Orexo (STO:ORX investor five-year losses grow to 74% as the stock sheds kr85m this past week

Some stocks are best avoided. It hits us in the gut when we see fellow investors suffer a loss. Anyone who held Orexo AB (publ) (STO:ORX) for five years would be nursing their metaphorical wounds since the share price dropped 74% in that time. Even worse, it's down 18% in about a month, which isn't fun at all.

After losing 12% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Orexo

Given that Orexo didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over half a decade Orexo reduced its trailing twelve month revenue by 7.5% for each year. That's not what investors generally want to see. If a business loses money, you want it to grow, so no surprises that the share price has dropped 12% each year in that time. We're generally averse to companies with declining revenues, but we're not alone in that. Fear of becoming a 'bagholder' may be keeping people away from this stock.

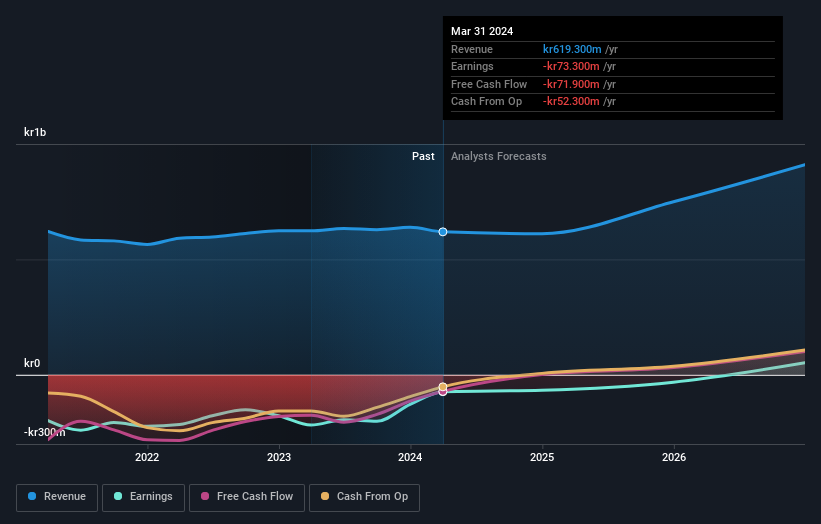

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Orexo will earn in the future (free profit forecasts).

A Different Perspective

Orexo shareholders gained a total return of 8.3% during the year. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 12% per year, over five years. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand Orexo better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Orexo you should know about.

Orexo is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ORX

Orexo

A specialty pharmaceutical company, develops and commercializes pharmaceuticals and digital therapies in the United States, European Union, and internationally.

Undervalued with reasonable growth potential.