- Sweden

- /

- Real Estate

- /

- OM:CAST

Castellum (OM:CAST) Returns to Profitability, But One-Off SEK728m Loss Tests Bullish Narratives

Reviewed by Simply Wall St

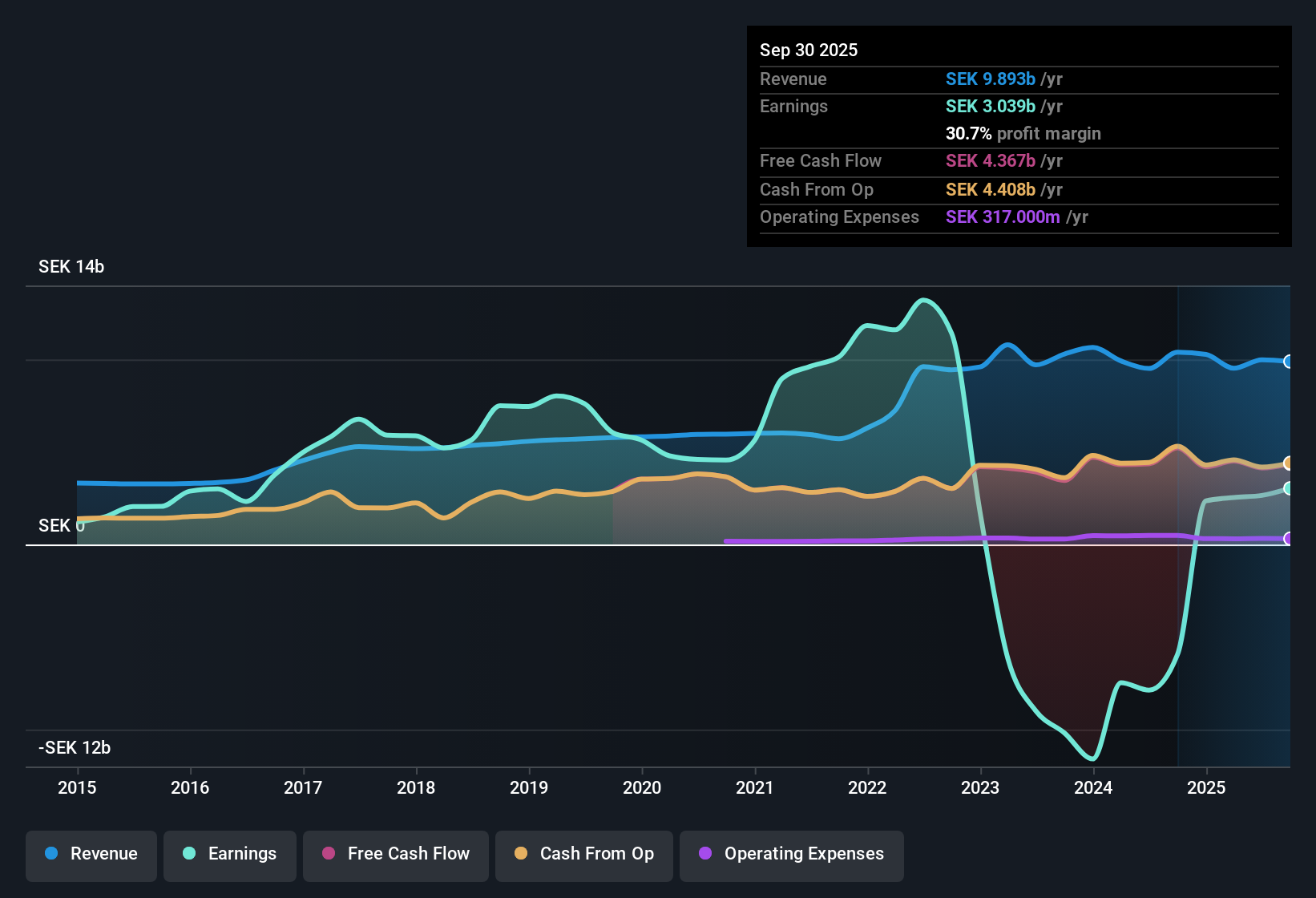

Castellum (OM:CAST) has turned a corner by reaching profitability, with its net profit margin improving over the past year, even as earnings have declined by 43.2% per year for the last five years and a one-off loss of SEK728.0 million weighed on the latest twelve-month results through September 2025. Looking forward, earnings are projected to grow by 32.7% annually, significantly faster than the broader Swedish market, while revenue growth is expected to trail at just 2% per year. Investors will be closely watching how recurring profitability compares with the company’s history of volatile results and significant non-recurring costs.

See our full analysis for Castellum.The next section examines how Castellum’s latest numbers align with the most widely followed narratives, highlighting where investor expectations might be confirmed or put to the test.

See what the community is saying about Castellum

Profit Margin Set to Surge

- Analysts project Castellum's profit margin will climb from 27.1% today to 65.9% in three years, a more than doubling that stands out against the current 43.2% annual earnings decline seen over the past five years.

- According to the analysts' consensus view, this dramatic margin expansion is expected to come despite revenue growth trailing the Swedish market. Management is focusing on higher-quality developments and reinvesting proceeds from non-strategic sales.

- Consensus narrative highlights projects like Infinity and acquisition of Entra shares as strategic levers to drive recurring earnings and reinforce Castellum’s position. Analysts expect SEK 6.6 billion in annual earnings by September 2028.

- Interest savings from improved credit ratings and lower expenses are anticipated to further boost net profitability. This shift is moving Castellum's focus from raw growth toward more sustainable margins.

- The combination of targeted investments and margin-driven profitability has analysts arguing that sustained execution could justify upside to Castellum’s current valuation, if the projected margin leap materializes. 📊 Read the full Castellum Consensus Narrative.

Property Value Write-downs Weigh

- Castellum recorded a SEK 1.6 billion property write-down, underlining ongoing market headwinds even as the company returns to profitability.

- Analysts' consensus view says this mark-to-market adjustment signals the riskier side of Castellum's strategy. Ongoing property devaluations, higher vacancy costs (SEK 122 million), and operational risk from new project launches all threaten to offset expected gains.

- Consensus narrative stresses that large-scale developments such as the Infinity project carry operational risks, particularly due to the lack of pre-signed leases. This could make recurring income and targeted margin expansion hard to achieve if market demand wavers.

- Pressure is likely to persist on revenue growth and asset valuations, especially as heightened competition and economic challenges in cities like Stockholm and Oslo put additional strain on the company’s financial stability.

Premium Valuation Despite Risks

- Castellum trades at a 20.9x price-to-earnings ratio, above both the industry’s 16.1x and peers’ 20x. The current share price of 112.85 SEK sits near the single consensus analyst target of 115.00 SEK, narrowing potential upside versus sector peers.

- The consensus narrative flags a split among analysts, with the most bullish forecasting SEK 150.0 and the most bearish at SEK 100.0. To meet consensus expectations, Castellum needs to deliver SEK 10.1 billion in revenue and SEK 6.6 billion in earnings by 2028, which would require a significant reset to an 11.3x PE versus today’s multiple.

- Analysts frame the premium as a bet on Castellum’s successful margin expansion and execution of its growth projects. Current trading levels leave little margin for error if profitability falters or asset values slip further.

- For now, the company remains priced for strong improvement, leaving the stock vulnerable to any shortfall in execution and making sustained delivery on narratives’ earnings assumptions critical for justifying the elevated multiple.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Castellum on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have another interpretation of Castellum's figures? Build your own narrative in just a few minutes and share your perspective: Do it your way.

A great starting point for your Castellum research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Castellum remains vulnerable to premium valuation risk and recurring asset revaluations, which can make consistent long-term performance harder to achieve if market headwinds persist.

Want more reliable prospects? Use stable growth stocks screener (2090 results) to find companies delivering steady earnings and revenue regardless of shifting market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CAST

Castellum

Castellum is one of the Nordic region's largest commercial real estate companies, focusing on office and logistics properties in Nordic growth cities.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives