Vitrolife (OM:VITR) Returns to Profit; Earnings Growth Outpaces Swedish Market Narratives

Reviewed by Simply Wall St

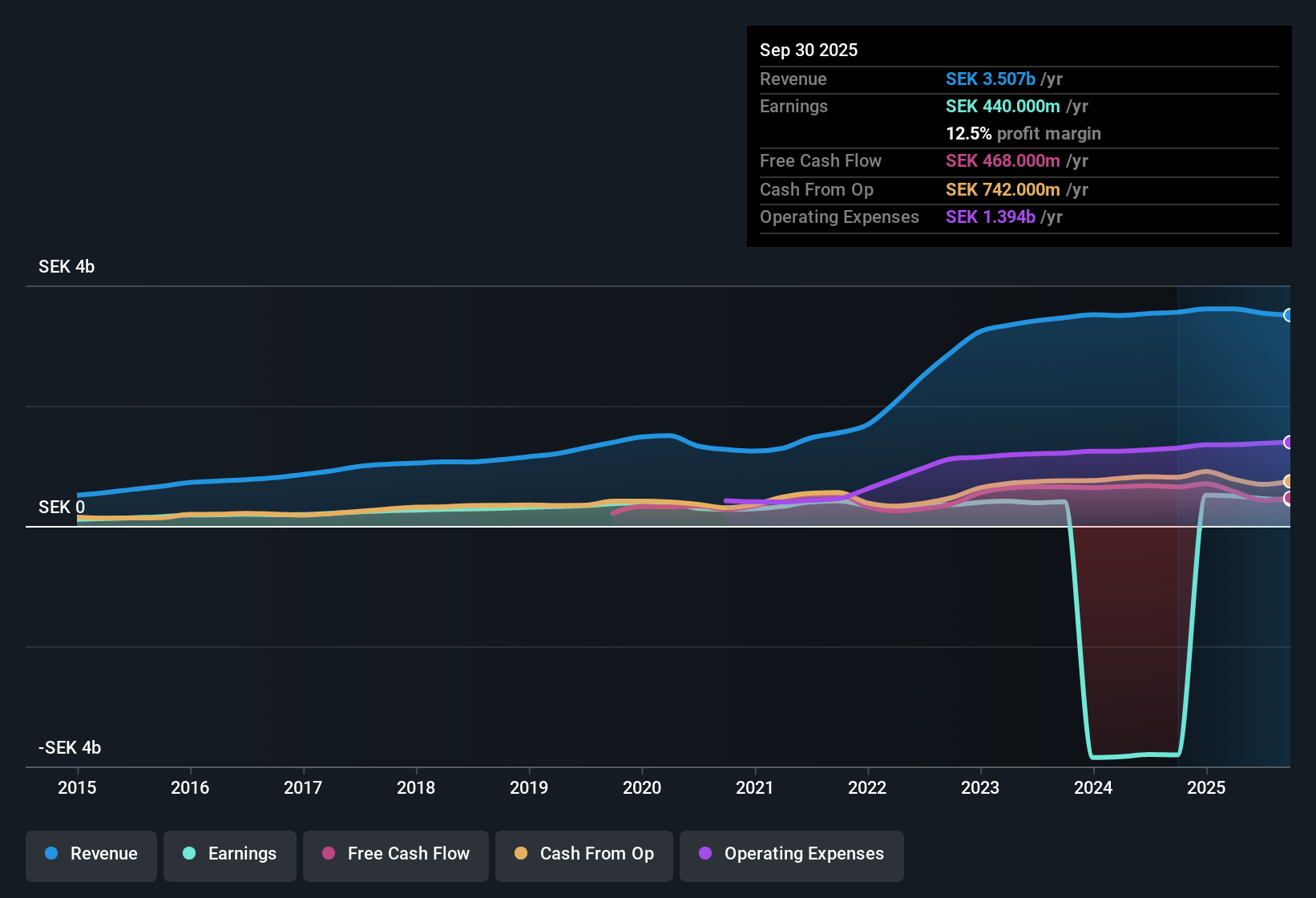

Vitrolife (OM:VITR) has returned to profitability, posting a positive net profit margin after previously operating at a loss. Earnings are set to grow rapidly at an expected rate of 22.2% per year over the next three years, outpacing projected revenue growth of 8% per year and the broader Swedish market’s forecast of 12.3%. High-quality earnings alongside a market price that sits below estimated fair value are driving a notably positive investor outlook for the stock.

See our full analysis for Vitrolife.We’ll now see how these headline numbers stack up against the most widely followed narratives. Some market takes may be confirmed, while others could be put to the test.

See what the community is saying about Vitrolife

Profit Margins On Track For Expansion

- Analysts project Vitrolife’s net profit margins to climb from 12.8% today to 20.3% within three years, a notable 7.5 percentage point improvement that points to structurally higher earnings potential.

- According to the analysts' consensus view, several dynamics are expected to drive this margin expansion:

- Stabilization in IVF procedure volumes and international reimbursement support should boost operating leverage and sales mix, paving the way for stronger margins as market disruptions ease.

- Investments in automation and product innovation are set to lift average selling prices and support margin growth, counterbalancing prior pressures from currency swings and one-time legal costs.

- As these operational levers take hold, the consensus narrative highlights Vitrolife’s ability to translate topline growth into improved profitability, in line with bullish expectations.

Consensus is firming that Vitrolife’s margin potential is about to turn the corner. See what the full narrative expects in the months ahead. 📊 Read the full Vitrolife Consensus Narrative.

Peer Comparison Reveals Relative Valuation Advantage

- While Vitrolife is trading at a price-to-earnings multiple of 44x, above the European biotech industry average of 18x, it remains cheaper than its selected peer group at 59.3x. This hints at relative value for investors comparing across sector leaders.

- The analysts' consensus notes this valuation setup:

- DCF fair value is pegged at SEK206.02 per share, well above the current share price of SEK148.00, indicating potential upside if growth and margin forecasts materialize.

- With the share price discounting a more conservative outlook than consensus targets, the set-up could appeal to those who anticipate a sector rebound or earnings delivery above market expectations.

Analyst Price Targets Signal High Expectations

- The current share price of SEK148.00 sits 26.56% below the consensus analyst target of SEK191.75, reflecting a sizable gap between what the market is willing to pay now versus where analysts believe the stock could trade if company projections are met.

- In the analysts' consensus narrative, expectations hinge on several milestones:

- To justify SEK191.75 and above, Vitrolife’s revenue is expected to reach SEK4.3 billion and earnings SEK865.2 million by 2028, with stable share count and a PE of 36.5x applied to those profits.

- Consensus underscores that forecasts rely on policy support in key markets and successful execution on tech-driven efficiency gains; missing either could close the price target gap.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Vitrolife on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the numbers? Turn fresh insights into a narrative of your own in just a few minutes: Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vitrolife.

See What Else Is Out There

While Vitrolife’s profit margins are climbing and expectations are high, its elevated price-to-earnings ratio signals that investors may be paying a premium for future growth.

Looking for opportunities that are not so richly priced? Check out these 876 undervalued stocks based on cash flows to spot companies where today’s market price offers real upside versus analyst forecasts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VITR

Vitrolife

Provides assisted reproduction products in Europe, the Middle East, Africa, Asia-Pacific, and the Americas.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives