As European markets continue to show resilience, with the pan-European STOXX Europe 600 Index and major stock indexes experiencing gains, investors are increasingly focused on identifying growth opportunities amid a backdrop of steady business activity and consumer confidence improvements. In this environment, companies with high insider ownership can be particularly appealing as they often signal strong internal confidence in future prospects.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 43.9% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 90.4% |

| Magnora (OB:MGN) | 10.4% | 75.4% |

| KebNi (OM:KEBNI B) | 36.3% | 69.2% |

| Egetis Therapeutics (OM:EGTX) | 10.3% | 85% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 67.1% |

| CD Projekt (WSE:CDR) | 29.7% | 49.6% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 51.4% |

Underneath we present a selection of stocks filtered out by our screen.

Bittium Oyj (HLSE:BITTI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bittium Oyj specializes in communications and connectivity solutions, healthcare technology products and services, as well as biosignal measuring and monitoring across Finland, Germany, and the United States, with a market cap of €572.52 million.

Operations: Bittium Oyj's revenue is segmented into Defense & Security (€55.50 million), Medical (€29.00 million), and Engineering Services (€14.72 million).

Insider Ownership: 12.4%

Bittium Oyj, known for its secure communication solutions, is experiencing significant growth prospects with earnings forecasted to rise 36.8% annually over the next three years, outpacing the Finnish market. The company's recent initiatives include launching an Embedded AI offering and a high-security smartphone, both aligning with its strategy to enhance technological capabilities in demanding markets. Despite a volatile share price recently, Bittium's insider ownership aligns management interests with shareholders, supporting long-term growth potential.

- Dive into the specifics of Bittium Oyj here with our thorough growth forecast report.

- Our expertly prepared valuation report Bittium Oyj implies its share price may be too high.

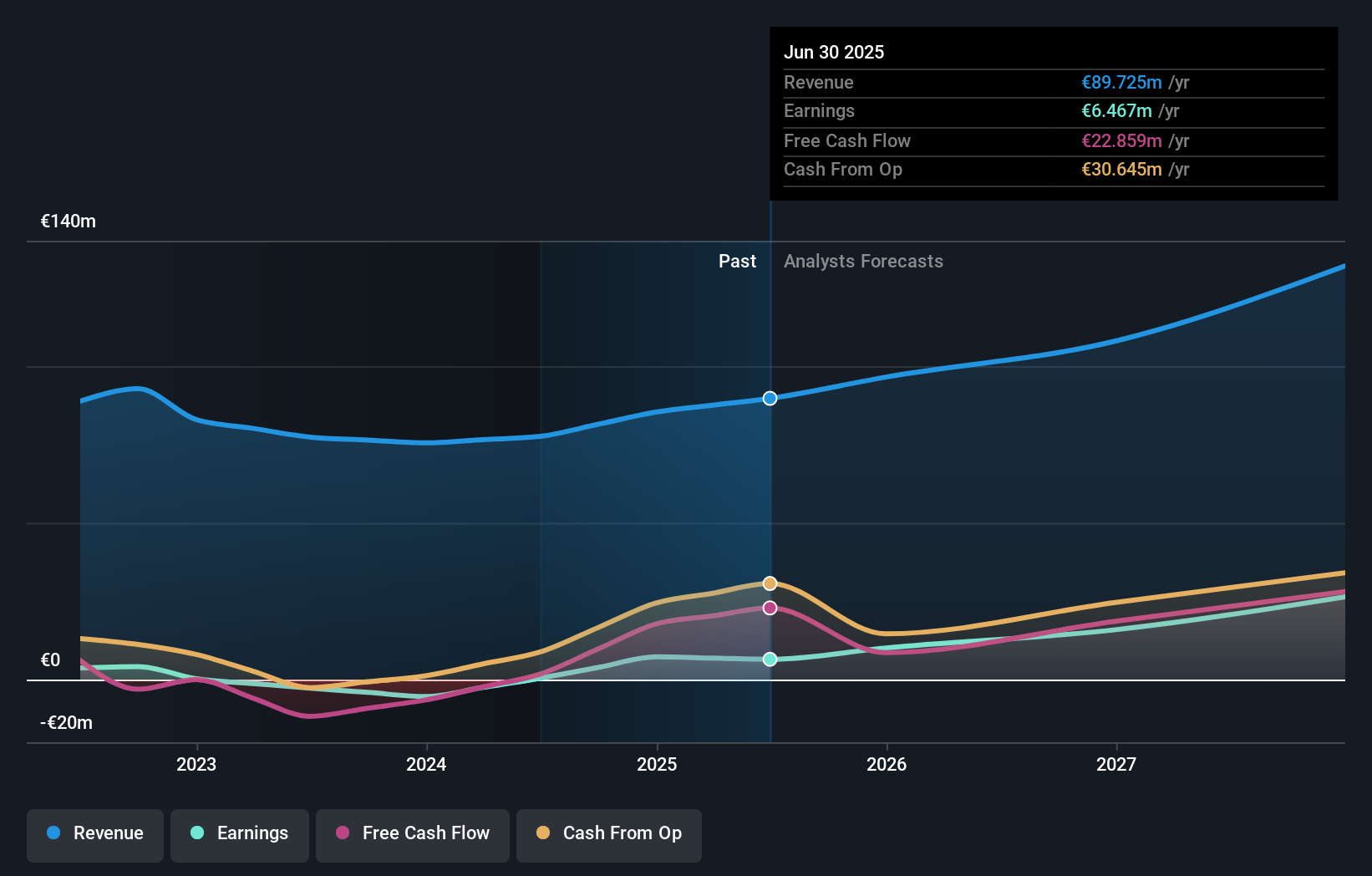

PowerCell Sweden (OM:PCELL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PowerCell Sweden AB (publ) develops and produces fuel cells and fuel cell systems for automotive, marine, and stationary applications in Sweden and internationally, with a market cap of SEK 2.56 billion.

Operations: The company's revenue segments include SEK 433.97 million from batteries and battery systems.

Insider Ownership: 11.3%

PowerCell Sweden is poised for growth with earnings forecasted to rise 77.45% annually, outpacing the Swedish market. Recent contracts, including a SEK 40 million deal for hydrogen-powered bulk carriers and a SEK 4.3 million order from Zeppelin Power Systems, bolster its position in sustainable energy sectors. However, despite promising revenue growth and strategic management changes aimed at commercialization, the company faces challenges with a limited cash runway and volatile share price history.

- Get an in-depth perspective on PowerCell Sweden's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that PowerCell Sweden is trading beyond its estimated value.

Xbrane Biopharma (OM:XBRANE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Xbrane Biopharma AB is a biotechnology company focused on developing, manufacturing, and selling biosimilars with a market cap of SEK26.99 billion.

Operations: Xbrane Biopharma AB generates revenue through its activities in the development, production, and distribution of biosimilar products.

Insider Ownership: 0.1%

Xbrane Biopharma is positioned for significant growth, with revenue expected to increase 46.2% annually, surpassing the Swedish market's average. The company has shown improvement in net income over the past nine months, reporting SEK 153.72 million compared to a loss last year. However, challenges remain due to high share price volatility and recent FDA issues with its biosimilar candidate's approval process, impacting its financial stability and operational focus.

- Delve into the full analysis future growth report here for a deeper understanding of Xbrane Biopharma.

- According our valuation report, there's an indication that Xbrane Biopharma's share price might be on the expensive side.

Summing It All Up

- Navigate through the entire inventory of 189 Fast Growing European Companies With High Insider Ownership here.

- Seeking Other Investments? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:XBRANE

Xbrane Biopharma

A biotechnology company, engages in the development, manufacture, and sale of biosimilars.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives