- Sweden

- /

- Life Sciences

- /

- OM:MCAP

Uncovering 3 Promising Small Cap Gems With Solid Foundations

Reviewed by Simply Wall St

As global markets react to recent political developments and economic indicators, small-cap stocks have been overshadowed by their larger counterparts, with major indexes like the S&P 500 reaching record highs. Despite this trend, the potential for growth in small-cap companies remains significant, especially when they possess solid foundations such as strong financial health and innovative strategies that align with current market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Etihad Atheeb Telecommunication | NA | 30.82% | 63.88% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Berger Paints Bangladesh | 3.72% | 10.32% | 7.30% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

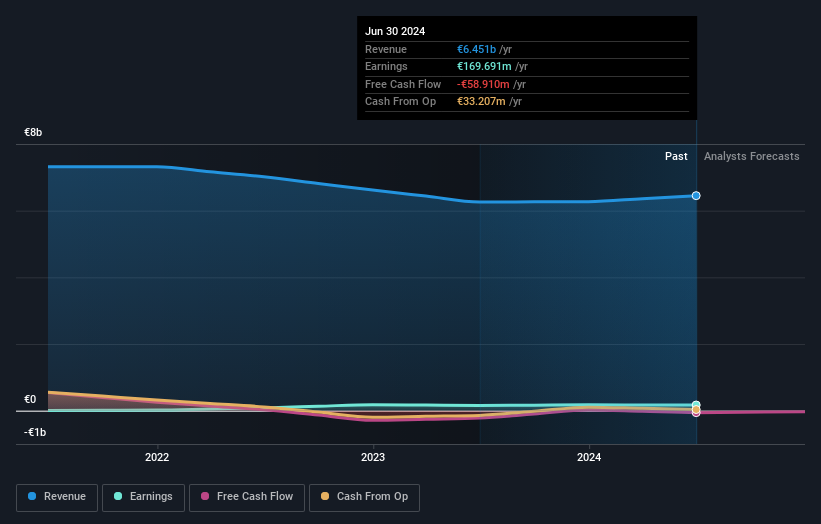

Koninklijke BAM Groep (ENXTAM:BAMNB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Koninklijke BAM Groep nv, with a market cap of approximately €1.11 billion, operates globally through its subsidiaries in the construction and property, civil engineering, and public private partnerships sectors.

Operations: Koninklijke BAM Groep generates revenue primarily from its operations in the Netherlands (€3.15 billion) and the UK & Ireland (€3.17 billion), with additional contributions from Germany, Belgium, and international markets (€133.14 million). The company focuses on construction and property, civil engineering, and public private partnerships sectors for its revenue streams.

BAM Groep, often flying under the radar in the construction sector, showcases a compelling financial profile. Over the past five years, its debt-to-equity ratio impressively dropped from 51.8% to 6.3%, indicating prudent financial management. The company is trading at 30.8% below its estimated fair value, suggesting potential upside for investors seeking undervalued opportunities. Earnings grew by 10.1% last year, outpacing industry growth of 9.4%. Recently completing a share buyback of €58.4 million for over 14 million shares reflects confidence in its valuation and future prospects as earnings are projected to grow annually by 11%.

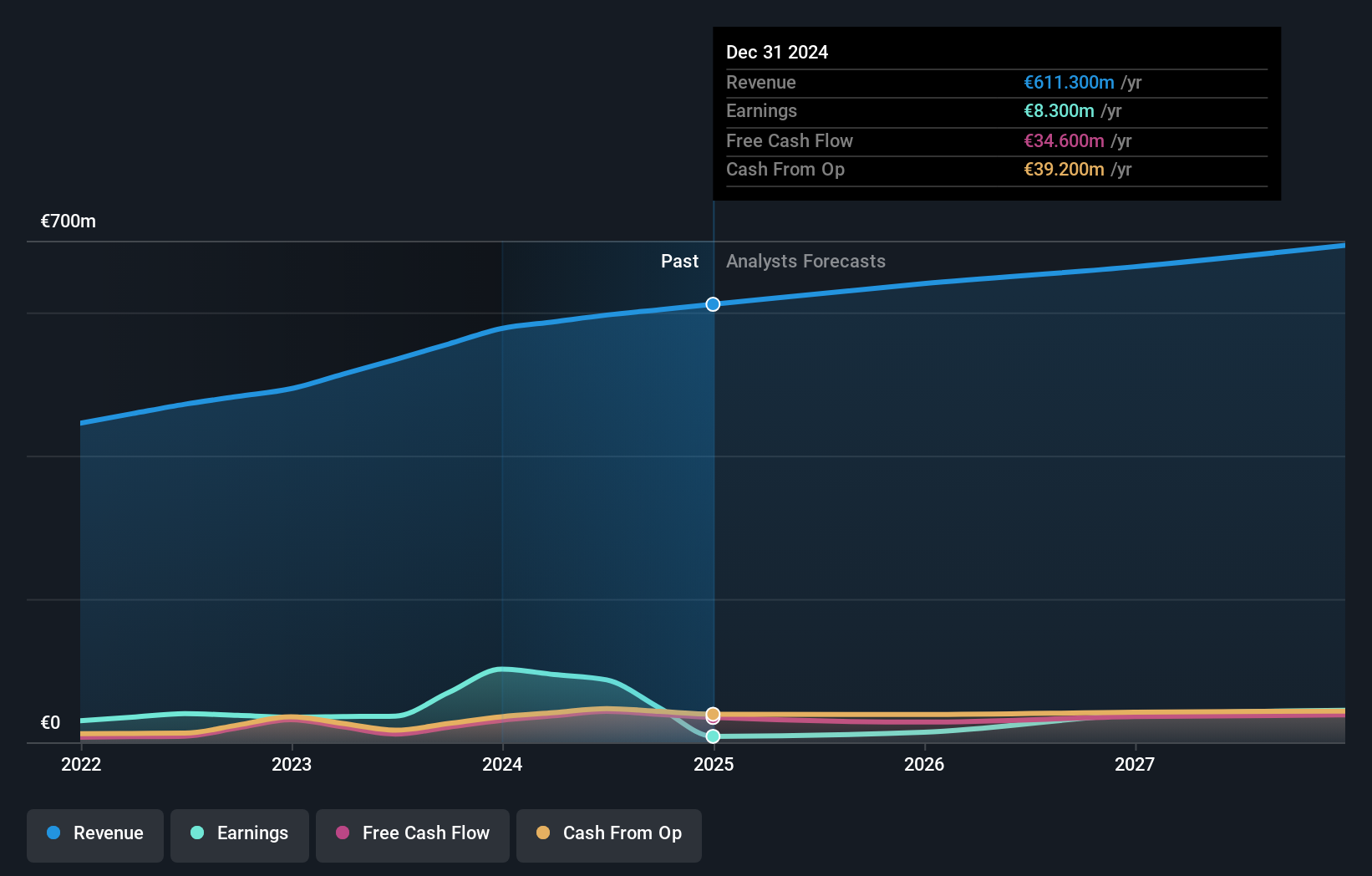

Assystem (ENXTPA:ASY)

Simply Wall St Value Rating: ★★★★★★

Overview: Assystem S.A. is a company that offers engineering and infrastructure project management services across France, the rest of Europe, Asia, the Middle East, and Africa, with a market capitalization of €556.22 million.

Operations: Assystem generates revenue primarily from its engineering and infrastructure project management services across various regions. The company has a market capitalization of €556.22 million.

Assystem, a smaller player in the professional services sector, shows a mixed financial landscape. Over the past year, its earnings surged by 138%, outpacing industry averages. This growth was notably influenced by a one-off gain of €85M. Despite this boost, future earnings are expected to decrease annually by 34% over the next three years. The company's debt-to-equity ratio has improved from 23% to 20% over five years, and it holds more cash than total debt. Recently, Assystem initiated a share repurchase program worth €20M to support employee share plans and maintain liquidity through September 2025.

- Dive into the specifics of Assystem here with our thorough health report.

Understand Assystem's track record by examining our Past report.

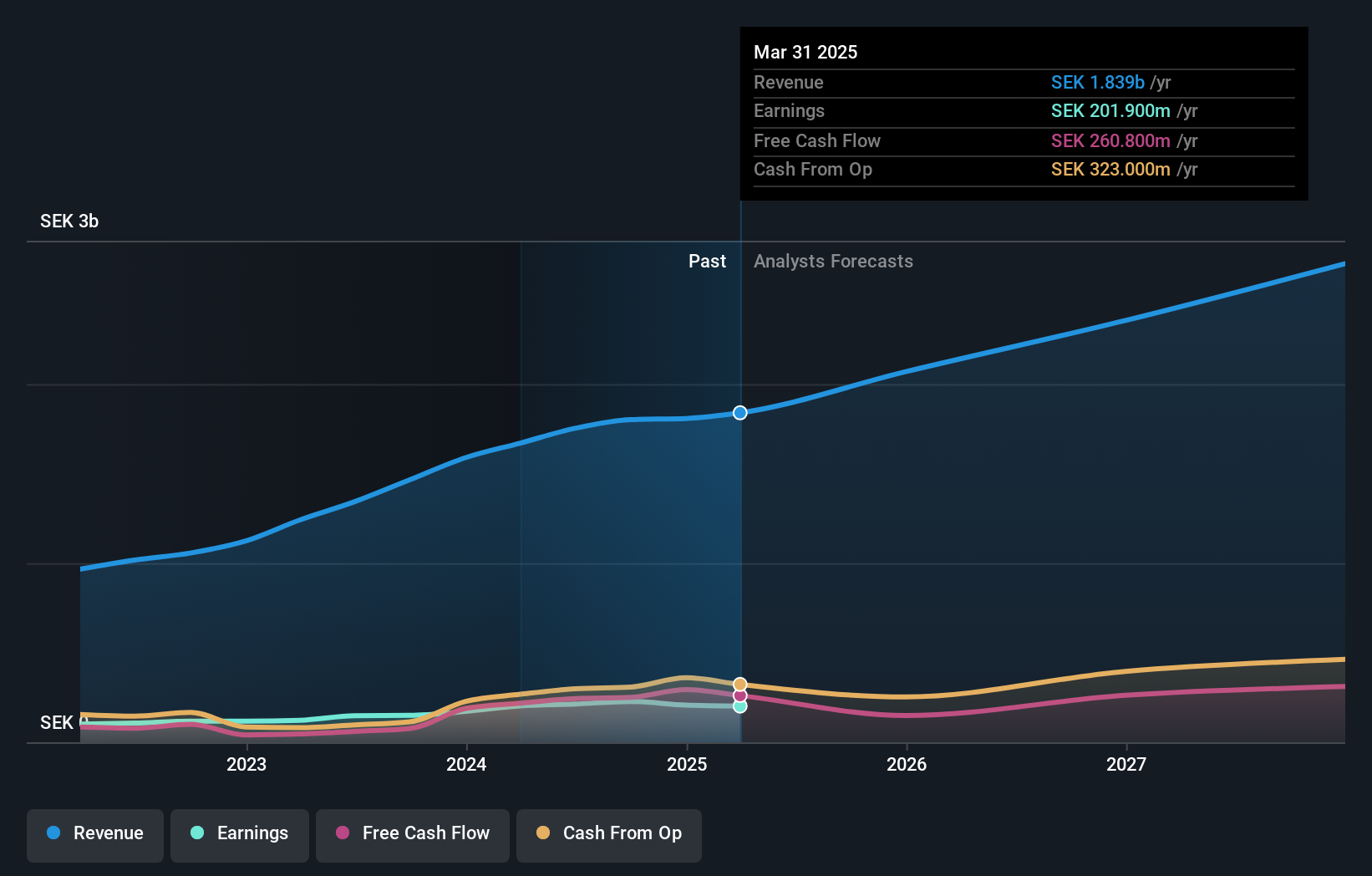

MedCap (OM:MCAP)

Simply Wall St Value Rating: ★★★★★★

Overview: MedCap AB (publ) is a private equity firm that focuses on secondary direct investments, later-stage industry consolidation, add-on acquisitions, growth capital, middle market opportunities, mature businesses, turnarounds, and buyouts with a market capitalization of approximately SEK5.43 billion.

Operations: MedCap generates revenue primarily from three segments: Support (SEK733.70 million), Specialist Drugs (SEK453.10 million), and Medicine Engineering (SEK602.50 million).

MedCap, a nimble player in the Life Sciences sector, is catching attention with its robust financial health and growth prospects. The company boasts more cash than total debt and has reduced its debt to equity ratio from 40.9% to 6.3% over five years, indicating prudent financial management. Its earnings surged by 51.7% last year, outpacing the industry average of 36%. Trading at a discount of 32.7% below estimated fair value suggests potential upside for investors seeking undervalued opportunities. Despite recent share price volatility, MedCap's high-quality earnings and strong EBIT coverage of interest payments (40.2x) provide stability and confidence in its future trajectory.

Where To Now?

- Get an in-depth perspective on all 4687 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MCAP

MedCap

A private equity firm specializing in investments in secondary direct, later stage, industry consolidation, add-on acquisitions, growth capital, middle market, mature, turnarounds, buyout.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)