- Sweden

- /

- Real Estate

- /

- OM:NP3

NP3 Fastigheter (OM:NP3) Margin Surge Challenges Quality Narrative After SEK425M One-Off Gain

Reviewed by Simply Wall St

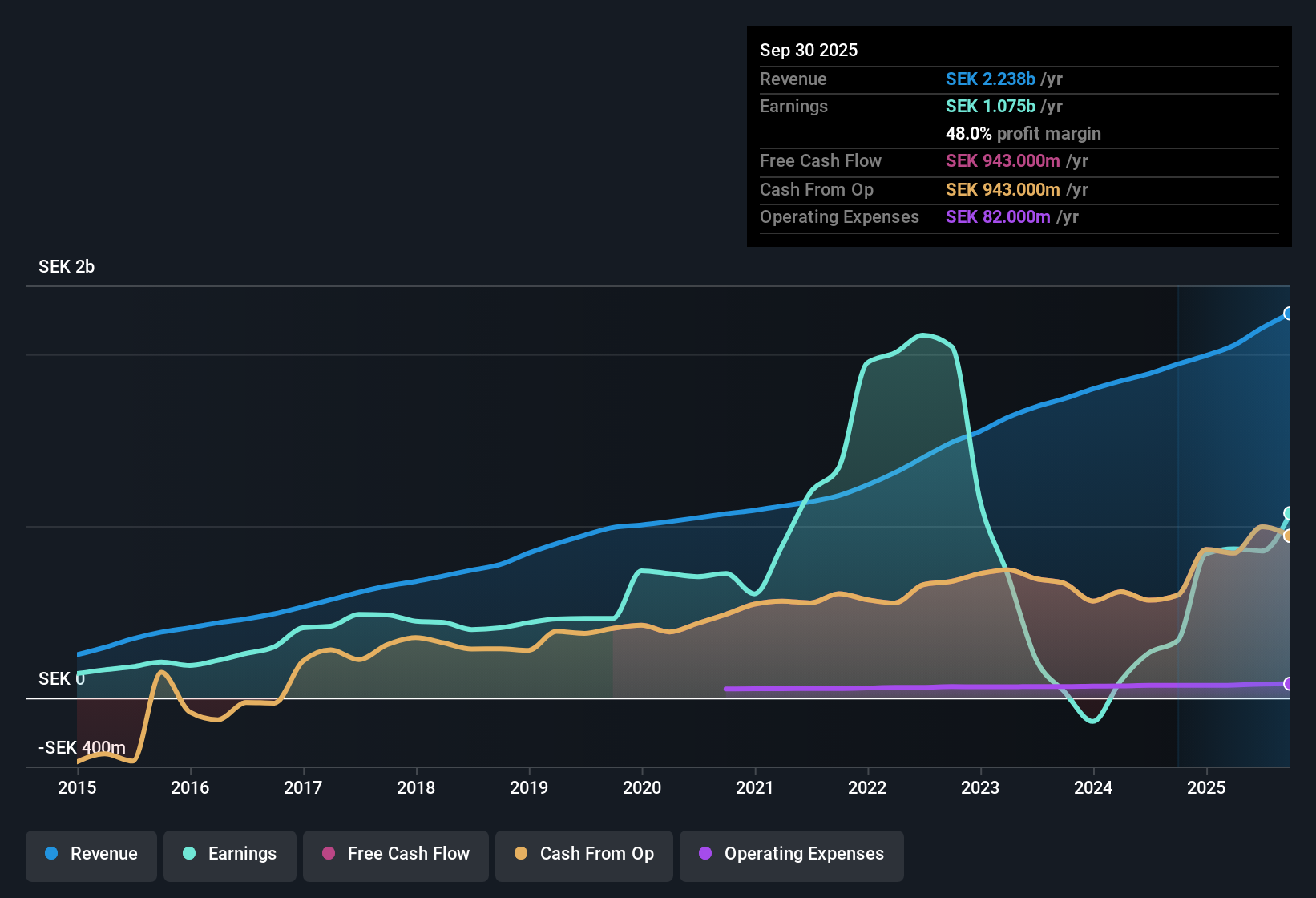

NP3 Fastigheter (OM:NP3) posted a net profit margin of 40.8%, jumping sharply from 13.9% the previous year, alongside earnings growth of 231.3% over the last year compared to its 5-year average decline of 17.3% per year. The headline figures benefited from a one-off gain of SEK425.0 million. Forecasts show revenue set to rise 5.9% annually and earnings expected to grow at 12.5% per year, both ahead of the Swedish market averages. Investors will see the margin improvement and upbeat growth outlook, but should also weigh earnings quality concerns tied to that significant non-recurring gain.

See our full analysis for NP3 Fastigheter.The next step is to see how these headline numbers compare with the major narratives shaping investor sentiment, and where the results might challenge those stories.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Gain Drives Margin Spike

- The reported net profit margin reached 40.8% mainly because of a one-off gain of SEK425.0 million, rather than from core business improvements.

- It is notable that, while the prevailing market analysis often praises high margin figures as a sign of strong operations, in NP3’s case the margin is artificially elevated due to this significant non-recurring benefit.

- This presents a dilemma for investors: bulls may focus on the jump in margin, but those looking deeper will observe that the figure does not reflect steady profitability.

- Investors prioritizing sustainable earnings should acknowledge that future results could appear very different without similar gains.

Growth Forecasts Outpace the Market

- NP3 Fastigheter's revenue is projected to grow by 5.9% per year and earnings by 12.5% annually, both ahead of Swedish market averages of 3.3% and 12.1% respectively.

- Analysts highlight that these above-market forecasts underpin optimistic views for steady long-term expansion, with

- projected top- and bottom-line growth rates positioning NP3 as an outlier compared to sector peers facing slow industry-wide trends.

- expectations for ongoing expansion contributing to the market narrative that the current trajectory reflects underlying business strength, rather than just a temporary windfall.

Share Price Lags DCF Fair Value

- At SEK258.5, NP3's share price remains noticeably below its DCF fair value estimate of SEK329.80, indicating potential room for upside according to the discounted cash flow model.

- The prevailing market analysis perceives this gap as a potential opportunity for investors, noting that

- the stock’s price-to-earnings multiple is viewed as lower than industry peers, supporting the view it could be undervalued if forecast growth is realized.

- however, ongoing risks related to the quality of earnings and balance sheet concerns could explain why the market is not reflecting future potential in the current price.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on NP3 Fastigheter's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While NP3 Fastigheter’s earnings jump was driven by a one-off gain, ongoing concerns remain about balance sheet health and the sustainability of future profits.

If you want to reduce your exposure to these risks, check out solid balance sheet and fundamentals stocks screener (1985 results) to discover companies with stronger finances and more stable foundations for long-term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NP3 Fastigheter might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NP3

NP3 Fastigheter

A real estate company, engages in commercial investment property business in Sweden.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives