- Sweden

- /

- Real Estate

- /

- OM:FABG

Assessing Fabege (OM:FABG) Valuation Following the Appointment of New CEO Bent Oustad

Reviewed by Simply Wall St

Fabege (OM:FABG) has announced that Bent Oustad, currently serving as CEO of Norwegian Property ASA and a board member since 2024, will take over as its new CEO and President starting this December.

See our latest analysis for Fabege.

Fabege’s announcement of Bent Oustad as incoming CEO comes after a year of muted performance, with the share price last closing at SEK 82.05. Despite the top-level change and a recent one-month share price return of 3.1%, longer-term momentum has yet to build. Total shareholder return over the past year sits at just 0.9%, while the five-year total return remains deeply negative. Investors seem to be weighing management’s new direction against a challenging backdrop.

If news like this has you reconsidering where fresh leadership could spark value, use this moment to discover fast growing stocks with high insider ownership.

The question now is whether Fabege represents an overlooked value play in today’s market or if recent gains already reflect expectations for a turnaround under new leadership. Is there a real buying opportunity here, or has the market priced in future growth?

Most Popular Narrative: 4.6% Undervalued

With Fabege closing at SEK 82.05 and the most widely followed narrative assigning a fair value of SEK 85.98, the consensus points to a modest upside. This latest outlook factors in improving profit margins and a slightly brighter growth profile for the company.

The company's strong commitment to sustainable, certified properties, along with new energy initiatives and a refreshed green finance framework, makes its assets more attractive to ESG-conscious tenants and investors. This could enable higher occupancy, greater rental pricing power, and lower long-term vacancy (impact: revenue, NAV growth).

Want to know the real driver behind this valuation? This narrative is built on ambitious profit assumptions and margin expansion that are more common in high-growth sectors. Curious which financial levers underpin that fair value? The full narrative reveals all the bold projections fueling this target.

Result: Fair Value of $85.98 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently weak Stockholm office demand or ongoing declines in property values could undermine the optimistic outlook for Fabege’s recovery and growth.

Find out about the key risks to this Fabege narrative.

Another View: What Do Market Ratios Tell Us?

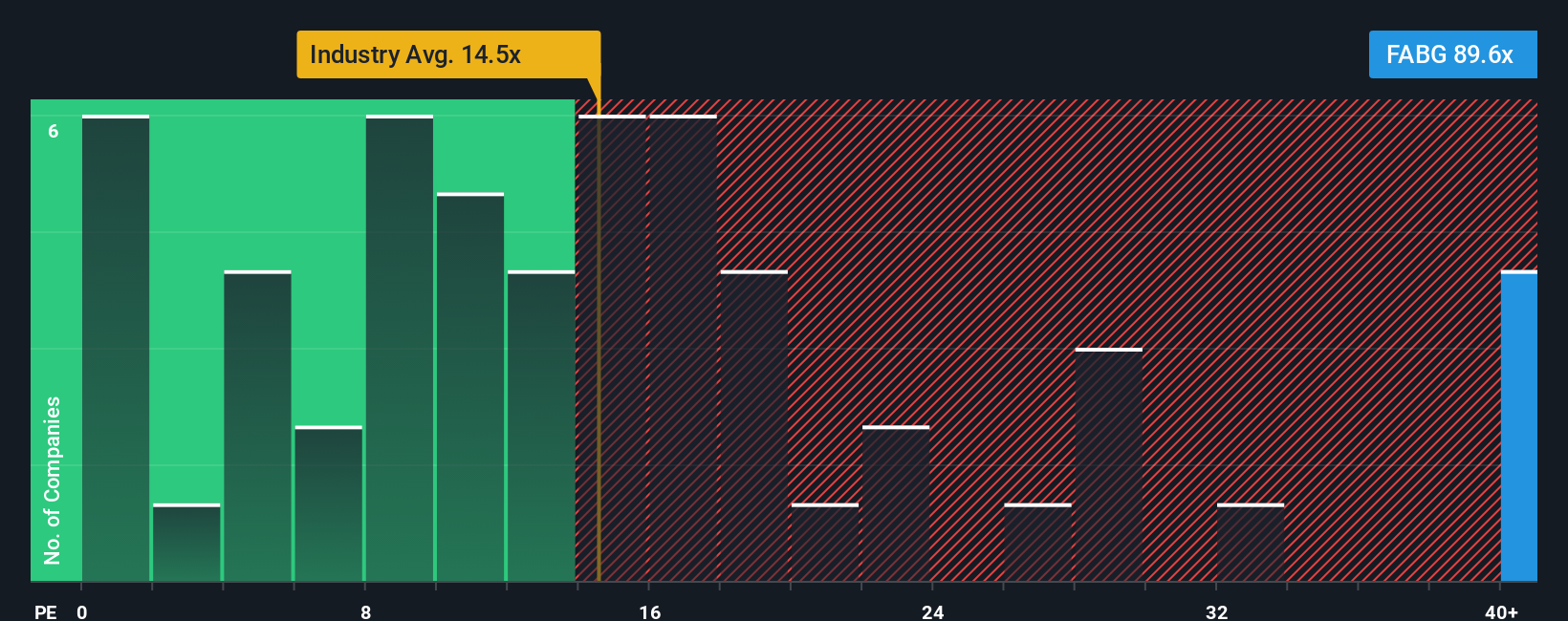

While analyst forecasts suggest Fabege might be undervalued, the company's price-to-earnings ratio currently stands at 89.9x. That is significantly higher than the Swedish Real Estate industry average of 14.6x, the peer average of 17.7x, and even above the fair ratio of 78.2x. This wide gap could point to elevated expectations or hidden risks that the market may eventually re-evaluate. Is the premium justified, or are investors overlooking the potential downside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fabege Narrative

If you have a different angle or want to dig deeper into Fabege's numbers, you can craft your own take on the company in just minutes. Do it your way.

A great starting point for your Fabege research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart decisions start with a broader view. Expand your horizon and unlock opportunities others might overlook. Don’t let the market’s next breakthrough pass you by.

- Uncover high-yield potential with access to these 14 dividend stocks with yields > 3% that deliver proven income above 3% while maintaining robust fundamentals.

- Tap into the unstoppable growth of artificial intelligence advancements through these 27 AI penny stocks built to ride the next technological wave.

- Boost your strategy by targeting deep value with these 881 undervalued stocks based on cash flows that stand out for strong cash flow at attractively low prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FABG

Fabege

A property company, primarily engages in the development, investment, and management of commercial premises in Sweden.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives