- Sweden

- /

- Real Estate

- /

- OM:NEOBO

Neobo Fastigheter (OM:NEOBO): Losses Compound at 42.3% Rate, Profitability Remains Elusive

Reviewed by Simply Wall St

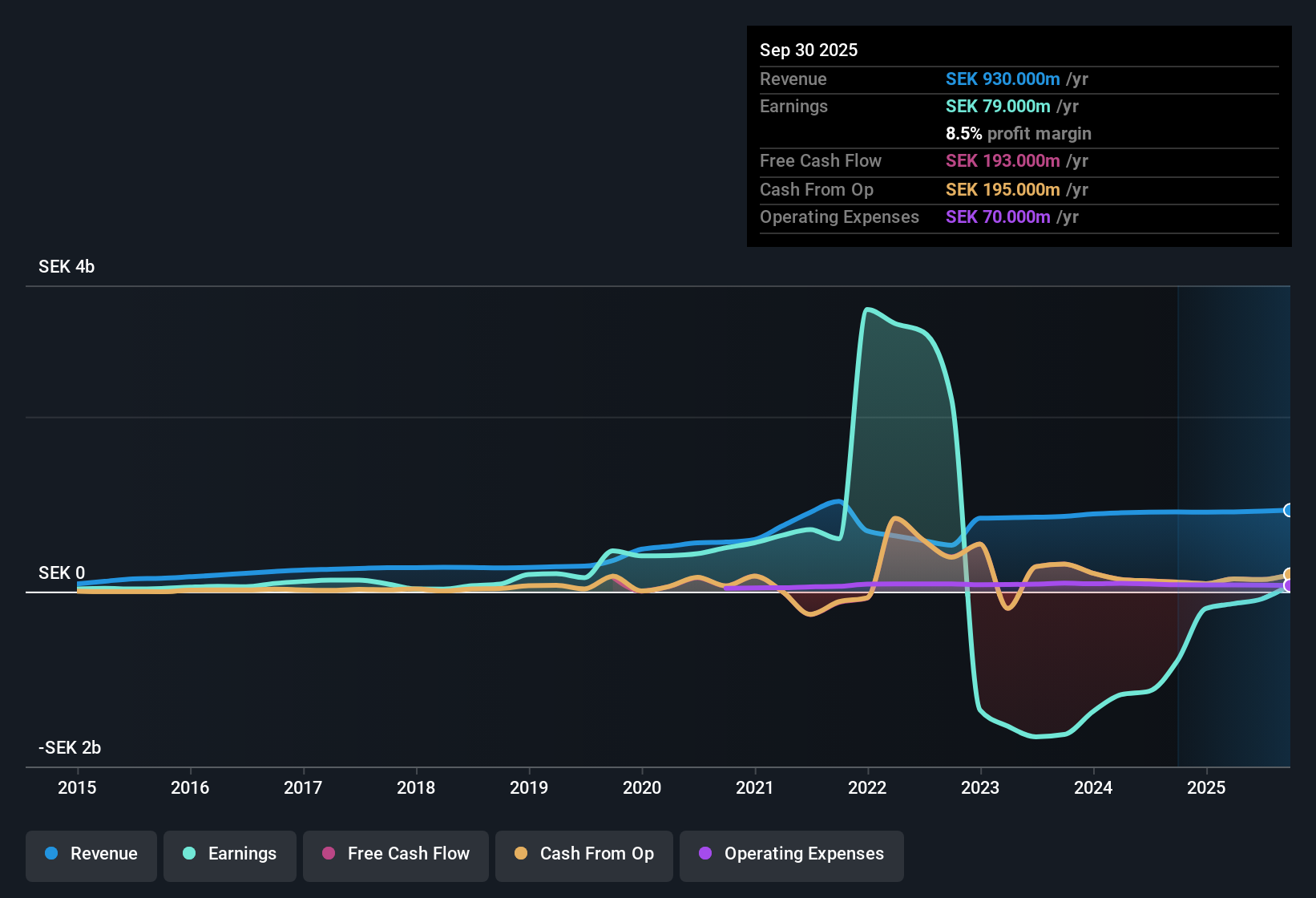

Neobo Fastigheter (OM:NEOBO) continues to grapple with rising losses, which have grown at an annual rate of 42.3% over the past five years. The company remains unprofitable, with its net profit margin showing no sign of recovery, and recent figures do not allow for a meaningful year-on-year comparison. Despite these ongoing challenges, Neobo’s Price-to-Sales Ratio of 3.1x stands below both the Swedish real estate industry average of 5.3x and its peer group’s 3.3x. This hints at a relatively attractive valuation even as the latest share price of SEK19.48 sits well above the estimated fair value of SEK12.27.

See our full analysis for Neobo Fastigheter.Next up, we will see how these earnings results hold up when compared side-by-side with the market narratives that investors have been following. Some stories will resonate, while others might face a reality check.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Compound at 42.3% Annually

- Neobo Fastigheter's annual loss growth rate stands at 42.3% over the past five years, spotlighting a persistent deepening of unprofitability that sets it apart from typical sector trends.

- What is surprising is that, despite this negative trajectory, prevailing market analysis notes a perception of operational stability that reassures some investors, even as multiyear losses persist.

- Market sentiment sees a lack of negative news headlines as a sign of resilience, though the steady deepening of losses emphasizes that profitability remains a distant prospect.

- Stable rental income and prudent management are seen as positives but are insufficient to offset concerns about the unbroken run of increasing losses.

Profit Margins Fail to Show Recovery Signs

- Net profit margin is still negative, with no year-on-year improvement evidenced in recent results, underscoring that Neobo has yet to demonstrate any earnings growth or margin turnaround.

- Critics highlight that, even with market optimism around stable operations, there is still no clear evidence of margin stabilization or earnings durability.

- The company’s ongoing unprofitability, without any improvement in its net profit margin, challenges hopes that bottom-line stability is imminent.

- Some investors watch for new operational catalysts, yet the absence of any positive margin trend means caution still dominates the bear case.

Discounted Price-to-Sales Ratio, But Share Trades Above DCF Fair Value

- Neobo’s Price-to-Sales Ratio of 3.1x is lower than both the Swedish real estate industry average (5.3x) and peer group (3.3x), but the current share price of SEK19.48 is meaningfully above DCF fair value of SEK12.27.

- What stands out in the prevailing market view is that, while valuation metrics appear attractive against industry and peer benchmarks, the premium over estimated fair value may prompt investors to remain cautious about near-term upside.

- Some see the discounted sales ratio as a sign of relative value, yet the gap between share price and fair value signals a risk that positive sentiment may already be priced in.

- The ongoing lack of earnings growth or margin improvement further complicates the case for upside, leaving valuation as the main but heavily debated anchor point.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Neobo Fastigheter's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Neobo’s deepening losses, negative margins, and share price premium all indicate persistent challenges with earnings growth and a lack of clear profitability ahead.

If you’re seeking companies with better value and growth prospects, use our these 875 undervalued stocks based on cash flows to discover those trading below their fair value and poised for potential upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neobo Fastigheter might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NEOBO

Neobo Fastigheter

Operates as a real estate company that owns, manages, and refines rental residential properties in Sweden.

Slightly overvalued with very low risk.

Similar Companies

Market Insights

Community Narratives