- Sweden

- /

- Real Estate

- /

- OM:FPAR A

Can FastPartner’s (OM:FPAR A) Rising Profits Amid Lower Sales Reveal a Shift in Business Priorities?

Reviewed by Sasha Jovanovic

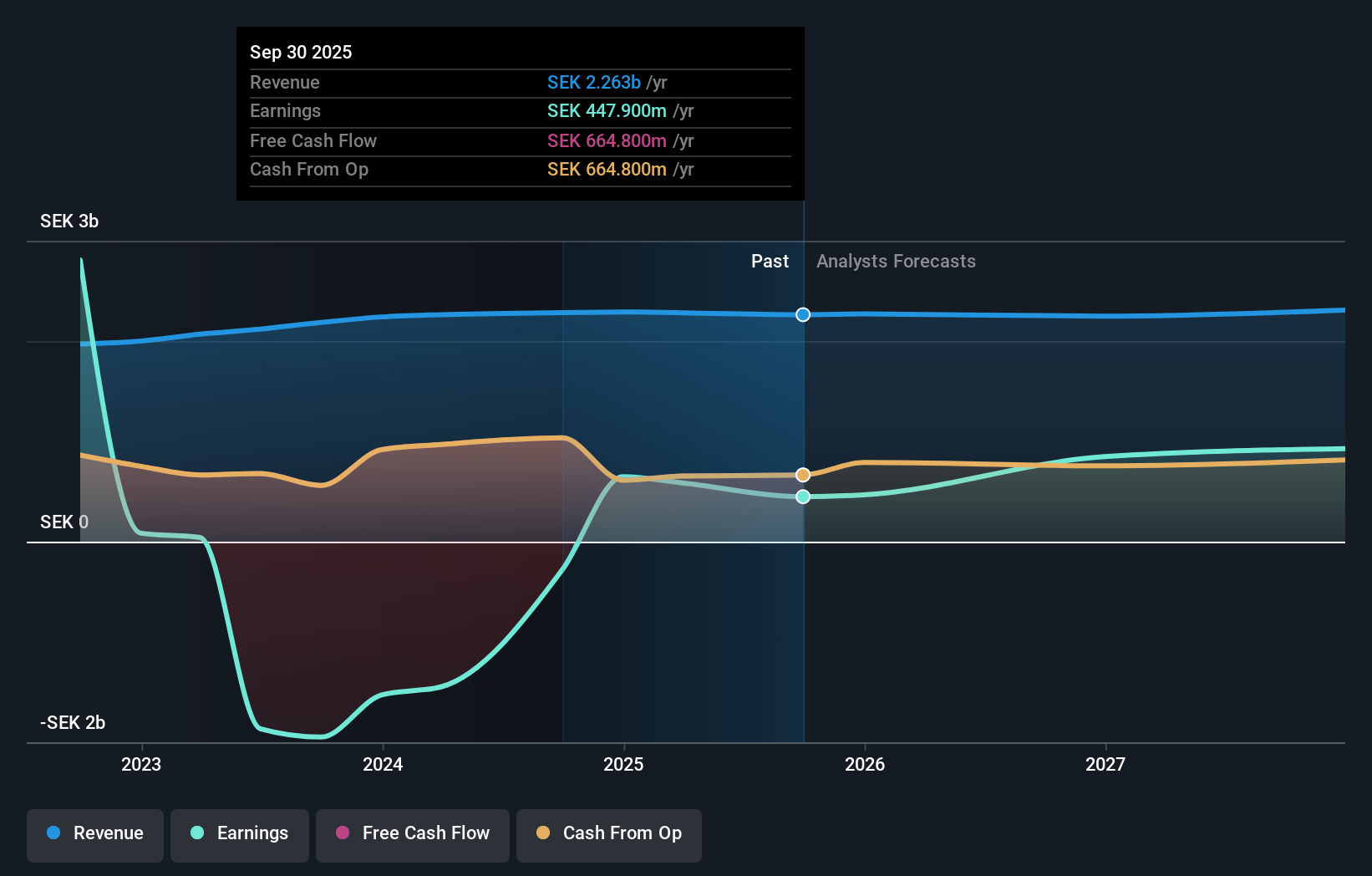

- FastPartner AB recently reported earnings results for the third quarter and nine months ended September 30, 2025, with third quarter sales slightly decreasing to SEK 568.6 million while net income rose to SEK 168.8 million year-over-year.

- An interesting outcome is the increase in third quarter profit against a backdrop of lower sales and a year-to-date net income decline.

- We'll now explore how the shift in quarterly profitability despite softer sales could influence FastPartner's broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is FastPartner's Investment Narrative?

To believe in FastPartner AB as a shareholder, you need confidence in the company’s ability to translate operational stability into sustainable returns, even when headline numbers fluctuate. The latest results deliver a mixed picture: third quarter profit jumped despite a slight sales drop, which calls attention to cost control, one-off items, or improved margins as possible explanations. This outcome could shift short term catalysts, with profitability performance becoming a stronger talking point than top-line growth for now. However, the steady decrease in year-to-date net income signals ongoing vulnerability and may reinforce concerns about revenue momentum and the quality of earnings. The company’s price-to-earnings ratio remains a bit pricier than peers in the Swedish real estate sector, and unstable dividend history and interest coverage continue to weigh on the risk profile. For investors, the real question is whether the profit rebound is sustainable or just a temporary lift masked by non-recurring factors, and how this affects the forward outlook following a period of underperformance against both the broader market and industry.

Yet, weak interest coverage is a concern that shouldn’t be ignored.

Exploring Other Perspectives

Explore another fair value estimate on FastPartner - why the stock might be worth as much as 9% more than the current price!

Build Your Own FastPartner Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FastPartner research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free FastPartner research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FastPartner's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FPAR A

FastPartner

A real estate company, owns, develops, and manages residential and commercial properties in Sweden.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives