- Sweden

- /

- Real Estate

- /

- OM:NYF

Will Nyfosa's (OM:NYF) Return to Profitability on Lower Revenues Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

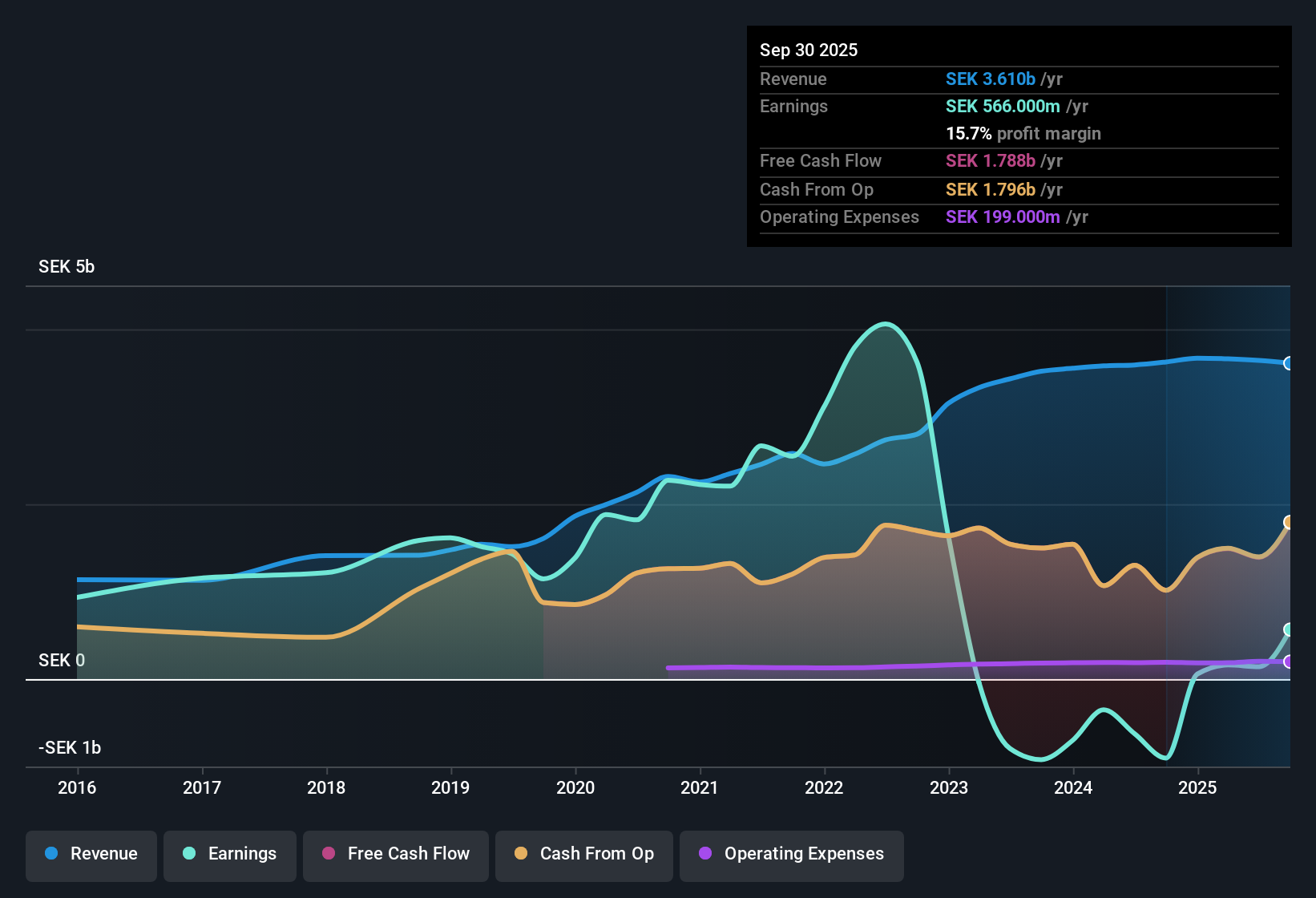

- Nyfosa recently reported third quarter earnings for 2025, revealing SEK 887 million in revenue and net income of SEK 295 million, compared to a net loss in the same period last year.

- This marks a turnaround in profitability for the company, achieved even as sales and revenues were slightly lower than the prior-year period.

- We'll explore how Nyfosa's return to profitability amid softer revenues could impact the company's overall investment narrative.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Nyfosa's Investment Narrative?

For anyone considering Nyfosa, the big-picture belief centres on the company’s ability to improve profits despite cyclical headwinds in Swedish real estate. The recent swing back to profitability in Q3 is a clear development, raising confidence that cost control and portfolio management efforts might be taking hold even as revenue edges slightly lower. Previously, questions about unsustainable dividends, weak coverage of interest payments, and a relatively high price-to-earnings ratio weighed on sentiment. This new earnings report may reduce the near-term risk of further dividend pressure and strengthens Nyfosa’s investment story in the short run, but the business still faces headwinds from its expensive valuation, slower revenue growth, and a management team that is still gaining experience. While this profitability turnaround is positive, those underlying risks, especially around leverage, sustainability of dividends, and the pace of top-line growth, should remain front of mind.

But, with interest payments still not well covered by earnings, this could remain a sticking point for some investors. Nyfosa's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore another fair value estimate on Nyfosa - why the stock might be worth as much as 29% more than the current price!

Build Your Own Nyfosa Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nyfosa research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Nyfosa research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nyfosa's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nyfosa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NYF

Nyfosa

A transaction-intensive real estate company, invests, manages, develops, and sells properties in Sweden, Norway, and Finland.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives