- Sweden

- /

- Real Estate

- /

- OM:CORE A

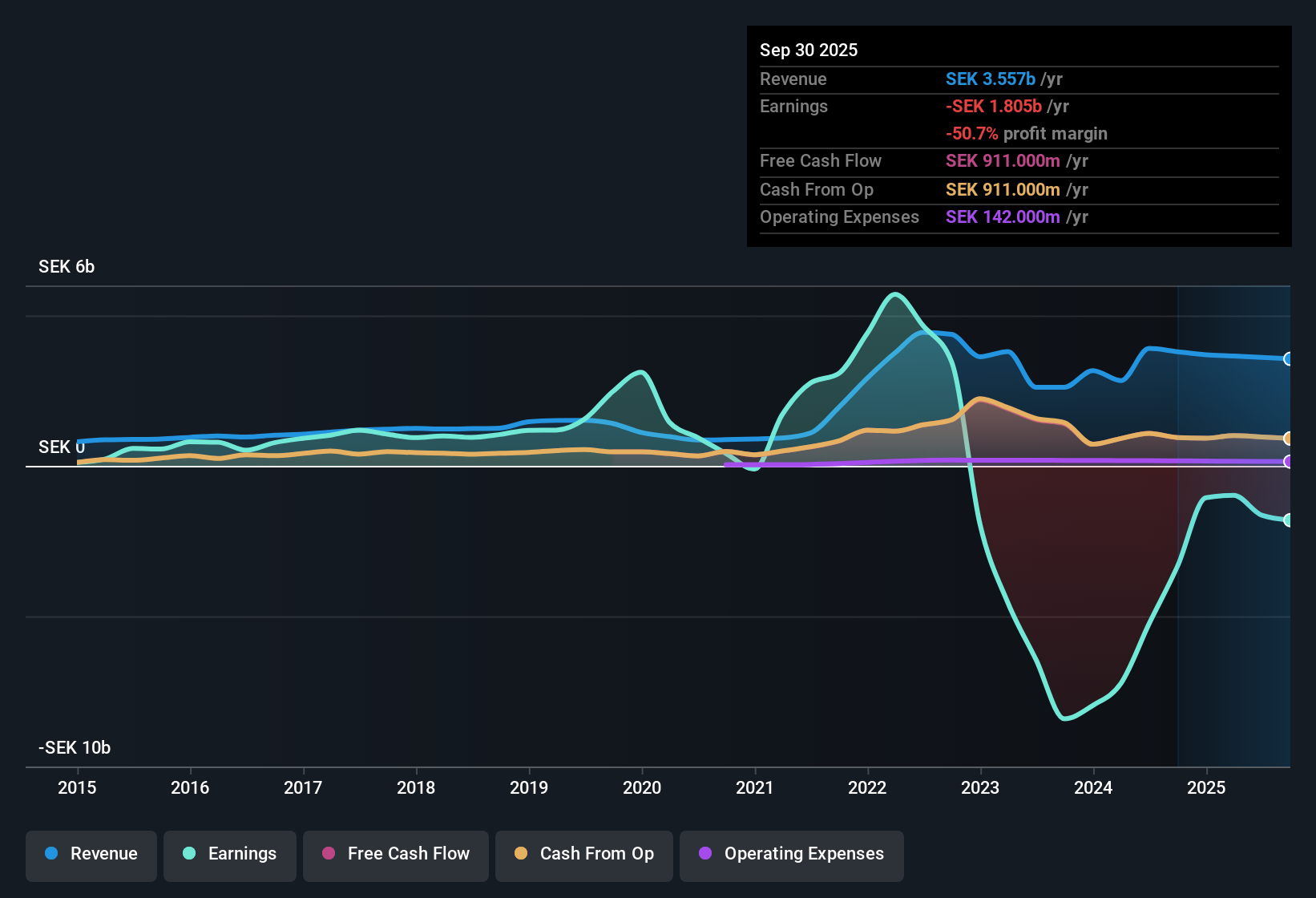

Corem Property Group (OM:CORE A) Margins Remain Negative Despite Forecasted 90.94% Annual Earnings Growth

Reviewed by Simply Wall St

Corem Property Group (OM:CORE A) remains unprofitable, with annual losses deepening at 45.2% per year on average over the past five years. Despite this track record, the company’s earnings are now forecast to grow at a rapid 90.94% annually, and analysts expect it to reach profitability within the next three years, representing a turnaround well above average market growth. Offsetting this, revenue is projected to slip by 0.2% per year.

See our full analysis for Corem Property Group.The real test comes next, as we put these headline numbers up against the latest market narratives to see which themes hold up and which might need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Discounted Price-to-Sales Ratio Stands Out

- Corem's Price-to-Sales Ratio is 1.8x, which is not only below the average of peer companies at 4.5x but also significantly lower than the Swedish real estate industry average of 5.3x. This highlights a notable relative discount on revenue multiples.

- Despite this favorable valuation, investors closely watch whether the company's discounted multiple reflects undervaluation or signals broader concerns:

- The market is treating Corem as cheaper than its peers, but continued losses and a lack of profit margin improvement may justify that wariness for now.

- Bulls see the low sales multiple as an opportunity if management can deliver the promised turnaround. Bears caution that ongoing financial risks and unstable dividends could be baked into the cheap pricing.

Margins Stuck in Negative Territory

- Net profit margins have not improved over the past year, with Corem remaining unprofitable and showing no sign of a turnaround in this key measure of core business health.

- Current sentiment weighs the prospect of management's turnaround plans against persistent margin weakness:

- Bears argue that persistent losses call into question the company's ability to capitalize on sector recovery, especially if sector-wide headwinds continue to pressure property values and cash flow.

- Critics highlight share dilution within the last year and financial health warnings as reasons to remain cautious, pointing out that without real improvement in margins, even a recovery in other metrics may not translate into sustainable profit.

Shares Trade Above Estimated Fair Value

- With shares at 4.56, Corem is trading above its DCF fair value estimate of 0.27. This suggests little short-term upside based strictly on discounted cash flow analysis.

- What is surprising is how this valuation gap shapes debate around the company’s prospects:

- Some investors focus on the low Price-to-Sales Ratio as justification for value hunting, but the significant premium to DCF fair value casts doubt on whether the stock is truly a bargain right now.

- The tension between discounted sales multiples and a premium to fair value challenges both optimists and skeptics. This serves as a reminder that cheap on one metric does not always mean undervalued overall.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Corem Property Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Corem’s persistent losses, weak margins, and financial health warnings raise doubts about its ability to deliver sustainable profits or withstand sector volatility.

If you’re looking for companies with stronger balance sheets and reliable fundamentals, consider switching focus to solid balance sheet and fundamentals stocks screener (1980 results) that are better equipped for resilience and steady growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CORE A

Corem Property Group

A real estate company, owns, manages, develops, and leases office, warehouse, logistics, and retail properties in Sweden, Denmark, and the United States.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion