- Sweden

- /

- Real Estate

- /

- OM:CATE

Catena (OM:CATE) One-Off Gain Clouds Earnings Quality, Challenges Bullish Growth Narratives

Reviewed by Simply Wall St

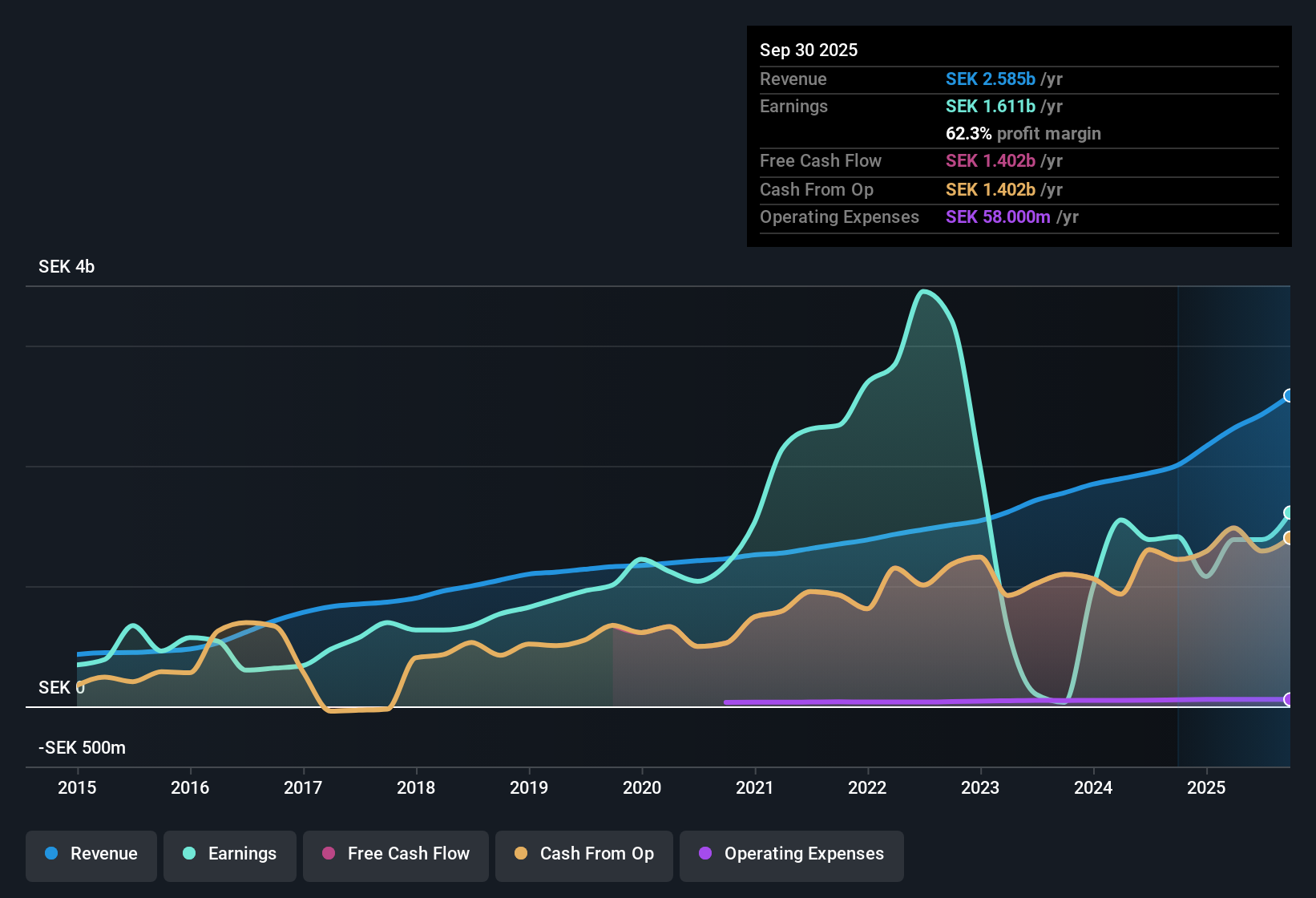

Catena (OM:CATE) is forecasting revenue growth of 9.3% per year, outpacing the Swedish market's 3.9% average. Its most recent net profit margin landed at 57.1%, down sharply from last year's 71.5%. The company posted flat earnings growth over the past year, which stands out positively against its five-year average earnings decline of 11.7% per year. However, with a significant SEK463 million one-off gain affecting results and expected earnings growth of just 0.3%, which is well behind peers and its own revenue ambitions, investors may remain cautious heading into the next period.

See our full analysis for Catena.Up next, we’ll break down how the fresh earnings figures measure up against Catena’s hottest narratives in the market. Some expectations might get reinforced, while others could be in for a reality check.

See what the community is saying about Catena

Analyst Price Target Now 7% Above Current Trading Level

- Catena's share price sits at SEK476.00, which is 7% below the analyst consensus price target of SEK510.00 and 15% higher than the DCF fair value of SEK413.91. This highlights a notable gap between near-term market expectations and longer-term intrinsic value.

- Analysts' consensus view maintains that reaching the SEK510.00 target requires believing in 10.3% average annual revenue growth and a 44.5% profit margin by 2028.

- With the market average price-to-earnings for Swedish real estate at 16.1x, Catena’s 20.7x multiple already implies a premium for its above-market growth.

- The consensus scenario assumes these multiples can rise further even as profit margins shrink from 57.1% to 44.5% over three years. Some may find this ambitious given the margin pressure trend.

- The consensus narrative hints that the growth case is widely accepted, but it still rests on high expectations for sustained execution. This gap between price and fundamentals invites close scrutiny as the next few years play out.

Shrinking Margins Despite Top-Line Momentum

- Profit margins have declined from 71.5% last year to 57.1% currently and are projected to tighten further to 44.5% by 2028, even as revenue growth remains strong at 9.3% per year.

- Analysts' consensus view points to the challenge of sustaining high earnings quality as expansion accelerates.

- Completion of new logistics projects and market expansion are expected to boost portfolio size and top-line income, reinforcing the revenue outlook.

- However, the steady decline in margins emphasizes that higher sales may not fully translate into stronger bottom-line performance. This demands efficient project execution to preserve profitability.

One-Off Gain Distorts Underlying Earnings Profile

- Recent bottom-line figures were heavily influenced by a single SEK463 million gain outside normal business, flattening annual earnings growth to 0% and masking ongoing underlying declines.

- Analysts' consensus view underscores the risk of mistaking this one-off for structural improvement.

- With typical annual earnings having declined at an average pace of 11.7% over five years, the lack of robust core earnings momentum remains a concern.

- For Catena to meet future earnings hopes and justify valuation multiples, future results will need to be consistently driven by recurring operations rather than extraordinary items.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Catena on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot an opportunity or trend others might miss? Put your unique take into words and shape your own narrative in just minutes. Do it your way.

A great starting point for your Catena research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Catena’s promising revenue growth is affected by shrinking profit margins and reliance on one-off gains instead of consistent earnings improvements.

If you want to sidestep those uncertainties, use stable growth stocks screener (2099 results) to find companies that deliver reliable, steady revenue and earnings growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CATE

Catena

Owns, develops, manages, and sells logistics properties in Sweden and Denmark.

Established dividend payer with very low risk.

Similar Companies

Market Insights

Community Narratives