- Sweden

- /

- Real Estate

- /

- OM:OP

Oscar Properties Holding AB (publ) (STO:OP) Might Not Be As Mispriced As It Looks After Plunging 41%

Oscar Properties Holding AB (publ) (STO:OP) shareholders won't be pleased to see that the share price has had a very rough month, dropping 41% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 64% loss during that time.

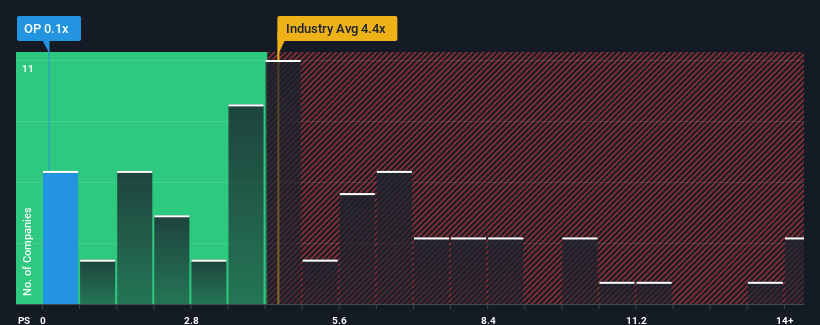

Since its price has dipped substantially, Oscar Properties Holding may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.1x, since almost half of all companies in the Real Estate industry in Sweden have P/S ratios greater than 4.4x and even P/S higher than 7x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Oscar Properties Holding

How Has Oscar Properties Holding Performed Recently?

With revenue growth that's superior to most other companies of late, Oscar Properties Holding has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Oscar Properties Holding.Is There Any Revenue Growth Forecasted For Oscar Properties Holding?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Oscar Properties Holding's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 32% gain to the company's top line. Pleasingly, revenue has also lifted 236% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 6.6% over the next year. With the industry only predicted to deliver 4.4%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Oscar Properties Holding's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Oscar Properties Holding's P/S looks about as weak as its stock price lately. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Oscar Properties Holding's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Oscar Properties Holding (at least 2 which can't be ignored), and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:OP

Oscar Properties Holding

Oscar Properties Holding AB (publ) purchases, develops, manages, and sells real estate properties in Stockholm.

Moderate and slightly overvalued.

Similar Companies

Market Insights

Community Narratives