- Sweden

- /

- Real Estate

- /

- OM:PLAZ B

3 Undervalued Small Caps In Global With Recent Insider Buying

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have shown resilience amid fluctuating economic indicators and shifting interest rate expectations. With recent labor market data influencing sentiment and potential rate cuts on the horizon, investors are increasingly attentive to small-cap opportunities that may be positioned for growth. Identifying a promising stock often involves looking at factors such as solid fundamentals, strategic positioning in their industry, and recent insider activity that could signal confidence in the company's future prospects.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| GDI Integrated Facility Services | 18.7x | 0.3x | 2.26% | ★★★★★☆ |

| Bytes Technology Group | 18.6x | 4.7x | 6.67% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 43.64% | ★★★★☆☆ |

| Sagicor Financial | 7.2x | 0.4x | -75.66% | ★★★★☆☆ |

| Daiwa House Logistics Trust | 13.5x | 7.0x | 10.02% | ★★★★☆☆ |

| CVS Group | 46.2x | 1.3x | 36.64% | ★★★★☆☆ |

| Nexus Industrial REIT | 18.6x | 3.0x | 21.11% | ★★★☆☆☆ |

| Pizu Group Holdings | 11.7x | 1.1x | 43.10% | ★★★☆☆☆ |

| Chinasoft International | 24.3x | 0.8x | -1180.71% | ★★★☆☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 6.8x | 1.8x | 18.57% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

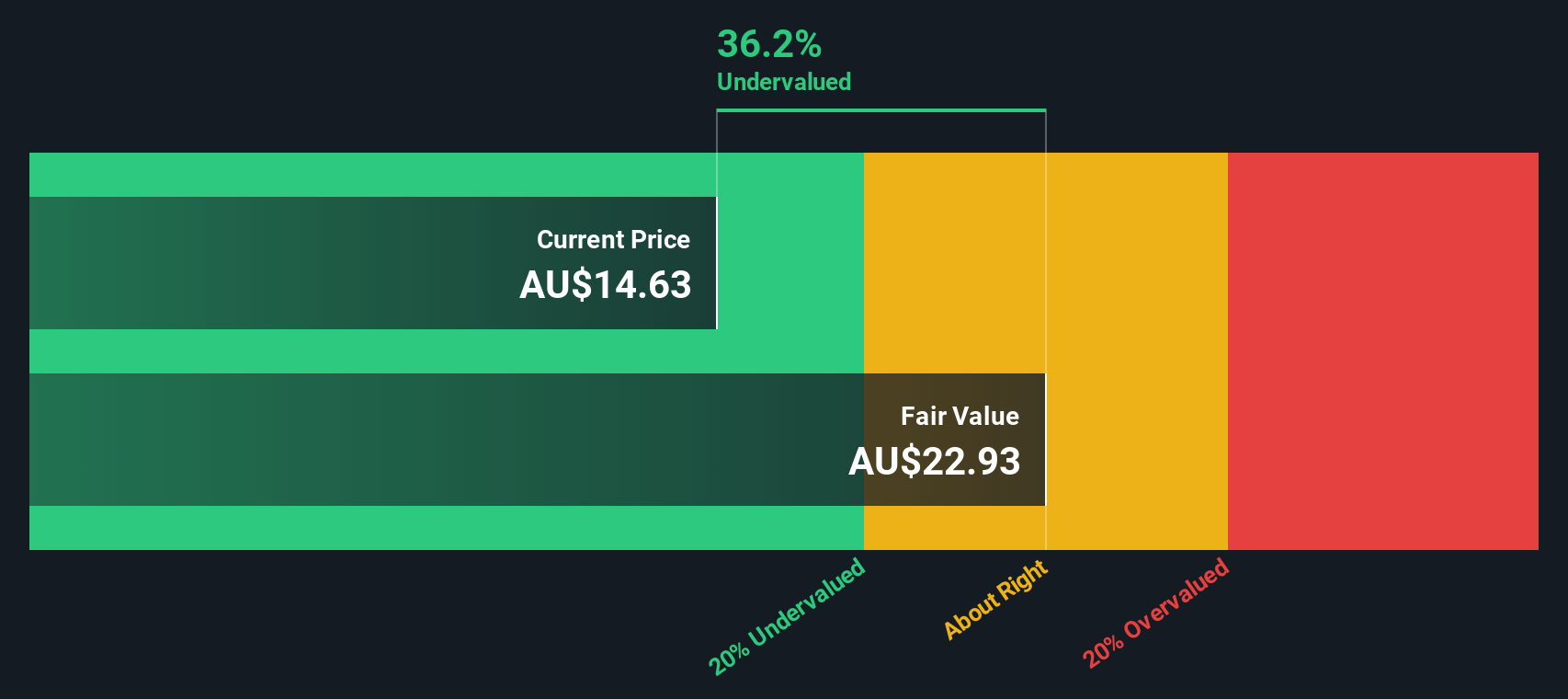

Domino's Pizza Enterprises (ASX:DMP)

Simply Wall St Value Rating: ★★★★★☆

Overview: Domino's Pizza Enterprises operates as a leading pizza delivery and carryout chain with a focus on restaurant operations, boasting a market capitalization of approximately A$5.95 billion.

Operations: The primary revenue stream is from restaurant sales, with a gross profit margin of 32.04% as of September 2025. Cost of goods sold (COGS) significantly impacts profitability, totaling A$1.57 billion in the latest period. Operating expenses are substantial, reaching A$592.22 million, while non-operating expenses stand at A$149.57 million for the same period.

PE: -371.5x

Domino's Pizza Enterprises, a smaller player in the market, faces challenges with a reported net loss of A$3.7 million for the year ending June 2025, contrasting with last year's A$95.96 million profit. Despite this, insider confidence is evident as Jack Cowin acquired 335,000 shares worth approximately A$5.06 million recently. The company navigates leadership changes and strategic shifts under Cowin's interim chairmanship while aiming to enhance operational efficiency and market performance amidst evolving industry dynamics.

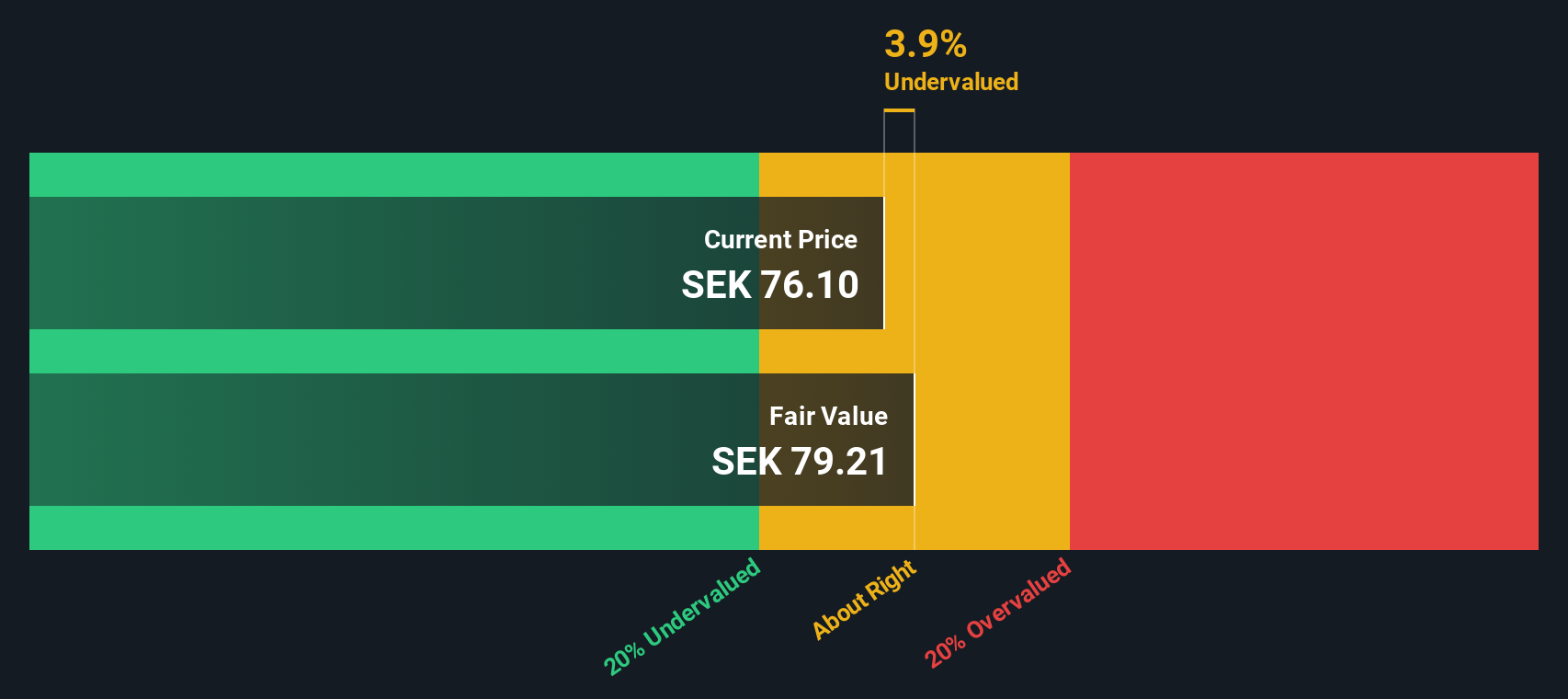

Platzer Fastigheter Holding (OM:PLAZ B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Platzer Fastigheter Holding is a Swedish real estate company specializing in the development and management of office, industrial, and logistics properties, with a market cap of approximately SEK 8.73 billion.

Operations: The company's revenue streams are primarily driven by its Offices and Industrial/Logistics segments, with the Development segment contributing minimally. Over recent periods, the gross profit margin has shown a trend of gradual increase, reaching 79.02% by mid-2025. Operating expenses have remained relatively stable compared to non-operating expenses, which have experienced significant fluctuations impacting net income margins.

PE: 21.2x

Platzer Fastigheter Holding, a player in the real estate sector, recently reported improved financial performance with Q2 sales rising to SEK 431 million and a reduced net loss of SEK 6 million. Insider confidence is evident as Henrik Schoultz increased their stake by 8%, purchasing shares worth approximately SEK 181,250. The company's joint venture sold a logistics property for SEK 385 million, showcasing strategic asset management. Despite higher risk funding through external borrowing, Platzer's earnings are projected to grow annually by over 31%.

- Click here and access our complete valuation analysis report to understand the dynamics of Platzer Fastigheter Holding.

Learn about Platzer Fastigheter Holding's historical performance.

North American Construction Group (TSX:NOA)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: North American Construction Group is a provider of heavy construction and mining services, primarily operating in Canada and Australia, with a market capitalization of CA$1.04 billion.

Operations: The company generates revenue primarily from its Heavy Equipment segments in Canada and Australia, with total revenues reaching CA$1.25 billion as of the latest period. The gross profit margin has seen fluctuations, peaking at 34.16% in 2024-09-30 before slightly decreasing to 29.57% by mid-2025. Operating expenses have been significant, with General & Administrative Expenses being a notable component, reaching CA$51.23 million in the most recent quarter.

PE: 15.8x

North American Construction Group, a smaller player in the construction sector, recently reported mixed financial results. While second-quarter sales rose to C$320.63 million from C$276.31 million last year, net income fell to C$10.25 million from C$14.5 million. Despite these challenges, insider confidence is evident as Martin Ferron acquired 21,264 shares for approximately C$365,418 between May and June 2025. The company repurchased 424,700 shares for C$9.48 million during the same period and maintained its dividend of C$0.12 per share payable in October 2025—signaling stability amidst volatility in oil sands operations and rising costs due to demand fluctuations and larger truck fleets managing near-term expenses but maintaining long-term growth targets with an annual organic revenue increase of 5% to 10%.

Make It Happen

- Gain an insight into the universe of 104 Undervalued Global Small Caps With Insider Buying by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:PLAZ B

Platzer Fastigheter Holding

Operates as a commercial real estate company in Sweden.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives