- Sweden

- /

- Real Estate

- /

- OM:NYF

Nyfosa (OM:NYF) One-Off SEK685m Loss Raises Doubts Over Profit Turnaround Narrative

Reviewed by Simply Wall St

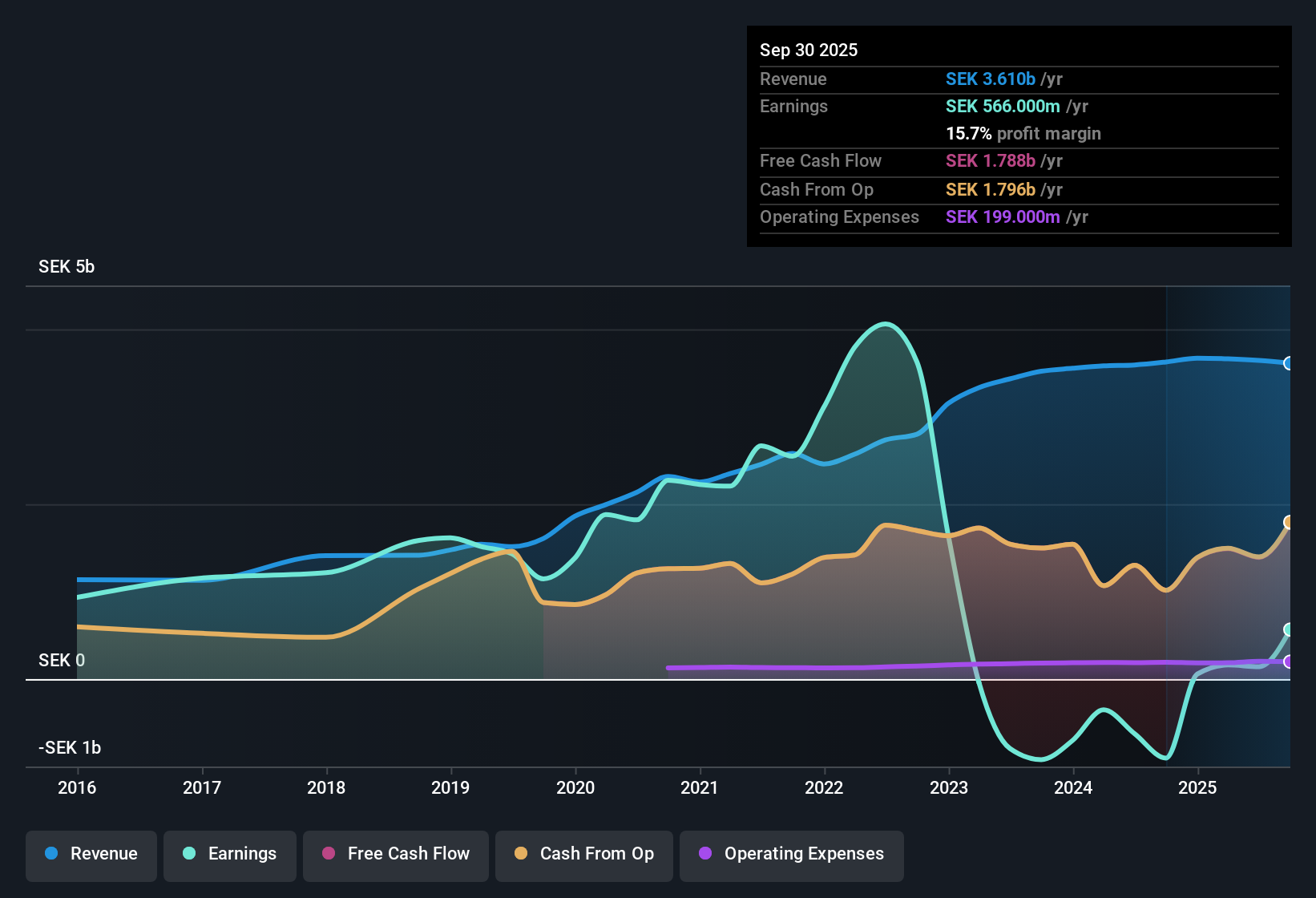

Nyfosa (OM:NYF) swung back to profitability after reporting earnings that had previously declined by 49.6% per year over the past five years. The company’s results for the twelve months ended September 30, 2025, were significantly impacted by a SEK685.0 million one-off loss, which weighed on net income figures. Looking ahead, Nyfosa is expected to grow earnings by 46.4% per year, well outpacing the Swedish market’s projected 12.3% annual profit expansion. However, anticipated revenue growth of just 1.9% per year lags the broader market forecast of 3.6%.

See our full analysis for Nyfosa.Now, let’s see how these fresh results line up with the ongoing narratives and where they might challenge what investors expect.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off SEK685 Million Loss Drags Past Profitability

- The latest reported period includes a SEK685.0 million one-off loss, which was significant enough to overshadow Nyfosa’s operational recovery and directly affected net income.

- What is notable is that, even with such a major non-recurring hit, Nyfosa managed to return to profitability. This supports the argument that its underlying business remains resilient despite recent turbulence.

- A prevailing narrative highlights that operational stability and prudent management of property portfolios can help companies withstand sector headwinds, particularly when large, one-time setbacks do not repeat.

- This one-off item may explain why headline profit lags historical performance and creates tension with claims that view the annual turnaround as sustainable long-term.

P/E Ratio Doubles Industry Average Amid Profit Growth Forecasts

- Nyfosa is trading at a price-to-earnings (P/E) ratio of 31x, a notable premium compared to both the Swedish real estate sector average of 16.1x and the peer average of 21.6x.

- Some argue that a P/E roughly double the industry average raises the bar for future profit growth, making Nyfosa vulnerable if those forecasts fall short.

- With annual earnings projected to grow 46.4 percent, well above the market, critics question whether current valuation already prices in much of that optimism, leaving little room for disappointment.

- This valuation context addresses concerns only if Nyfosa consistently meets or exceeds its aggressive growth targets, as any setbacks could trigger a sharp rerating.

Share Price More Than Twice DCF Fair Value

- The current share price of SEK86.50 is more than double the estimated discounted cash flow (DCF) fair value of SEK41.76, suggesting a substantial valuation gap based on fundamental analysis.

- The market is focused on whether Nyfosa’s robust earnings trajectory and sector positioning justify this premium, making it important for investors to weigh high growth expectations against the risk of a correction if sentiment shifts.

- While strong projected profit growth can support higher multiples, the large gap to DCF fair value suggests investors should examine future results and sector trends carefully.

- Peer companies generally trade closer to their intrinsic value, so Nyfosa’s premium indicates either perceived safety or investor willingness to pay for expected growth that must be demonstrated over time.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Nyfosa's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Nyfosa’s lofty valuation and the wide gap between its share price and DCF fair value raise real concerns about paying too much for expected growth that may not materialize.

If you’re seeking better value for your investment, discover these 876 undervalued stocks based on cash flows to pinpoint companies trading at more attractive prices and leave less room for disappointment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nyfosa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NYF

Nyfosa

A transaction-intensive real estate company, invests, manages, develops, and sells properties in Sweden, Norway, and Finland.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives