As global markets react to mixed economic signals and fluctuating indices, the Swedish market has not been immune to these broader trends. Amidst this backdrop, dividend stocks in Sweden offer a potential avenue for investors seeking steady income. In today's environment, a good dividend stock typically exhibits financial stability and a consistent history of payouts. With yields up to 4%, the following three Swedish stocks stand out as noteworthy considerations for those looking to balance growth with reliable returns.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Betsson (OM:BETS B) | 6.13% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 9.15% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 4.13% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.61% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.25% | ★★★★★☆ |

| Duni (OM:DUNI) | 5.09% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.85% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 5.03% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 3.81% | ★★★★☆☆ |

| SSAB (OM:SSAB A) | 9.75% | ★★★★☆☆ |

Click here to see the full list of 23 stocks from our Top Swedish Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

ITAB Shop Concept (OM:ITAB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ITAB Shop Concept AB (publ) offers solution design, customized shop fittings, checkouts, consumer flow solutions, professional lighting systems, and digitally interactive solutions for physical stores with a market cap of SEK5.33 billion.

Operations: ITAB Shop Concept AB (publ) generates revenue from solution design, customized shop fittings, checkouts, consumer flow solutions, professional lighting systems, and digitally interactive solutions for physical stores.

Dividend Yield: 3%

ITAB Shop Concept's dividend payments are well covered by earnings (42.3% payout ratio) and cash flows (28.2% cash payout ratio). Despite a history of volatile dividends, recent increases suggest improvement, with the latest dividend set at SEK 0.75 per share for 2023. The company reported strong growth in net income and sales for Q2 2024, indicating robust financial health, though its share price has been highly volatile recently.

- Navigate through the intricacies of ITAB Shop Concept with our comprehensive dividend report here.

- Our valuation report unveils the possibility ITAB Shop Concept's shares may be trading at a discount.

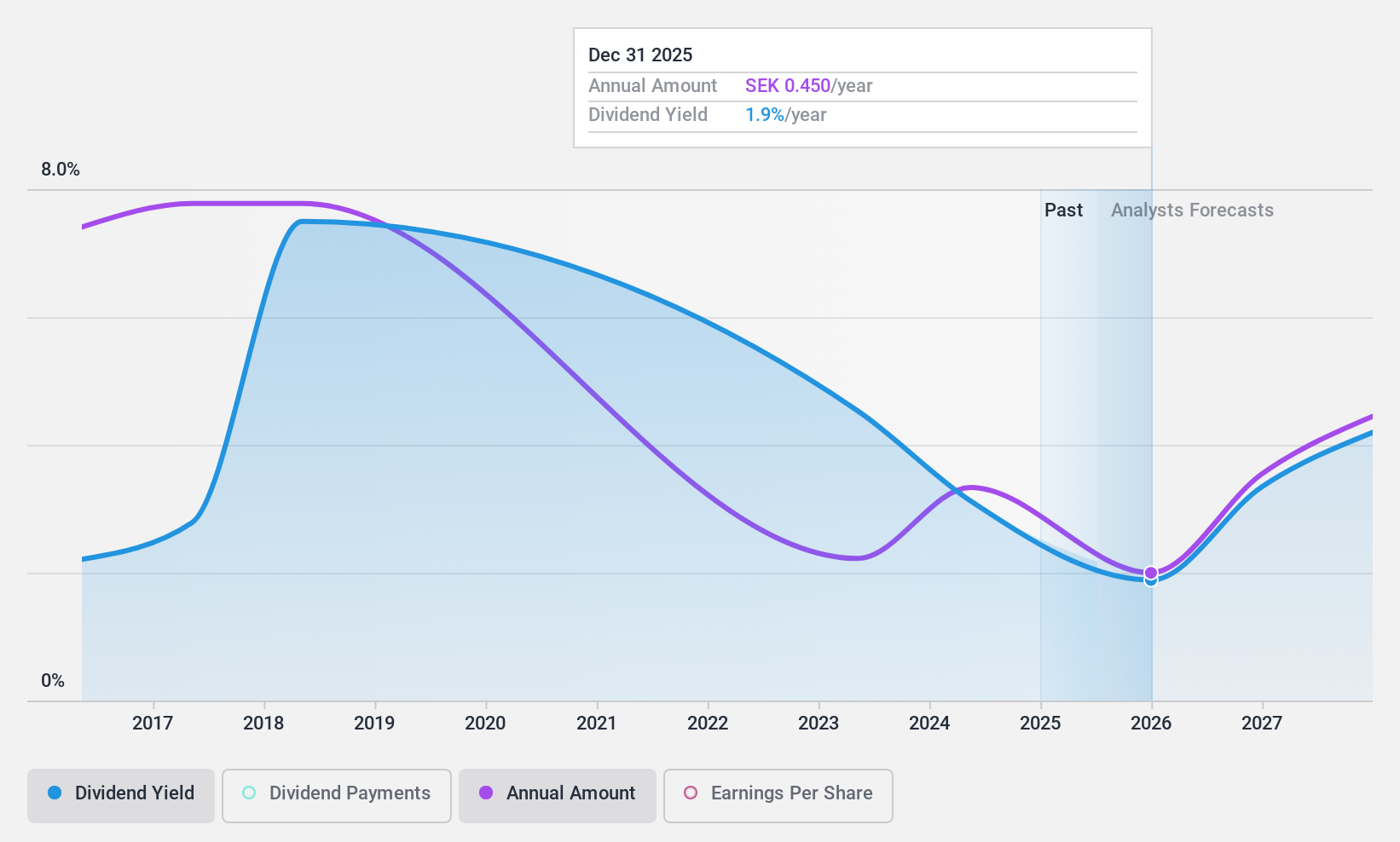

Rejlers (OM:REJL B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rejlers AB (publ) and its subsidiaries provide technical and engineering consultancy services in Sweden, Finland, Norway, and the United Arab Emirates with a market cap of SEK 3.27 billion.

Operations: Rejlers AB (publ) generates revenue from various regions, including SEK 2.63 billion from Sweden, SEK 1.37 billion from Finland, and SEK 304.40 million from Norway (including Embriq), along with an additional SEK 46.90 million classified as Group Wide revenue.

Dividend Yield: 3%

Rejlers' dividend payments are covered by earnings (50% payout ratio) and cash flows (30.7% cash payout ratio), although they have been volatile over the past decade. The company reported Q2 2024 sales of SEK 1.14 billion and net income of SEK 47.1 million, maintaining stable earnings per share from continuing operations at SEK 2.13. Recent collaborations, including a framework agreement with Better Energy Sweden AB, highlight Rejlers' ongoing expansion in sustainable energy projects.

- Get an in-depth perspective on Rejlers' performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Rejlers' share price might be too pessimistic.

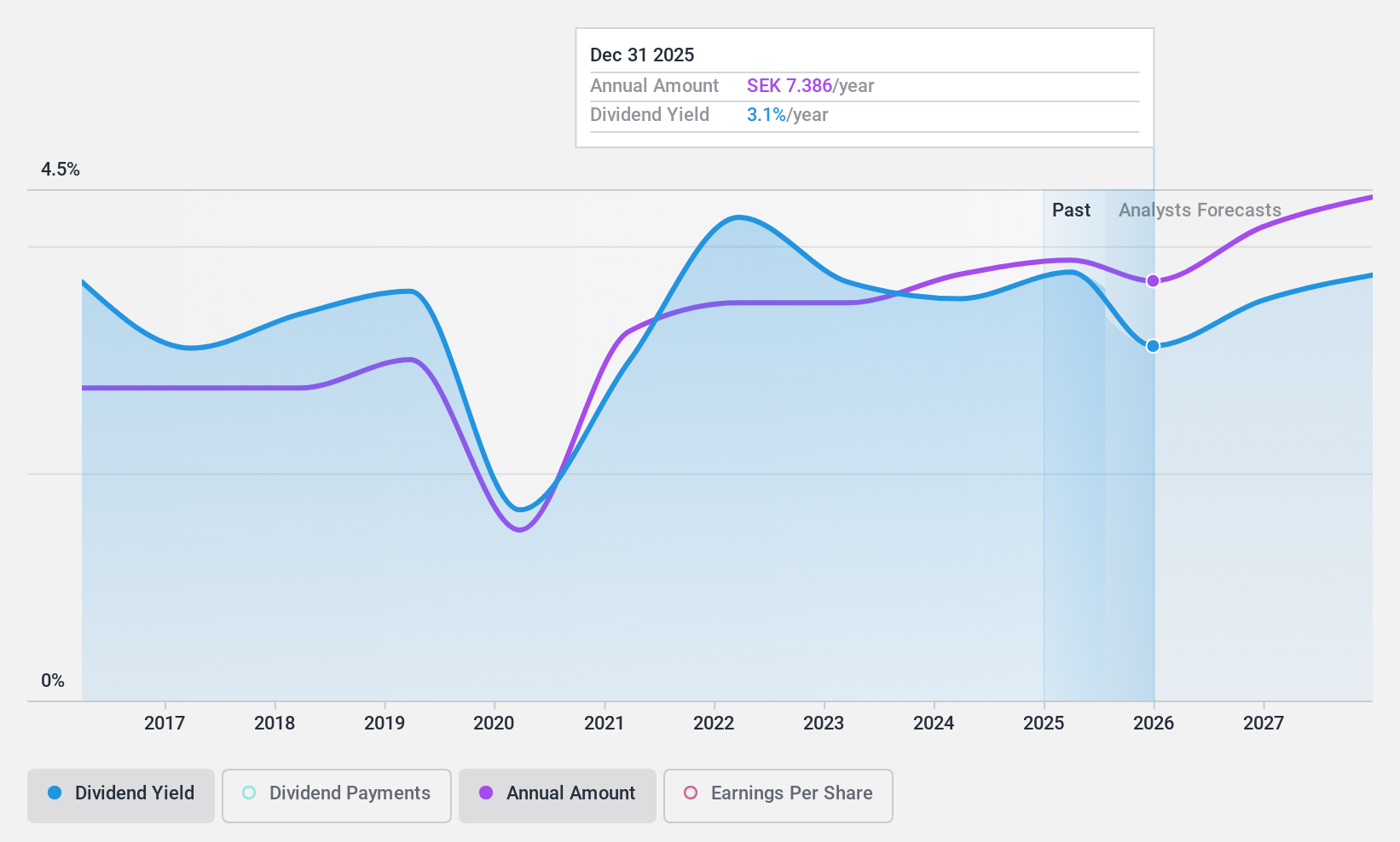

AB SKF (OM:SKF B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AB SKF (publ) designs, manufactures, and sells bearings and units, seals, lubrication systems, condition monitoring, and services worldwide with a market cap of SEK84.40 billion.

Operations: AB SKF (publ) generates revenue from two main segments: Automotive, which contributes SEK29.44 billion, and Industrial, which contributes SEK71.08 billion.

Dividend Yield: 4%

AB SKF's dividend payments are covered by earnings (59.9% payout ratio) and cash flows (53.6% cash payout ratio), though they have been volatile over the past decade. Recent Q2 2024 results show sales of SEK 25.61 billion and net income of SEK 1.53 billion, reflecting a year-over-year decline. The CFO's upcoming departure may introduce uncertainty, but strategic alliances like the H-DRI steel partnership with voestalpine underscore SKF’s commitment to sustainability and innovation in bearing production.

- Dive into the specifics of AB SKF here with our thorough dividend report.

- Our valuation report here indicates AB SKF may be undervalued.

Seize The Opportunity

- Investigate our full lineup of 23 Top Swedish Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SKF B

AB SKF

Designs, manufactures, and sells bearings and units, seals, lubrication systems, condition monitoring, and services worldwide.

Flawless balance sheet, undervalued and pays a dividend.