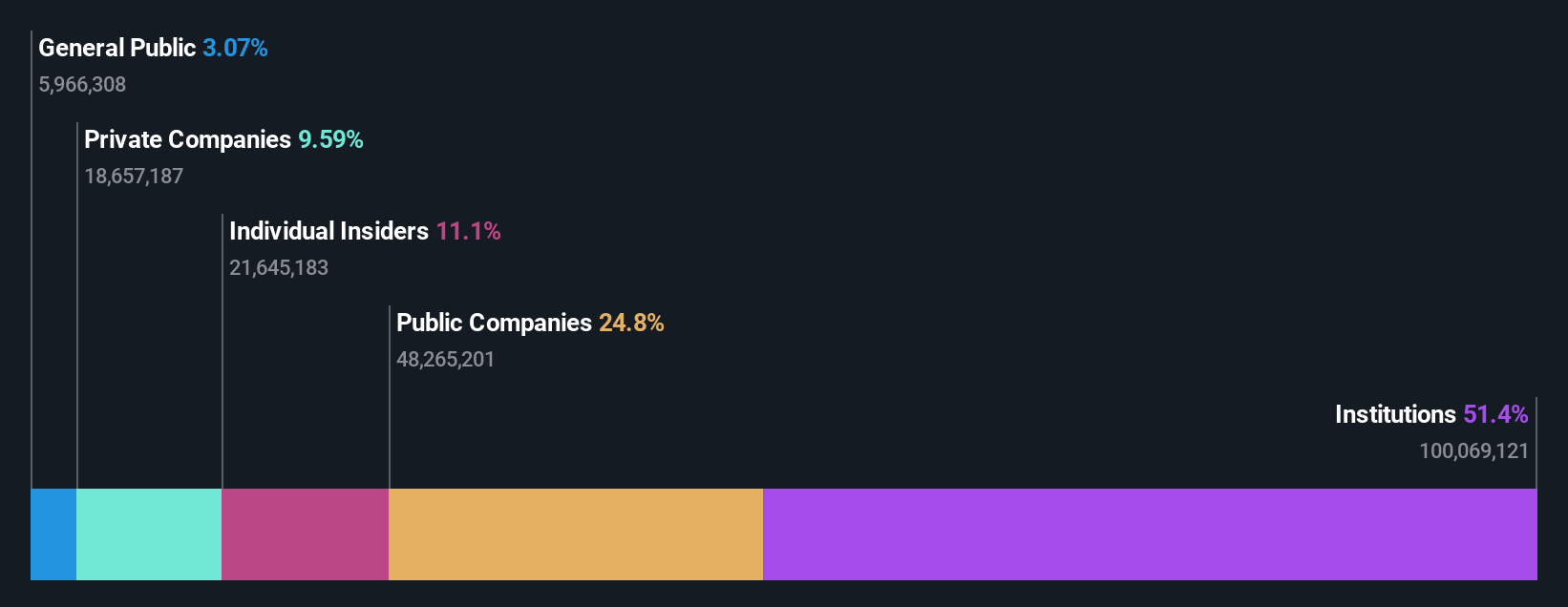

Insider Ownership: 11.1%

Earnings Growth Forecast: 22.3% p.a.

Pandox shows strong insider ownership with substantial insider buying in the last three months and no significant selling. Despite a drop in Q1 net income to SEK 113 million, revenue increased slightly. The company is expanding its portfolio with acquisitions in Sweden and Germany, enhancing growth potential. Earnings are forecast to grow significantly at 22.25% annually, although interest payments remain a concern due to limited coverage by earnings.

- Navigate through the intricacies of Pandox with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Pandox implies its share price may be lower than expected.

Landis+Gyr Group (SWX:LAND)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Landis+Gyr Group AG, along with its subsidiaries, offers integrated energy management solutions to the utility sector across the Americas, Europe, the Middle East, Africa, and the Asia Pacific regions; it has a market cap of CHF1.54 billion.

Operations: The company's revenue segments are divided as follows: $964.60 million from the Americas, $158.10 million from Asia Pacific, and $606.60 million from Europe, the Middle East, and Africa (EMEA).

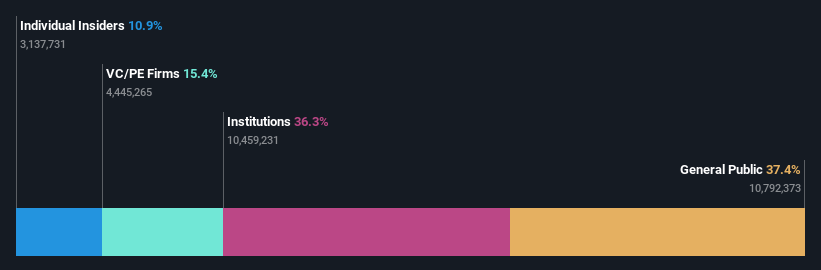

Insider Ownership: 10.8%

Earnings Growth Forecast: 101.9% p.a.

Landis+Gyr Group, despite lacking recent insider trading activity, is expanding its product line with innovative solutions like SPAN Edge and Revelo Cellular to enhance grid management capabilities. However, the company reported a net loss of US$150.46 million for the year ended March 31, 2025. Revenue growth is expected between 5% and 8% this year, outpacing the Swiss market average. While earnings are forecast to grow significantly at over 100% annually, share price volatility remains a concern.

- Delve into the full analysis future growth report here for a deeper understanding of Landis+Gyr Group.

- The analysis detailed in our Landis+Gyr Group valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Take a closer look at our Fast Growing European Companies With High Insider Ownership list of 212 companies by clicking here.

- Contemplating Other Strategies? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:PNDX B

Pandox

A hotel property company, owns, develops, and leases hotel properties.

Average dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives